Final Accounts - Class 10 Elements Of Book Keeping And Accountancy - Extra Questions

What are net profits?

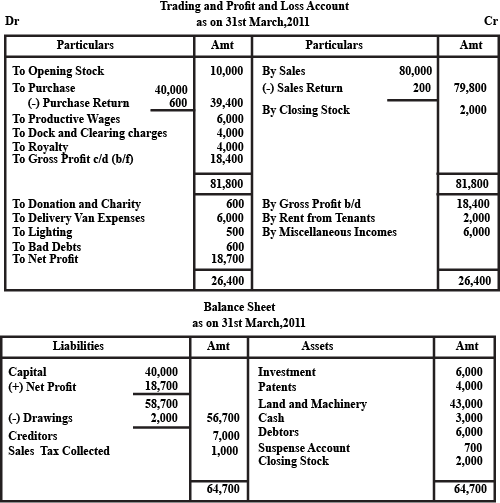

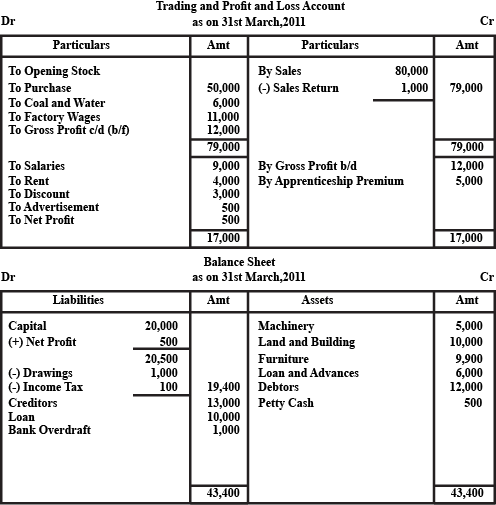

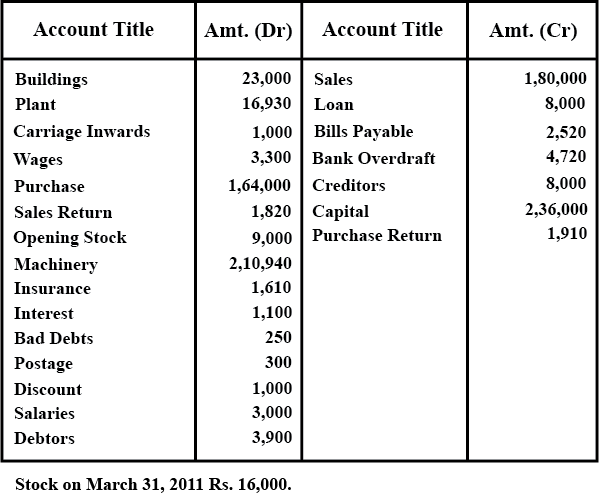

The following is a trial balance of Manju Chawla on March 31,You are required to prepare Trading and Profit and Loss account and a balance sheet as on date

