Financial Statements 2 - Class 11 Commerce Accountancy - Extra Questions

What do you mean by income received in advance?

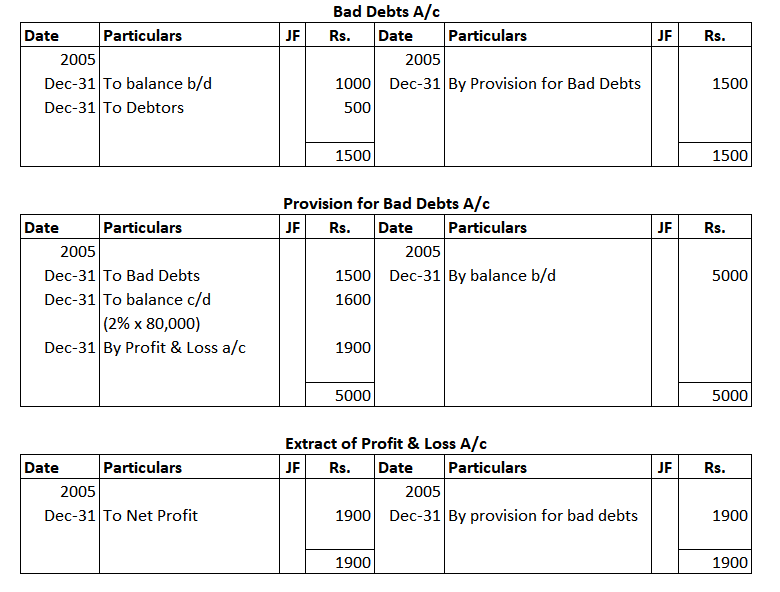

Question: The following information is extracted from the Trial Balance of M/s Nisha traders on 31 December 2005.

| Sundry Debtors | $$80,500$$ |

| Bad debts | $$1,000$$ |

| Provision for bad debts | $$5,000$$ |

| Additional Information | |

| Bad Debts | Rs$$500$$ |

Provision is to be maintained at $$2\%$$ of Debtors.

Prepare Bad debts account, Provision for bad debts account and Profit and Loss account.

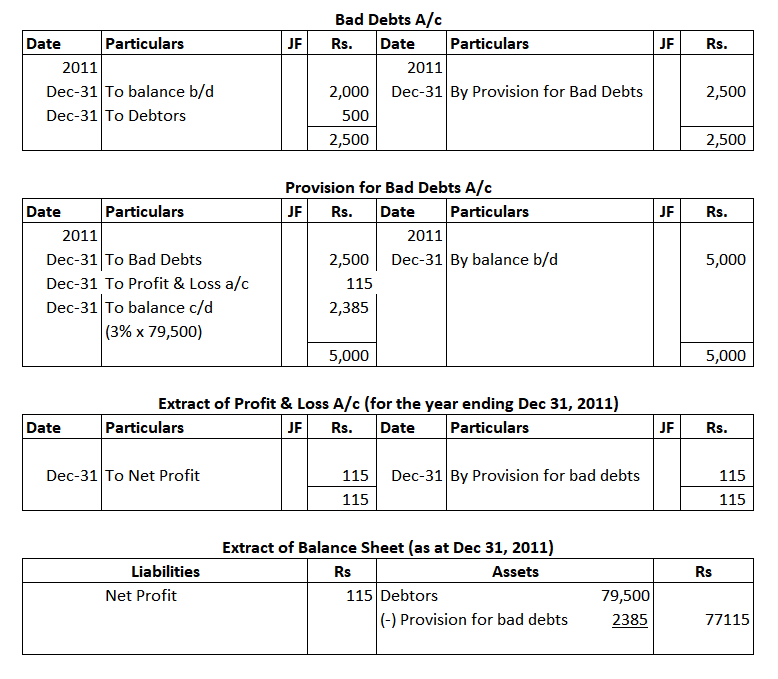

Prepare the bad debts account, provision for bad debts account, profit and loss account and balance sheet from the following information as on December, 31, 2011.

(Rs.)

Debtors 80,000

Bad Debts 2,000

Provision for bad debts 5,000

Adjustments:

Bad debts Rs. 500, Provision on debtors @ 3%.

What is meant by provision for discount on debtors?

What do you mean by prepaid expenses?

Explain the term - accrued income.

Answer the following questions in 'one' sentence each:

What is bad debts?

Answer the following questions in 'one' sentence each:

What do you mean by Analysis of Financial Statement?

State whether revaluation account is debited or credited to record the increase in the amount of creditors.

