Accounting For Not-For-Profit Organisations - Class 12 Commerce Accountancy - Extra Questions

Mrs. Indu started a voluntary association of 10 peoples, who are also consumers. She collected the capital by selling shares to members and opened a retail shop so that they can eliminate middlemen and get the goods at low price.

(a) State the type of organisation mentioned in above case.

(b) State any 2 merits organisation.

Why is it important to choose an appropriate form of organisation? Discuss the factors that determine the choice of form of organisation.

Name the type of cooperative society set up:

(a) To help the small producers in selling their products.

(b) To provide easy credit on reasonable terms to the members.

Also, distinguish between the two on the basis of:

(i) Members (ii) Aim.

(a) Producer Cooperative (b) Credit Cooperative

Explain the difference between the cooperative organisations and company form of business.

Enumerate various types of cooperative societies.

State three merits of cooperative society.

What do you mean by not-for-profit organization? Give examples.

What are the major sources of income of not-for-profit organizations?

Discuss about the authority to which not-for-profit organizations submit their records.

Prize Fund Rs.22,Intrest on prize fund investment Rs.3,Prizes given Rs.5,Prize Fund Investments Rs.18,000.

Explain the statement,"Receipt and Payment Account is a summarised version of Cash Book".

What is the subscription? How is it calculated?

State the meaning of Receipt and Payment Account.

Distinguish between capital and revenue expenditure and state whether the following statements are items of capital or revenue expenditure

(a) Expenditure incurred on repairs and whitewashing at the time of purchase of an old building in order to make it usable.

(b) Expenditure incurred to provide one more exit in a cinema hall in compliance with a government order.

(c) Registration fees paid at the time of purchase of the building.

(d) Expenditure incurred in the maintenance of a tea garden which will produce tea after four years.

(e) Depreciation charged on a plant.

(f) The expenditure incurred in erecting platform on which a machine will be fixed.

(g) Advertising expenditure,the benefits of which will last for four years.

How would you treat the following items in the case of a 'not-for-profit' organisation?

Tournament Fund Rs.40,Tournament Expencess Rs.14,Receipt from Tournament Rs.16,000.

What is capital Fund? How is it calculated?

Sharad Singh Company Ltd. has been incorporated with an authorised capital of $$Rs. 10,00,000$$ divided into $$10,000$$ equity shares of $$Rs. 100$$ each. The company issued $$5,000$$ shares to the public payable $$Rs. 20$$ per share on application, $$Rs. 20$$ per share on allotment, $$Rs. 30$$ per share on first call and the balance on the final call. All the money was duly received. Make Journal entries to record the issues of share. Also prepare Bank Account and the Balance Sheet.

State whether the following would result in inflow, outflow, or no flow of cash:

(i) Bill Receivable endorsed to Creditors

(ii) Old vehicle written off

List the factors that help in selecting a suitable form of organisation.

Despite limitations of size and resources, many people continue to prefer sole proprietorship over other forms of organisation. Why? Give merits of sole proprietorship.

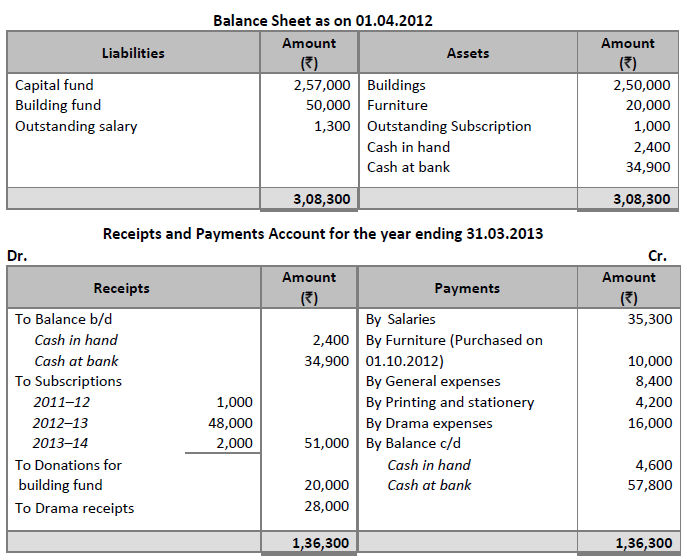

With the help of the Balance Sheet and Receipts and Payments Accounts of Adarsh Cultural Club, Mumbai, prepare Income and Expenditure Account for the year ended $$31^{st}$$ March, 2013 and the Balance Sheet as on that date:

You are also required to consider the additional information given below:

(1) The club had 100 members, each paying Rs. 500 as annual subscription.