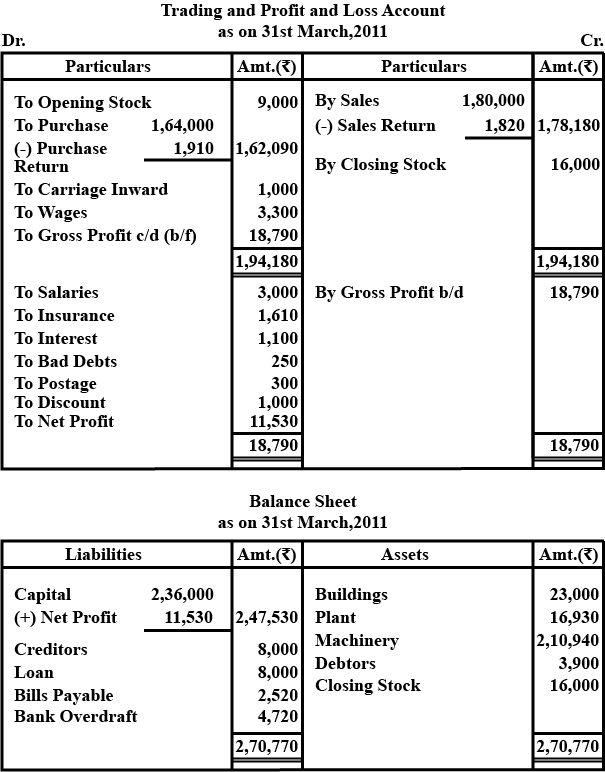

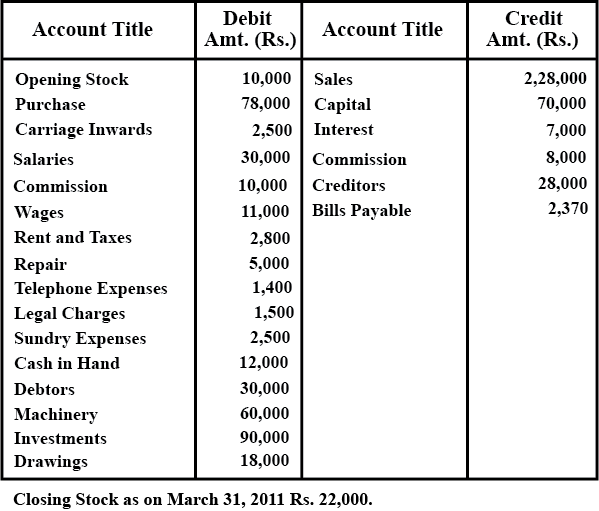

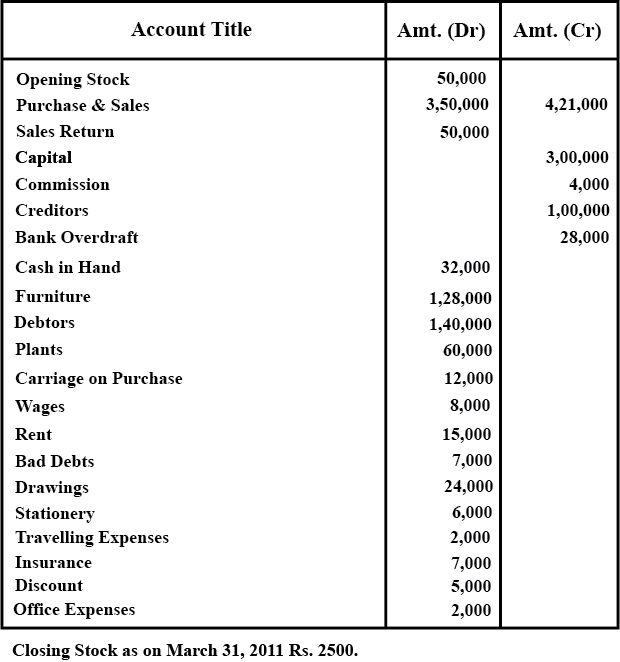

Prepare Trading and Profit and Loss account and balance sheet on M/s Royal Traders from the following balances as on March 31, 2011.

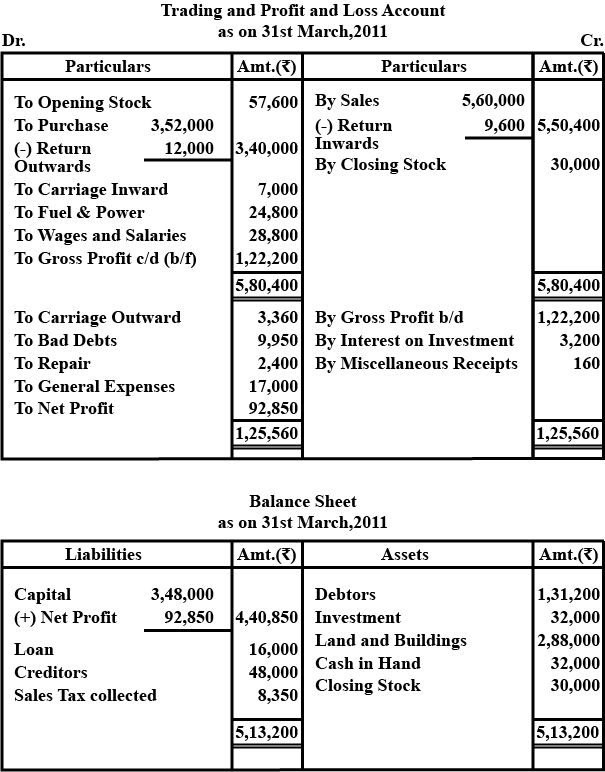

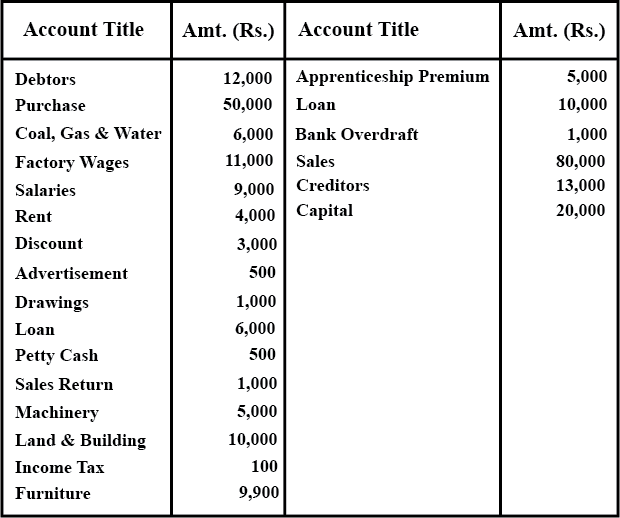

From the following balances of M/s Nilu Sarees as on March 31,Prepare Trading and Profit and Loss account and balance sheet as on date.

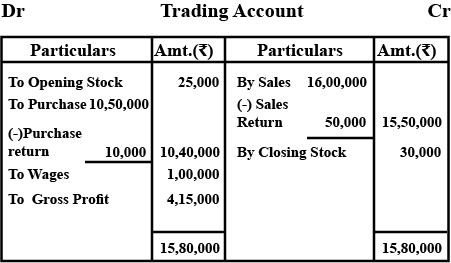

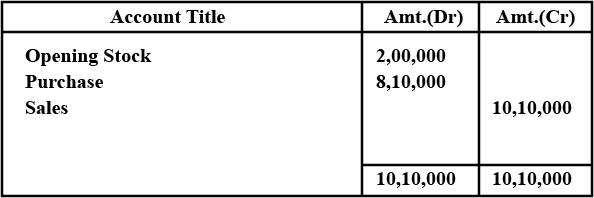

Prepare the Trading and Profit and Loss account from the following particulars of M/s Neema Traders as Merch 31, 2011.

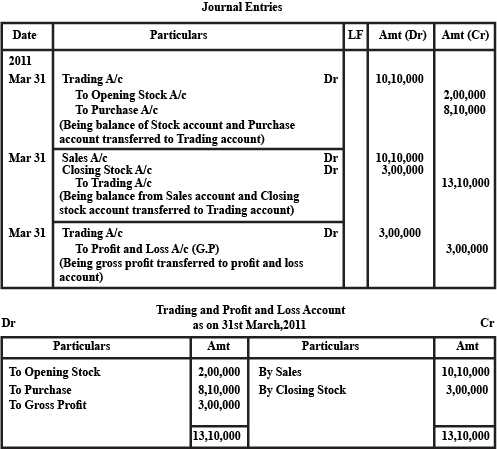

The following are the extracts from the trial balance of M/s Bhola & Sons as on March 31, 2011.

