Sources Of Business Finance - Class 11 Commerce Business Studies - Extra Questions

What do you mean by collateral security?

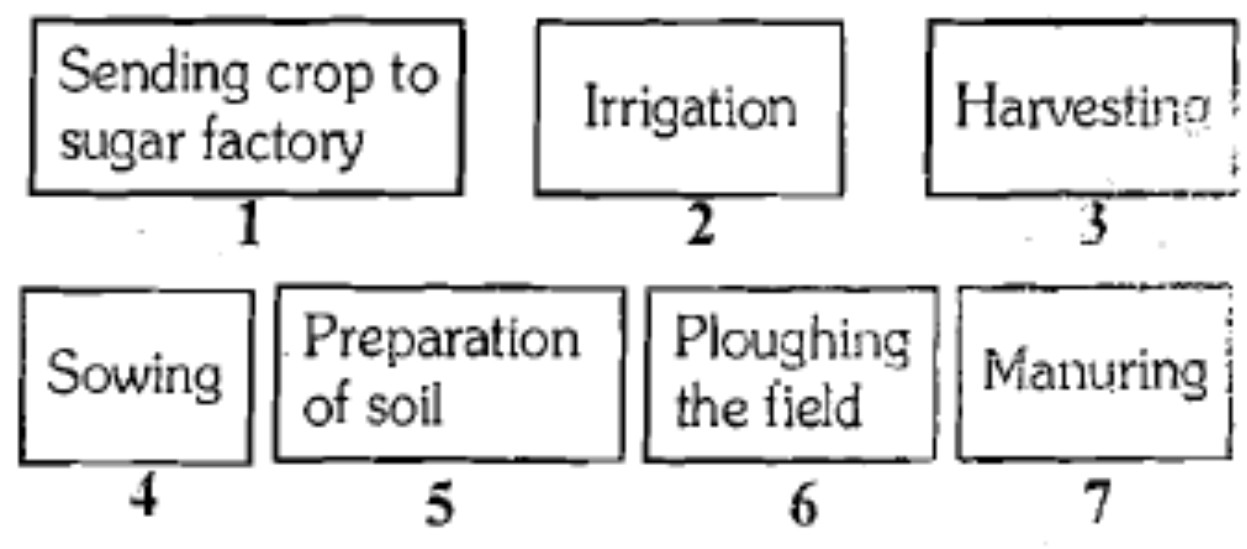

Arrange the following boxes in proper order to make a flow chart of sugar cane crop production:

Answer briefly:

Give two merits of Inter Corporate Deposits.

Answer the question.

What is the difference between Sinking Fund Method and Insurance Policy Method?

Answer the question briefly.

What is meant by factoring?

Why are the financial institutions also known as Development Banks?

Write short notes on the following.

Types of Debentures.

Explain Features of Debentures.

What do you mean by Public Deposits?

What do you mean by retained earnings?

Mention the preferential rights that are enjoyed by the preference shareholders.

What is debenture?

Why do banks or financial institutions demand collateral security?

What do you mean by Specific Coupon Rate Debentures?

Explain the relation between the bank and its customers.

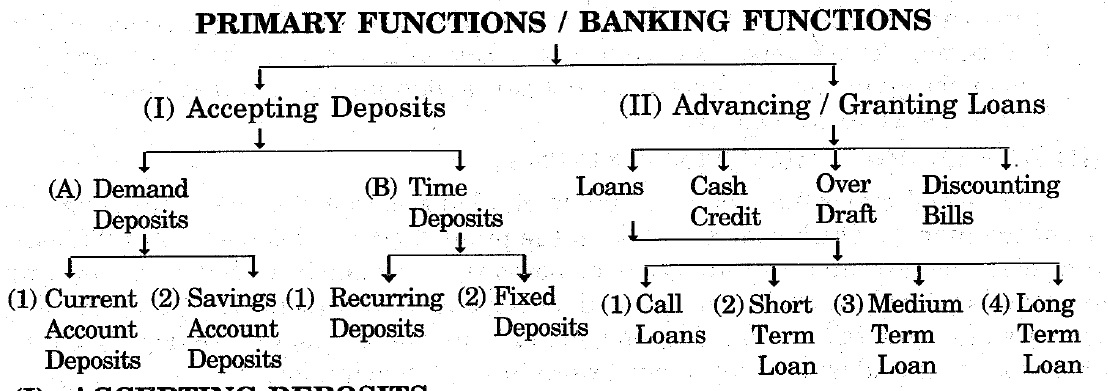

Explain the different ways in which commercial banks advance loans to the public.

