Depreciation - Class 10 Elements Of Book Keeping And Accountancy - Extra Questions

State the advantages of straight line method.

" In case of a long term asset, repair and maintenance expenses are expected to rise in later years than in earlier year". Which method, is suitable for charging depreciation if the management does not want to increase burden on profits and loss account of depreciation and repair.

Question: On January 1,Satkar Transport Ltd purchased 3 buses for Rs$$10,00,000$$ each. On July 1, 2003, one was involved in an accident and was completely destroyed and Rs$$7,00,000$$ were received from the Insurance company in full settlement. Depreciation is written off @ $$15\%$$ per annum on diminishing balance method. Prepare Bus account from 2001 toBooks are closed on December 31st every year.

Question : On October 1, 2001, Juneja Transport Company purchased 2 trucks for Rs $$10,00,000$$ each. On July 1, 2003, one truck was involved in an accident and was completely destroyed and Rs$$6,00,000$$ were received from the insurance company in full settlement. On December 31, 2003, another truck was involved in an accident and destroyed partially, which was not insured. It was sold off Rs $$1,50,000$$. On January 31, 2004, company purchased a fresh truck for Rs $$12,00,000$$. Depreciation is to be provided at $$10\%$$ per annum on the written down value every year. The books are closed every year on MarchGive the Truck account from 2001 to 2004.

In which method amount of depreciation remains constant for every year ?

Which method of depreciation would you suggest for depreciating a $$5$$ years lease?

What do you understand by Reducing Balance Method of depreciation?

Under which method of depreciation an amount of depreciation remains constant every year.

Give the formula to calculate the annual depreciation as per Straight Line Method.

What is meant by Straight Line Method of depreciation?

Under which method of depreciation amount of depreciation changes every year.

Chetan International Ltd. acquired a machine costing Rs. $$50,000$$ having estimate useful life of 5 years. The expected salvage value of the machine after 5 years is Rs. $$5,000$$. Calculate rate of depreciation according to Double Declining Method.

State with reasons whether following statements are True or False:

Reducing Balance Method of Depreciation is followed to have a uniform charge for depreciation and repairs and maintenance together.

State with reasons whether following statements are True or False:

There exists difference between the Written Down Value Method and Diminishing Balance Method of depreciation.

State with reasons whether following statements are True or False:

Providing depreciation in the accounts reduces the amount of profit available for dividend.

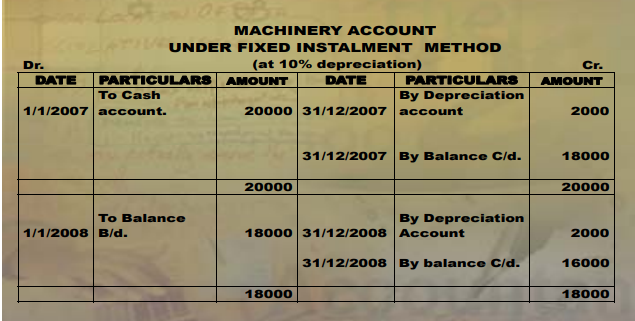

Prepare a Machinery account for two years with imaginary figures under fixed installment method.

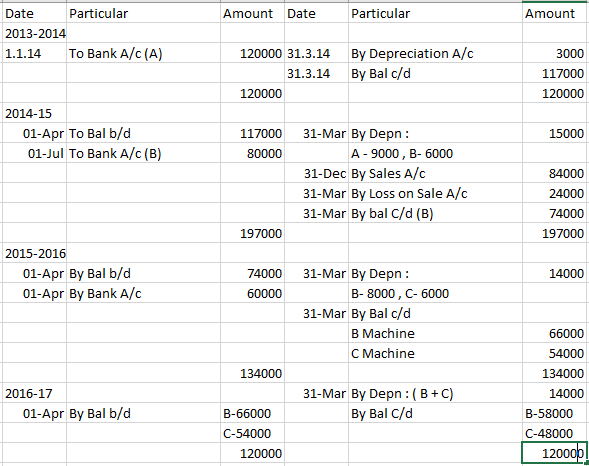

On $$01.01.2014$$ Umesh purchased $$'A'$$ Machinery for $$Rs.1,20,000$$. On $$01.07.2014$$ $$'B'$$ Machinery purchased for $$Rs.80,000$$ $$31.12.2015\,\,'A'$$ Machine was sold for $$Rs.84,000$$ and on $$01.04.2016\,'C'$$ Machine was purchased for $$Rs.60,000$$ Depreciation was charged at $$10\%$$ p.a. under fixed installment method. The accounts are closed in $$31st$$ March every year.

Show Machinery account and Depreciation account for $$3$$ years ending $$31.03.2017$$.

Question : On October 1, 2000, a Truck was purchased for Rs $$8,00,000$$ by Laxmi Transport Ltd. Depreciation was provided at $$15\%$$ per annum on the diminishing balance basis on this truck. On December 31, 2003, this truck was sold for Rs $$5,00,000$$. Accounts are closed on 31st March every year. Prepare a Truck account for the four years.

Question : Berlia Ltd purchased a second hand machine for Rs $$56,000$$ on July 1, 2001 and spent Rs $$24,000$$ on its repair and installation and Rs $$5,000$$ for its carriage. On September 1, 2002,it purchased another machine for Rs $$2,50,000$$ and spent RS$$10,000$$ on its installation.

(a) Depreciation is provided on machinery @ $$10\%$$ per annum on original cost method annually on DecemberPrepare Machinery account and Depreciation account from the year 2001 to 2004.

(b) Prepare Machinery account and Depreciation account from the year 2001 toIf depreciation is provided on machinery annually on December 31.

(a) Depreciation is provided on machinery @ $$10\%$$ per annum on original cost method annually on DecemberPrepare Machinery account and Depreciation account from the year 2001 to 2004.

(b) Prepare Machinery account and Depreciation account from the year 2001 toIf depreciation is provided on machinery annually on December 31.