Closing stock as on date was valued at Rs. 3,00,000

You are required to record the necessary journal entries and show how the above items will appear in the Trading and Profit & Loss account of M/s Bhola & Sons.

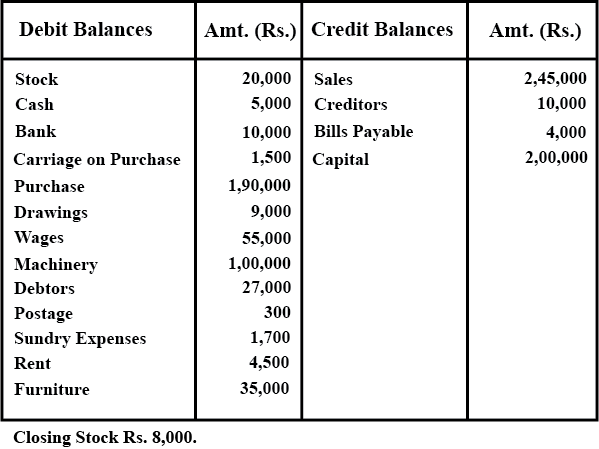

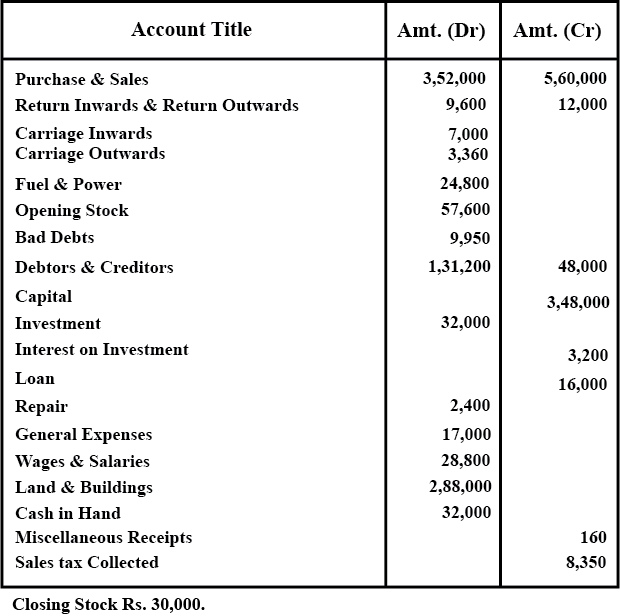

The following trial balance is extracted from the books of M/s Ram on March 31,You are required to prepare Trading and Profit and Loss account and the balance sheet as on date.

The following balances have been extracted from the trial of M/s Haryana Chemical Ltd. You are required to prepare a trading and profit and loss account and balance sheet as on December 31, 2010 from the given information

| Account Title | Amt. (Rs) | Account Title | Amt. (Rs) |

| Opening Stock | 50,000 | Sales | 3,50,000 |

| Purchase | 1,25,500 | Purchase Return | 2,500 |

| Sales Return | 2,000 | Creditors | 25,000 |

| Cash in Hand | 21,200 | Rent | 5,000 |

| Cash at Bank | 12,000 | Interest | 2,000 |

| Carriage | 100 | Bills Payable | 1,72,700 |

| Freehold Land | 3,20,000 | Capital | 3,00,000 |

| Patents | 1,20,000 | ||

| General Expenses | 2,000 | ||

| Sundry Debtors | 32,500 | ||

| Building | 86,000 | ||

| Machinery | 34,500 | ||

| Insurance | 12,400 | ||

| Drawings | 10,000 | ||

| Motor Vehicle | 10,500 | ||

| Bad Debts | 2,000 | ||

| Light and Water | 1,200 | ||

| Trade Expenses | 2,000 | ||

| Power | 3,900 | ||

| Salary and wages | 5,400 | ||

| Loan 15% (1.9.2010) | 3,000 | ||

| 8,56,200 | 8,56,200 |

Closing stock was valued at the end of the year Rs. 40,000.

Salary amounting Rs. 500 and trade expenses Rs. 300 a redue.

Depreciation charged on building and machinery are @ 4% and @ 5% respectively.

Make a provision of @ 5% on sundry debtors.

Prepare Trading and Profit and Loss account and balance sheet from the following particulars as on March 31, 2011.

(Rs.) Opening stock 25, 000 Credit purchase 7,50,000 Cash purchase 3,00,000 Credit sales 12,00,000 Cash sales 4,00,000 Wages 1,00,000 Salaries 1,40,000 Closing Stock 30,000 Sales return 50,000 Purchase return 10,000

From the following balances extracted from the books of M / s Ahuja and Nanda. Calculate the amount of

(a) Cost of goods available for sale

(b) Cost of goods sold during the year

(c) Gross Profit

| (Rs.) | |

| Opening stock | 25, 000 |

| Credit purchase | 7,50,000 |

| Cash purchase | 3,00,000 |

| Credit sales | 12,00,000 |

| Cash sales | 4,00,000 |

| Wages | 1,00,000 |

| Salaries | 1,40,000 |

| Closing Stock | 30,000 |

| Sales return | 50,000 |

| Purchase return | 10,000 |

What is the purpose of preparing Trading and Profit and Loss account?

Which are the accounts that are not balanced but transferred to Trading A/c or Profit & Loss A/c?