(2) Furniture to be depreciated at 20% p.a.

(3) Salaries include Rs. 1,300 paid for outstanding salaries for the year 2011-12.

Salaries outstanding for the tear 2012-13 were Rs. 700.

Write a word/term/phrase which can substituted each of the following statements:

Excess of expenditure over income of 'not for profit' concerns.

Explain how a cooperative organisation is a democratic set-up.

Give any two examples of Non-profit organisation.

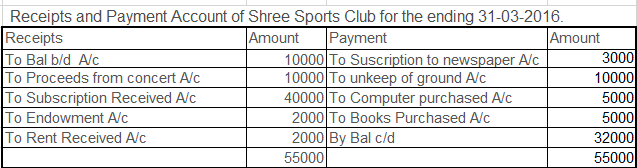

From the following ledger balance, prepare Receipts and Payment Account of Shree Sports Club for the ending 31-03-2016.

| Rs. | |

| Cash balance | 10,000 |

| Subscription to newspapers | 3,000 |

| Upkeep of ground | 10,000 |

| Proceeds from concerts | 10,000 |

| Computers purchased | 5,000 |

| Subscriptions Received | 40,000 |

| Endowment fund | 2,000 |

| Rent received | 2,000 |

| Books purchased | 5,000 |

State any two features of Receipts and payments account.

How are Specific donations treated while preparing final accounts of a 'Not-For -Profit Organisation'?

State the main aim of a not-for-profit organisation.

Give the meaning of 'Cash Equivalents' for the purpose of preparing Cash Flow Statement.

State the basis of accounting of preparing 'Income and Expenditure Account' of a Not For - Profit Organisation.

From the following information extracted from the Statement of Profit of Loss for the years ended $$31^{st}$$ March, 2017 and 2018, prepare a comparative Statement of Profit & Loss.

| Particulars | 2017-18 | 2016-18 |

| Revenue from operations Other incomes (% of revenue from operations) Employee benefit expense (% of Total Revenue) Tax rate | Rs. 6,00,000 20% 40% 50% | Rs. 5,00,000 20% 30% 50% |

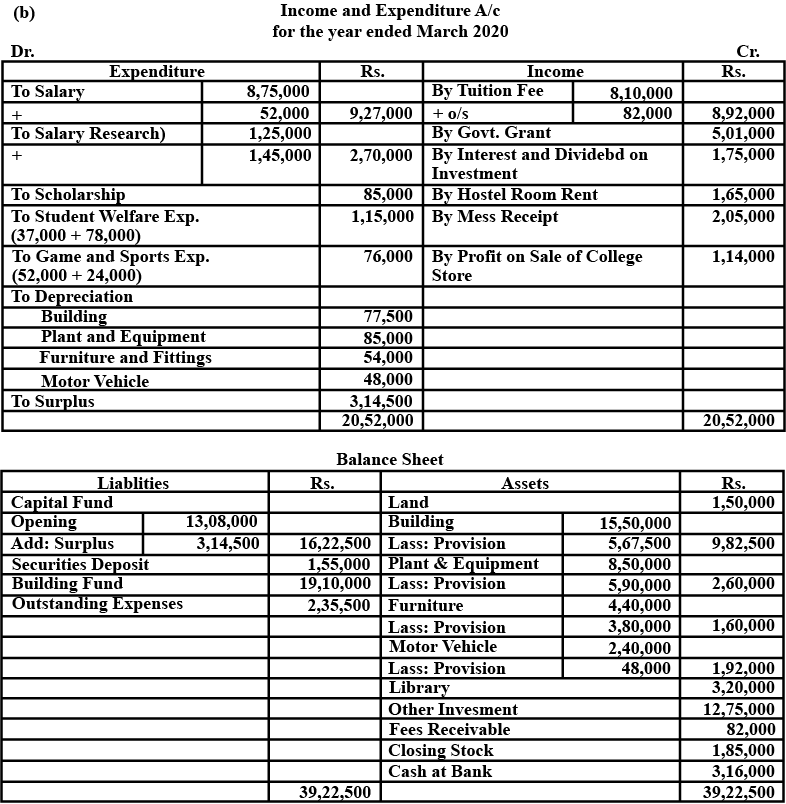

From the following balances and particulars of AS College, prepare Income & Expenditure Account for the year March, $$2020$$ and a Balance Sheet as on the date :