Mention any two functions of a commercial bank.

Explain two methods of accepting deposits by commercial banks.

Explain the agency functions of commercial banks.

Briefly explain two methods of advancing loans by Commercial Banks.

Explain the 'Discount of bills'.

Explain the function of commercial banks in the field of "acceptance of deposits".

What are the chief methods of lending available to the commercial banks?

Which of the following is a function of a Commercial Bank? Give a reason to support your answer:

i. Acting as a lender of last resort

ii. Deciding what is legal tender

iii. Determining monetary policy

iv. Providing cash credit facility.

Match the following two lists of statements:

List-I:List-II

Match the following with their year of establishment

Explain the primary functions of commercial bank.

Fill in the blanks with appropriate alternatives given in the brackets:

Bank rate is __ measure of credit control.

(Quantitative, Government, Qualitative, Selective)

Explain the meaning of commercial banks and give its definition.

Fill in the blanks with appropriate alternatives given in the brackets:

___ is the apex body of the monetary and banking system of the nations's economy. (commercial bank, Central Bank, Government, Co-operative bank)

Write Short Notes on.

E-banking facility.

What are the primary functions of commercial bank?

Write Short Notes on.

Agency function of Commercial Bank.

Write Short Notes on.

Overdraft facility or Bank Overdrafts.

Write Short Notes on.

Demat account.

Explain any five types of debentures through which a company can collect borrow capital from the public.

On $$1^{st}$$ April $$2015$$,P Ltd. Issued $$6,000 12\%$$ Debenture of $$Rs.100$$ each at per redemable at a Premium of $$7\%$$.The Debentures were to be redemmed a the the end of third year.Prepare Loss on issue of $$12\%$$ Debenture Accounts.

Write Short Notes on.

General utility functions of commercial banks.

Answer the following question.

Explain in brief the agency function of commercial bank.

Discuss the Primary and Secondary functions of bank.

Write short notes on the following:

Types of Advances.

Attempt the following

State the position of debenture holders in a company.

Write notes on:

Renewal of deposits.

Attempt the following :

Draft a letter of thanks to the depositor of a company.

Explain the effect of an increase in bank rate on credit creation by commercial banks.

How do changes in bank rate affect money creation by Commercial Banks?Explain.

State any three points of distinction between Central Bank and Commercial Banks.

Calculate the total deposit created by commercial banks if reserve ratio is $$10\%$$ and primary deposit is $$Rs. 1,250$$ crores.

Explain any three reasons for the banks and cooperative societies to increase their lending facilities in rural areas.

Write notes on(Any Three)

Constituents and concepts in Depository system.

Write notes on (Any Three)

Repayment of Deposits.

Write short notes on the following:

Advantages of public deposit for a company.

What do you mean by banks?

Answer the following question:

Draft a letter to the depositor regarding repayment of deposit.

Write notes on the following :

Bonus shares

What do you mean by "Owner's Fund"?

What is the difference between internal and external sources of raising funds? Explain.

What is meant by "trade credit"?

What do you mean by debentures?

Define mortgage.

Explain two methods adopted by Commercial Banks to advance loans to the general public.

Discuss the meaning of "discounting bills of exchange".

State two agency functions of a commercial bank.

Class 11 Commerce Business Studies Extra Questions

- Business Services Extra Questions

- Business Trade And Commerce Extra Questions

- Emerging Modes Of Services Extra Questions

- Formation Of A Company Extra Questions

- Forms Of Business Organisation Extra Questions

- Internal Trade Extra Questions

- International Business Extra Questions

- Private Public And Global Enterprises Extra Questions

- Small Business And Entrepreneurship Extra Questions

- Social Responsibilities Of Business And Business Ethics Extra Questions

- Sources Of Business Finance Extra Questions