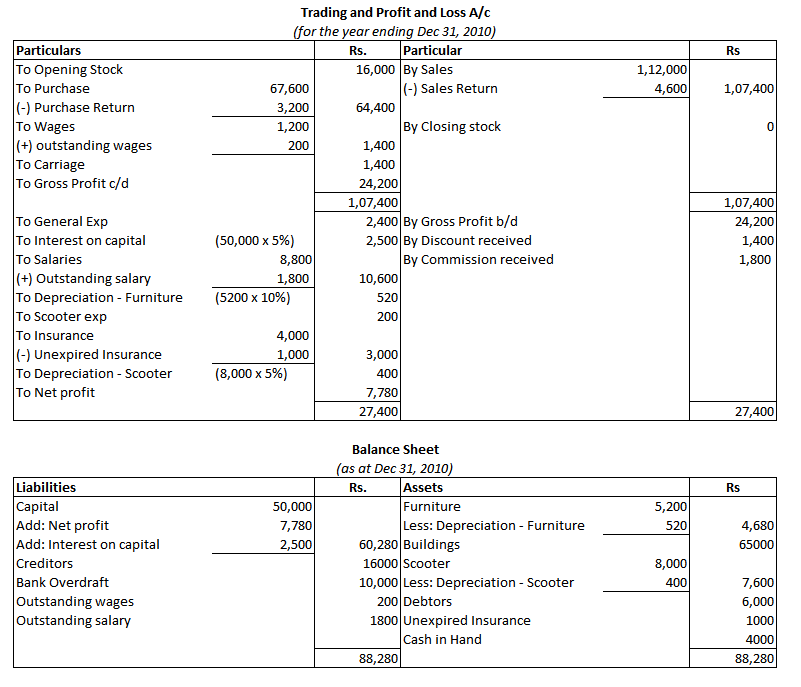

The following balances were extracted from the books of M/s Panchsheel Garments on December 31, 2010.

| Account Title | Amt. (Rs) | Account Title | Amt. (Rs) |

| Opening Stock | 16,000 | Sales | 1,12,000 |

| Purchase | 67,600 | Return Outwards | 3,200 |

| Return Inwards | 4,600 | Discount | 1,400 |

| Carriage Inwards | 1,400 | Bank Overdraft | 10,000 |

| General Expenses | 2,400 | Commission | 1,800 |

| Insurance | 4,000 | Creditors | 16,000 |

| Scooter Expenses | 200 | Capital | 50,000 |

| Salary | 8,800 | ||

| Cash in Hand | 4,000 | ||

| Scooter | 8,000 | ||

| Furniture | 5,200 | ||

| Buildings | 65,000 | ||

| Debtors | 6,000 | ||

| Wages | 1,200 | ||

| 1,94,400 | 1,94,400 |

(a) Unexpired insurance Rs. 1,000.

(b) Salary due but not paid Rs. 1,800.

(c) Wages outstanding Rs. 200.

(d) Interest on capital @ 5%.

(e) Scooter is depredated @ 5%.

(f) Furniture is depredated @ 10%.

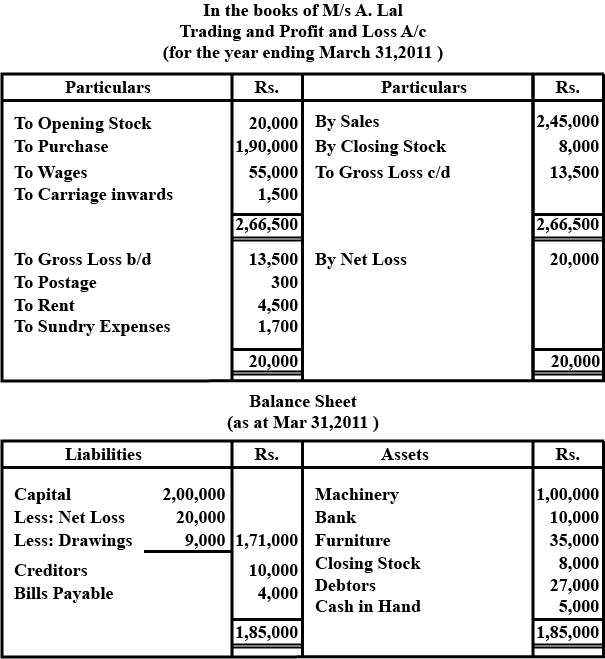

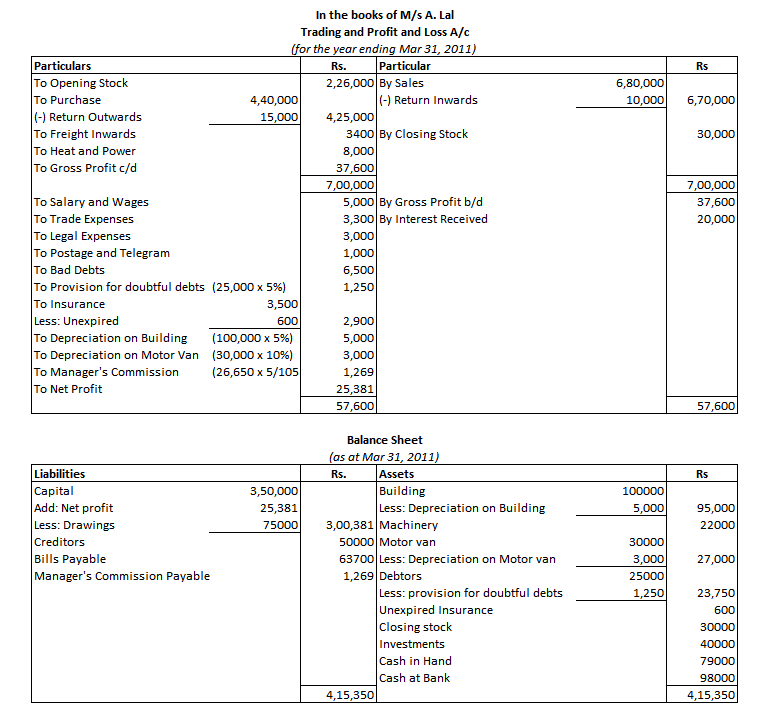

Following balances have been extracted from the trial balance of M/s A. Lal. You are required to prepare the Trading and Profit & Loss account and Balance Sheet as on December 31, 2011.