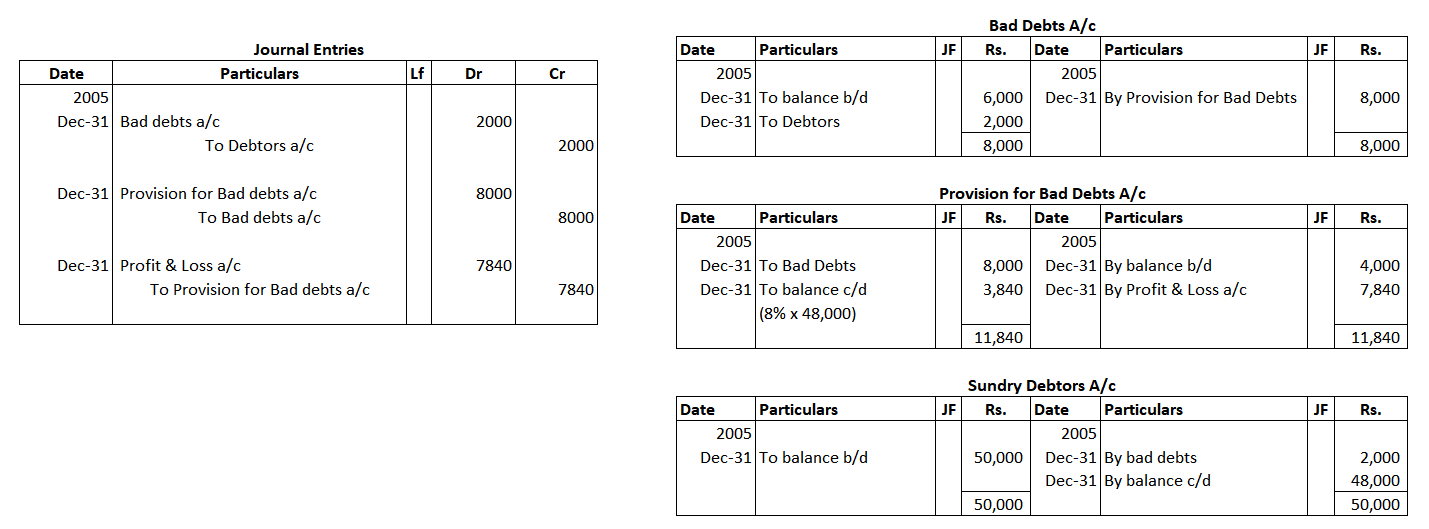

An extract of Trial balance from the books of Tahiliani and Sons Enterprises on December 31, 2005, is given below.

| Name of Account | Debit Amt. (Rs) | Credit Amt. (Rs) |

| Sundry debtors | $$50,000$$ | |

| Bad debts | $$6,000$$ | |

| Provision for doubtful debts | $$4,000$$ |

Additional Information:

Bad Debts proved but not recorded amounted to Rs $$2,000$$.

Provision is to be maintained at $$8\%$$ of Debtors.

Give necessary accounting entries to write off the bad debts and creating the provision for doubtful debts account. Also, show the necessary accounts.

Max & Co. employs a team of $$9$$ workers who were paid $$Rs. 40,000$$ per month each in the year ending $$31^{st}$$ December, $$2018$$. At the start of $$2019$$, the company raised salaries by $$10\%$$ to $$Rs. 44,000$$ per month each.

On $$1^{st}$$ July, $$2019$$ the company hired $$2$$ trainees at salary of $$Rs. 21,000$$ per month each. The work force are paid salary on the first working day of every month, one month in arrears, so that the employees receive their salary for January on the first working day of February, etc.

You are required to calculate :

(i) Amount of salaries which would be charged to the profit and loss for the year ended $$31^{st}$$ December, $$2019$$.

(ii) Amount actually paid as salaries during $$2019$$.

(iii) Outstanding salaries as on $$31^{st}$$ December, $$2019$$.

Class 11 Commerce Accountancy Extra Questions

- Accounts From Incomplete Records Extra Questions

- Bank Reconciliation Statement Extra Questions

- Bill Of Exchange Extra Questions

- Computerised Accounting System Extra Questions

- Depreciation, Provision And Reserves Extra Questions

- Financial Statements 1 Extra Questions

- Financial Statements 2 Extra Questions

- Introduction To Accounting Extra Questions

- Recording Of Transactions - I Extra Questions

- Recording Of Transactions - Ii Extra Questions

- Theory Base Of Accounting Extra Questions

- Trial Balance And Rectification Of Errors Extra Questions