| Particulars | Amount (Rs.) | Amount (Rs.) |

| Security Deposit - Students Capital Fund Building Fund Tuition Fee Received Government Grants Interest & Dividends on Investments Hostel Room Rent Mess Receipts (Net) College Stores - Sales Outstanding expenses Stock of Stores and Supplies (opening) Purchases - Stores & Supplies Salaries - Teaching Salaries - Research Scholarships Students Welfare expenses Game & Sports expenses Other investments Land Building Plant and Machinery Furniture and Fittings Motor Vehicle Provision for Depreciation: Building Plant & Equipment Furniture & Fittings Cash at bank Library | $$-$$ $$-$$ $$-$$ $$-$$ $$-$$ $$-$$ $$-$$ $$-$$ $$-$$ $$-$$ $$3,10,000$$ $$8,20,000$$ $$8,75,000$$ $$1,25,000$$ $$85,000$$ $$37,000$$ $$52,000$$ $$12,75,000$$ $$1,50,000$$ $$15,50,000$$ $$8,50,000$$ $$5,40,000$$ $$2,40,000$$ $$-$$ $$-$$ $$-$$ $$3,16,000$$ $$3,20,000$$ $$\overline{75,45,000}$$ | $$1,55,000$$ $$13,08,000$$ $$19,10,000$$ $$8,10,000$$ $$5,01,000$$ $$1,75,000$$ $$1,65,000$$ $$2,05,000$$ $$7,60,000$$ $$2,35,000$$ $$-$$ $$-$$ $$-$$ $$-$$ $$-$$ $$-$$ $$-$$ $$-$$ $$-$$ $$-$$ $$-$$ $$-$$ $$-$$ $$-$$ $$4,90,000$$ $$5,05,000$$ $$3,26,000$$ $$\overline{75,45,000} $$ |

Adjustments:

(a) Materials & Supplies consumed : (From College stores)

Teaching - $$Rs. 52,000$$

Research - $$Rs. 1 , 45, 000 $$

Students Welfare - $$Rs. 78,000$$

Games or Sports - $$Rs. 24,000$$

(b) Tuition fee receivable from Government for backward class Scholars - $$Rs. 82,000$$

(c) Stores selling prices are fixed to give a net profit of $$15\%$$ on selling price.

(d) Depreciation is provided on straight line basis at the following rates :

Building $$5\%$$

Plant & Equipment $$10\%$$

Furniture & Fixtures $$10\%$$

Motor Vehicle $$20\%$$

What are the ways by which not-for-profit organizations earn a reputation in society?

State the meaning of ' Not-for-profit' Organisations.

Sanjana and Alok were partners in a firm sharing profit and losses in the ratio $$3:2$$. On $$31^{st}$$ March, 2018 their Balance Sheet was as follows:

Balance Sheet of Sanjana and Alok as on 31-3-2018

| Liabilities | Amount (Rs,) | Assets | Amount (Rs,) |

| Creditors Work men's Compensation Fund Capital: Sanjana $$5,00,000$$ Alok $$\underline{4,00,000}$$ | $$60,000$$ $$60,000$$ $$9,00,000$$ | Cash Debtors $$1,46,000$$ Less:Provision for doubtful debts $$\underline{2,000}$$ Stock Investment Furniture | $$1,66,000$$ $$1,44,000$$ $$1,50,000$$ $$2,60,000$$ $$3,00,000$$ |

| $$10,20,000$$ | $$10,20,000$$ |

(a) Goodwill of the firm was valued at Rs. 4,00,000 and Nidhi brought the necessary amount in each for her share of goodwill premium, half of which was withdrawn by the old partners.

(b) Stock was to be increased by 20% and furniture was to be reduced to 90%.

(c) Investments were to be valued at Rs. 3,00,Alok took over investments at this value.

(d) Nidhi brought Rs. 3,00,000 as her capital and the capitals of Sanjana and Alok were adjusted in the new profit sharing ratio.