Account Title Amt.(Rs) Account Title Amt.(Rs) Opening Stock 2,26,000 Sales 6,80,000 Purchase 4,40,000 Return Outwards 15,000 Drawings 75,000 Creditors 50,000 Buildings 1,00,000 Bills Payable 63,700 Motor Van 30,000 Interest Received 20,000 Freight Inwards 3,400 Capital 3,50,000 Sales Return 10,000 Trade Expenses 3,300 Heat and Power 8,000 Salary and Wages 5,000 Legal Expenses 3,000 Postage and Telegram 1,000 Bad Debts 6,500 Cash in Hand 79,000 Cash at Bank 98,000 Sundry Debtors 25,000 Investments 40,000 Insurance 3,500 Machinery 22,000 11,78,700 11,78,700

The following additional information is available

Stock on December 31, 2011 was Rs. 30,000.

Depreciation is to be charged on building @ 5% and motor van @ 10%.

Provision for doubtful debts is to be maintained Sundry Debtors @ 5%.

Unexpired insurance was Rs. 600.

The Manager is entitled to a commission @ 5% on net profit after charging such commission.

| Account Title | Amt.(Rs) | Account Title | Amt.(Rs) |

| Opening Stock | 2,26,000 | Sales | 6,80,000 |

| Purchase | 4,40,000 | Return Outwards | 15,000 |

| Drawings | 75,000 | Creditors | 50,000 |

| Buildings | 1,00,000 | Bills Payable | 63,700 |

| Motor Van | 30,000 | Interest Received | 20,000 |

| Freight Inwards | 3,400 | Capital | 3,50,000 |

| Sales Return | 10,000 | ||

| Trade Expenses | 3,300 | ||

| Heat and Power | 8,000 | ||

| Salary and Wages | 5,000 | ||

| Legal Expenses | 3,000 | ||

| Postage and Telegram | 1,000 | ||

| Bad Debts | 6,500 | ||

| Cash in Hand | 79,000 | ||

| Cash at Bank | 98,000 | ||

| Sundry Debtors | 25,000 | ||

| Investments | 40,000 | ||

| Insurance | 3,500 | ||

| Machinery | 22,000 | ||

| 11,78,700 | 11,78,700 |

Stock on December 31, 2011 was Rs. 30,000.

Depreciation is to be charged on building @ 5% and motor van @ 10%.

Provision for doubtful debts is to be maintained Sundry Debtors @ 5%.

Unexpired insurance was Rs. 600.

The Manager is entitled to a commission @ 5% on net profit after charging such commission.

Prepare the trading and profit and loss account and balance sheet of M/s Shine Ltd from the following particulars.

| Account Title | Amt.(Rs) | Account Title | Amt. (Rs) |

| Sundry Debtors | 1,00,000 | Bills Payable | 85,550 |

| Bad Debts | 3,000 | Sundry Creditors | 25,000 |

| Trade Expenses | 2,500 | Provisions for Bad Debts | 1,500 |

| Printing and Stationery | 5,000 | Return Outwards | 4,500 |

| Rent, Rates and Taxes | 3,450 | Capital | 2,50,000 |

| Freight | 2,250 | Discount Received | 3,500 |

| Sales Return | 6,000 | Interest Received | 11,260 |

| Motor Car | 25,000 | Sales | 1,00,000 |

| Opening Stock | 75,550 | ||

| Furniture and Fixture | 15,500 | ||

| Purchase | 75,000 | ||

| Drawings | 13,560 | ||

| Investments | 65,500 | ||

| Cash in Hand | 36,000 | ||

| Cash at Bank | 53,000 | ||

| 4,81,310 | 4,81,310 |

Closing stock was valued Rs.35,000.

Depredation charged on furniture and fixture @ 5%.

Further bad debts Rs.1,Make a provision for bad debts @ 5% on sundry debtors.

Depreciation charged on motor car @ 10%.

Interest on drawings @ 6%.

Rent, rates and taxes was outstanding Rs. 200.

Discount on debtors 2%.

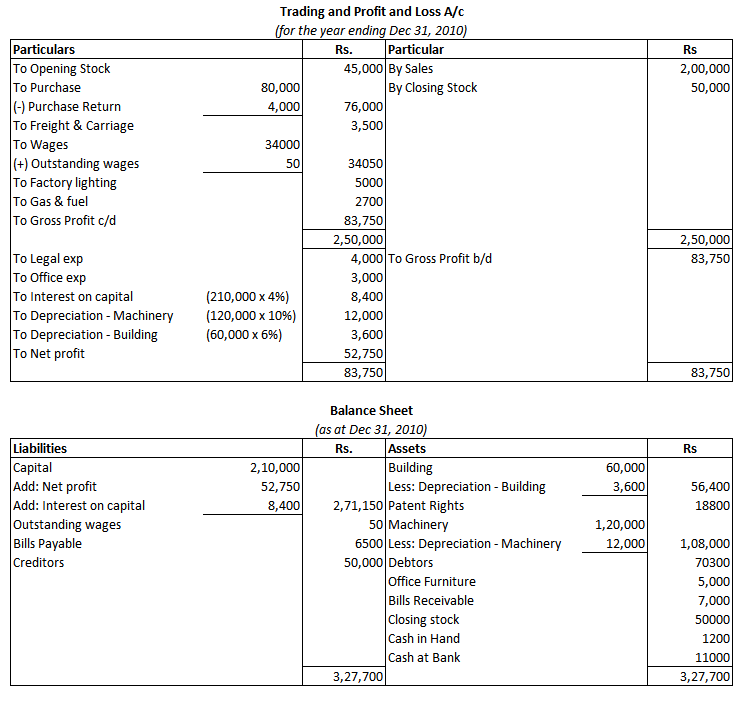

The following balances have been extracted from the books of M/s Green House for the year ended December 31, 2010, prepare trading and profit and loss account and balance sheet as on this date.

| Account Title | Amt. (Rs) | Account Title | Amt. (Rs) |

| Purchase | 80,000 | Capital | 2,10,000 |

| Bank Balance | 11,000 | Bills Payable | 6,500 |

| Wages | 34,000 | Sales | 2,00,000 |

| Debtors | 70,300 | Creditors | 50,000 |

| Cash in Hand | 1,200 | Return Outwards | 4,000 |

| Legal Expenses | 4,000 | ||

| Building | 60,000 | ||

| Machinery | 1,20,000 | ||

| Bills Receivable | 7,000 | ||

| Office Expenses | 3,000 | ||

| Opening Stock | 45,000 | ||

| Gas and Fuel | 2,700 | ||

| Freight and Carriage | 3,500 | ||

| Factory Lighting | 5,000 | ||

| Office Furniture | 5,000 | ||

| Patent Right | 18,800 | ||

| 4,70,500 | 4,70,500 |

(a) Machinery is depreciated @ 10% and buildings depreciated @ 6%.

(b) Interest on capital @ 4%.

(c) Outstanding wages Rs. 50.

(d) Closing stock Rs. 50,000.

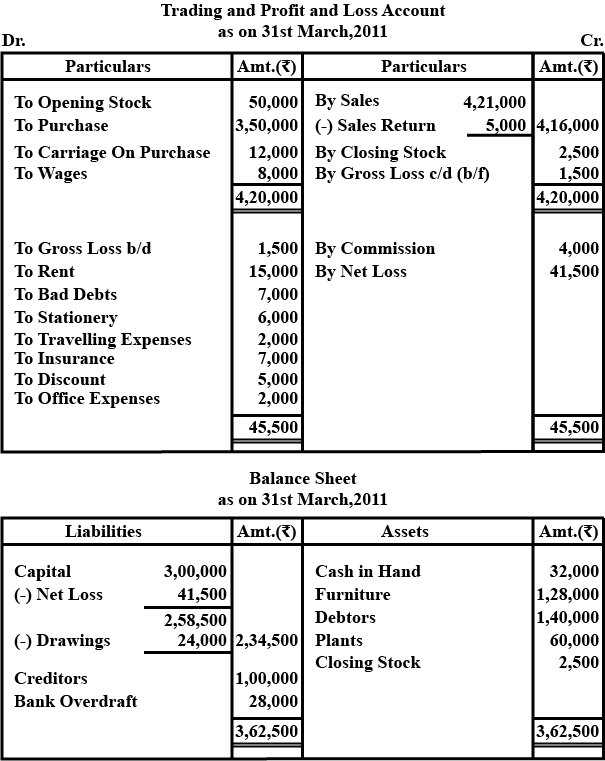

Prepare Trading and Profit and Loss account of M/s Sports Equipment's for the year ended March 31,2011 and balance sheet as on that date

What is gross profit?

What are gross profits?

Write a word/term/phrase which can substituted of the following statements:

Payment of the bill before due date.

Mr. Fazhil is a proprietor in business of trading. An abstract of his Trading and P&L account is as follows:

Trading and P&L A/c for the year ended $$31^{st}$$ March, $$2018$$

| Particulars | (Rs.) | Particulars | (Rs.) |

| To Cost of Goods sold | $$22,00,000$$ | By Sales | $$45,00,000$$ |

| To Gross Profit C/d | ? | $$45,00,000$$ | |

| By Gross Profit B/d | ? | ||

| To Salaries paid | $$12,00,000$$ | By Other Income | $$45,000$$ |

| To General Expenses | $$6,00,000$$ | ||

| To Selling Expenses | ? | ||

| To Commission to Manager(On net profit before charging such commission) | $$1,00,000$$ | _____ | |

| To Net Profit | ? | ||

| ? | ? |

You are required to compute the missing figures.

With the following ratios and further information given, you are required to prepare a Trading account and Profit & Loss account and a Balance Sheet of Sri Ganesh:

(i) Gross Profit Ratio $$=25\%$$

(ii) Net Profit/Sales$$=20\%$$

(iii) Stock Turnover Ratio$$=10$$

(iv) Net Profit/Capital$$=1/5$$

(v) Capital to Total other Liabilities$$=1/2$$

(vi) Fixed Assets/Capital $$=5/4$$

(vii) Fixed Assets/Total Current Assets$$=5/7$$

(viii) Fixed Assets$$=$$Rs. $$10,00,000$$

(ix) Closing Stock$$=$$Rs. $$1,00,000$$.