Prepare Revaluation Account, Partners Capital Accounts and the Balance Sheet of the reconstituted firm on Nidhi's admission.

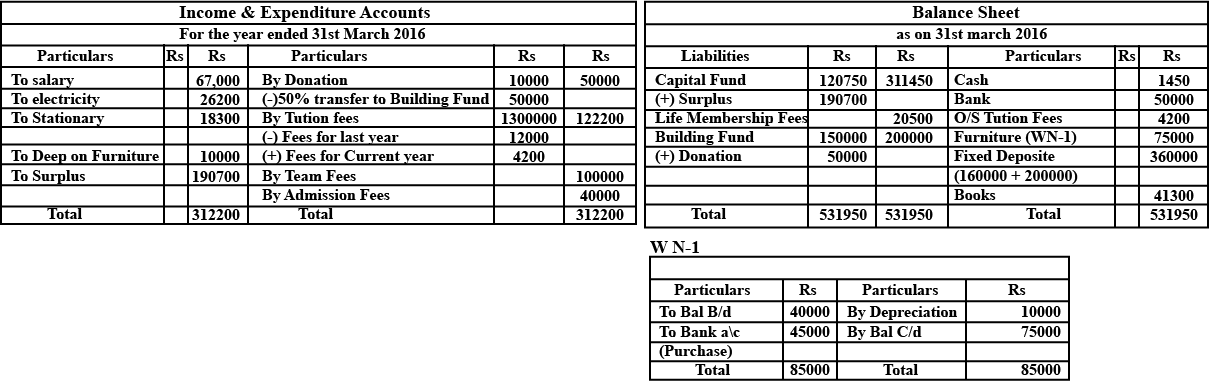

From the following Receipts and Payments Account of A.S.C. College of Commerce, Ramanand Nagar, for the year ending $$31^{st}$$ March, $$2016$$ and additional information, prepare Income and Expenditure Account for the year ending $$31$$st March, $$2016$$ and Balance Sheet as on that date.

Receipts and Payments Account for the year ended on $$31$$ March, $$2016$$

| Receipts | Amount(Rs.) Dr. | Payments | Amount(Rs.) Cr. |

| To Balance b/d | By Salaries | $$67,000$$ | |

| Cash in hand | $$7,950$$ | By Electricity | $$26,200$$ |

| Cash at bank | $$50,800$$ | By Books | $$41,300$$ |

| To Life membership fees | $$20,500$$ | By Furniture | $$45,000$$ |

| To Donations | $$1,00,000$$ | By Stationery | $$18,300$$ |

| To Tuition fees | $$1,30,000$$ | By Fixed deposits | $$2,00,000$$ |

| To Term fees | $$1,00,000$$ | By Balance c/d | |

| To Admission fees | $$40,000$$ | Cash | $$1,450$$ |

| Bank | $$50,000$$ | ||

| $$4,49,250$$ | $$4,49,250$$ |

$$(1)$$

| Particulars | $$01.04.2015$$ Amount (Rs.) | $$31.03.2016$$ Amount $$(Rs.) |

| Furniture | $$40,000$$ | $$75,000$$ |

| Building fund | $$1,50,000$$ | - |

| Fixed deposits | $$1,60,000$$ | - |

| Capital fund | $$1,20,750$$ | - |

$$(3)$$ Life membership fees are to be capitalised.

$$(4)$$ Tuition fees includes Rs. $$12,000$$ received for the last year.

$$(5)$$ Outstanding tuition fees for the current year amounted to Rs. $$4,200$$.

Class 12 Commerce Accountancy Extra Questions

- Accounting For Not-For-Profit Organisations Extra Questions

- Accounting For Partnership: Basic Concepts Extra Questions

- Accounting For Share Capital Extra Questions

- Accounting Ratios Extra Questions

- Analysis Of Financial Statements Extra Questions

- Cash Flow Statement Extra Questions

- Dissolution Of Partnership Firm Extra Questions

- Financial Statements Of A Company Extra Questions

- Issue And Redemption Of Debentures Extra Questions

- Reconstitution Of A Partnership Firm - Admission Of A Partner Extra Questions

- Reconstitution Of A Partnership Firm - Retirement / Death Of A Partner Extra Questions