Prepare a trading and profit and loss account of M/s Green Club Ltd for the year ending December 31, 2010 from the following figures taken from his trial balance

| Account Title | Amt. (Rs.) | Account Title | Amt. (Rs.) |

| Opening Stock | 35,000 | Sales | 2,50,000 |

| Purchase | 1,25,000 | Purchase Return | 6,000 |

| Return Inwards | 25,000 | Creditors | 10,000 |

| Postage and Telegram | 600 | Bills payable | 20,000 |

| Salary | 12,300 | Discount | 1,000 |

| Wages | 3,000 | Provision for Bad Debts | 4,500 |

| Rent and Rates | 1,000 | Interest Received | 5,400 |

| Packing and Transport | 500 | Capital | 75,000 |

| General Expenses | 400 | ||

| Insurance | 4,000 | ||

| Debtors | 50,000 | ||

| Cash in Hand | 20,000 | ||

| Cash at Bank | 40,000 | ||

| Machinery | 20,000 | ||

| Lighting and Heating | 5,000 | ||

| Discount | 3,500 | ||

| Bad Debts | 3,500 | ||

| Investment | 23,100 | ||

| 3,71,900 | 3,71,900 |

Depreciation charged on machinery @ 5% pa.

Further bad debts Rs. 1,500, discount on debtors @ 5% and make a provision on debtors @ 6%.

Wages prepaid Rs. 1,000.

Interest on investment @ 5% pa.

Closing stock Rs. 10,000.

From the following information prepare trading and profit and loss account of M/s Indian sports house for the year ending December 31, 2011.

| Account Title | Amt. (Rs) | Account Title | Amt. (Rs) |

| Drawings | 20,000 | Capital | 2,00,000 |

| Sundry Debtors | 80,000 | Return Outwards | 2,000 |

| Bad Debts | 1,000 | Bank Overdraft | 12,000 |

| Trade Expenses | 2,400 | Provision for Bad Debts | 4,000 |

| Printing and Stationaery | 2,000 | Sundry Creditors | 60,000 |

| Rent, Rates and Taxes | 5,000 | Bills Payable | 15,400 |

| Freight | 4,000 | Sales | 2,76,000 |

| Return Inwards | 7,000 | ||

| Opening Stock | 25,000 | ||

| Purchase | 1,80,000 | ||

| Furniture and Fixture | 20,000 | ||

| Plant and Machinery | 1,00,000 | ||

| Bills Receivable | 14,000 | ||

| Wages | 10,000 | ||

| Cash in Hand | 6,000 | ||

| Discount Allowed | 2,000 | ||

| Investments | 40,000 | ||

| Motor Car | 51,000 | ||

| 5,69,400 | 5,69,400 |

Closing stock was Rs. 45,000.

Provision for bad debts is to be maintained @ 2% on debtors.

Depreciation charged on furniture and fixture @ 5%, plant and machinery @ 6% and motor car @ 10%

A machine of Rs. 30,000 was purchased on July 1, 2011.

The manager is entitled to a commission of @ 10% of the net profit after charging such commission.

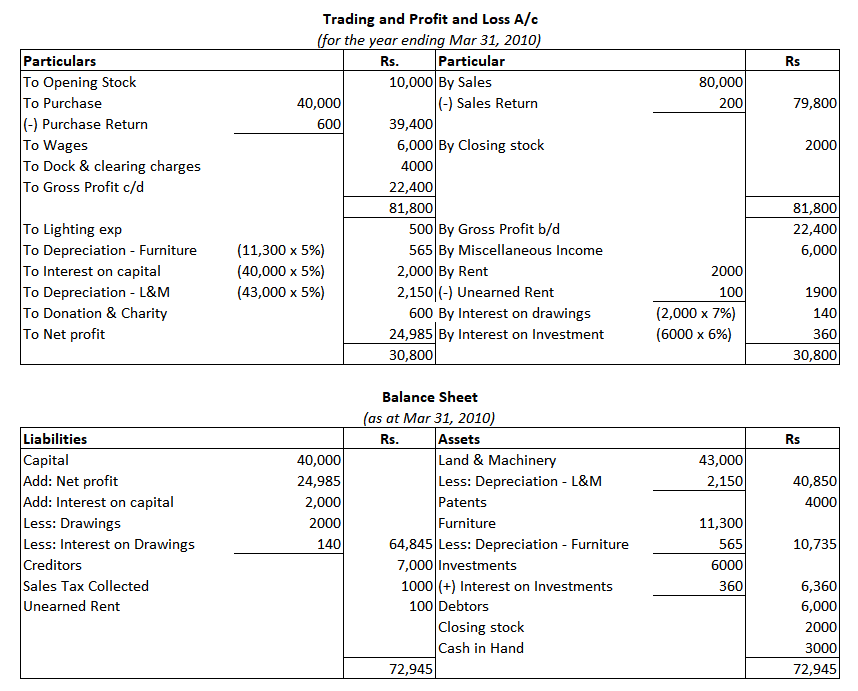

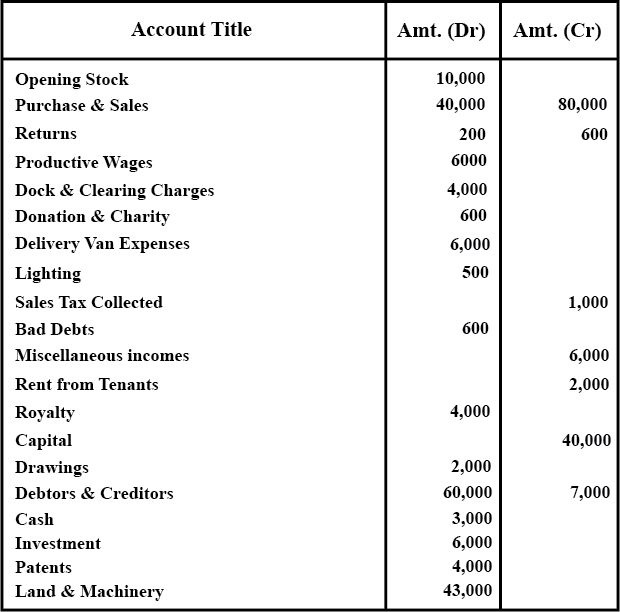

From the following balances extracted from the book of M/s Manju Chawla on March 31,You are requested to prepare the trading and profit and loss account and a balance sheet as on this date.

| Account Title | Amt. (Dr) | Amt. (Cr) |

| Opening Stock | 10,000 | |

| Purchase and Sales | 40,000 | 80,000 |

| Returns | 200 | 600 |

| Wages | 6,000 | |

| Dock and Clearing Charges | 4,000 | |

| Lighting | 500 | |

| Miscellaneous Income | 6,000 | |

| Rent | 2,000 | |

| Capital | 40,000 | |

| Drawings | 2,000 | |

| Debtors and Creditors | 6,000 | 7,000 |

| Cash | 3,000 | |

| Investment | 6,000 | |

| Patent | 4,000 | |

| Land and Machinery | 43,000 | |

| Donations and Charity | 600 | |

| Sales Tax Collected | 1,000 | |

| Furniture | 11,300 | |

| 1,36,600 | 1,36,600 |

(a) Interest on drawings @ 7% and interest, on capital @ 5%.

(b) Land and machinery is depredated at 5%.

(c) Interest on investment @ 6%.

(d) Unexpired rent Rs. 100.

(e) Charge 5% depreciation on furniture.

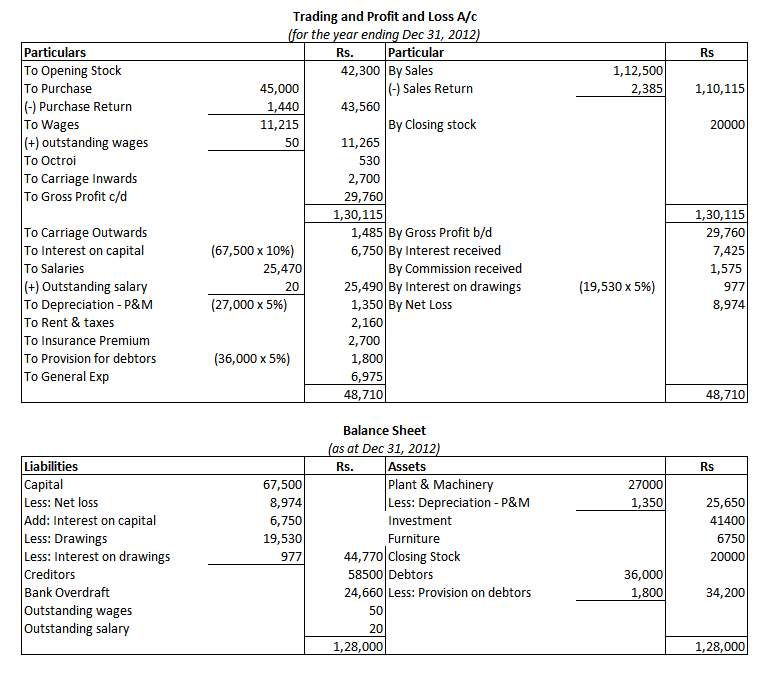

Prepare the trading and profit and loss account and balance sheet of M/s Control Device India on December 31, 2012 from the following balance as on the date.

| Account Title | Amt. (Dr) | Amt. (Cr) |

| Drawings and Capital | 19,530 | 67,500 |

| Purchase and Sales | 45,000 | 1,12,500 |

| Salary and Commission | 25,470 | 1,575 |

| Carriage | 2,700 | |

| Plant and Machinery | 27,000 | |

| Furniture | 6,750 | |

| Opening Stock | 42,300 | |

| Insurance Premium | 2,700 | |

| Interest | 7,425 | |

| Bank Overdraft | 24,660 | |

| Rent and Taxes | 2,160 | |

| Wages | 11,215 | |

| Returns | 2,385 | 1,440 |

| Carriage Outwards | 1,485 | |

| Debtors and Creditors | 36,000 | 58,500 |

| General Expenses | 6,975 | |

| Octroi | 530 | |

| Investment | 41,400 | |

| 2,73,600 | 2,73,600 |

(a) Interest on capital @ 10%.

(b) Interest on drawings @ 5%.

(c) Wages outstanding Rs. 50.

(d) Outstanding salary Rs. 20.

(e) Provide a depreciation @ 5% on plant and machinery.

(f) Make a 5% provision on debtors.

The following balances have been extracted from the books of Vanity Ltd. as at 31$$^{st}$$ March, 2017:

Trial Balance as at 31$$^{st}$$ March, 2017

| Particulars | Debit (Rs.) | Credit (Rs.) |

| Equity Share Capital ($$5,000$$ share of $$Rs. 100$$ each fully paid) | $$5,00,000$$ | |

| Fixed Assets | $$7,30,000$$ | |

| Reserves Surplus | $$2,00,000$$ | |

| Inventories | $$50,000$$ | |

| Cash and Bank Balances | $$1,70,000$$ | |

| Creditors | $$40,000$$ | |

| Bill Payable | $$20,000$$ | |

| Underwriting Commission on issue of shares | $$10,000$$ | |

| $$5\%$$ Debentures ($$\frac{1}{5}$$ of the Debentures to be redeemed on 31$$^{st}$$ March, 2018) | $$2,00,000$$ | |

| Proposed Dividend | $$12,000$$ | |

| Interest accrued and due on $$5\%$$ Debentures | $$8,000$$ | |

| Trade Receivables | $$20,000$$ | |

| TOTAL | $$\overline{\underline{9,80,000}}$$ | $$\overline{\underline{9,80,000}}$$ |

(i) The Balance Sheet of Vanity Ltd. as per Schedule III of the Companies Act, 2013

(ii) Notes to Accounts.