Reconstitution Of A Partnership Firm - Retirement / Death Of A Partner - Class 12 Commerce Accountancy - Extra Questions

$$X, Y$$ and $$Z$$ are partners in a firm sharing profits in $$2 : 2 : 1$$ ratio. The fixed capitals of the partners were: $$X\ Rs. 5,00,000;\, Y\ Rs. 5,00,000$$ and $$Rs. 2,50,000$$ respectively. The Partnership Deed provides that interest on capital is to be allowed @ 10% p.a. $$Z$$ is to be allowed a salary of $$Rs.2,000$$ per month. The profit of the firm for the year ended 31st March, 2018 after debiting Z's salary was $$Rs. 4,00,000$$

Prepare Profit and Loss Appropriation. Account.

$$A, B$$ and $$C$$ are partners sharing profits and losses in the ratio of $$2 : 2 :1$$ respectively. $$A$$ is entitled to a commission of 10% on the net profit. Net profit for the year is Rs. 1,10,Determine the amount of commission payable to $$A$$.

What is meant by Purchased Goodwill?

The average profit earned by a firm is Rs.$$7,50,000$$ which includes overvaluation of stock of Rs. $$30,000$$ of an average basis. The capital invested in the business Rs. $$42,00,000$$ and the normal rate of return is $$15%$$. Calculate goodwill of the firm on the basis of $$3$$ times the super profit.

From the following information, calculate value of goodwill of the firm by applying Capitalisation Method. Total capital of the firm is Rs.$$16,00,000$$.

Normal rate of return $$10\%$$. Profit for the year is Rs. $$2,00,000$$.

What is meant by Self-generated Goodwill?

How does the market situation affect the value of Goodwill of a firm?

Why Goodwill considered as an intangible asset but not a fictitious asset?

How does location affect the Goodwill of a business?

When the General Reserve is distributed, is the partner's Capital Account debited or credited?

If the new partner brings in his share of goodwill in cash and if goodwill also appears in books, how is existing amount of goodwill dealt with?

Why do we distribute reserves, accumulated profits and losses among the old partners?

State the reason of contributing for goodwill by a new partner at the time of his admission.

When capitals are made proportionate to profit-sharing ratio and excess capital is paid back to a partner, is his Capital Account debited or credited?

Under what circumstances will the premium for goodwill paid by the incoming partner not be recorded in the books of account?

Why should a new partner contribute for goodwill on admission?

State whether Revaluation Account is debited or credited to record an unrecorded asset.

State the need for treatment of goodwill on admission of a partner.

When existing Goodwill is written off, is the partner's Capital Account debited or credited?

$$A, B$$ and $$C$$ are partners having capitals of $$Rs.3,00,000, Rs. 2,00,000$$ and $$Rs. 1,00,000$$. They admit $$D$$ as a partner for $$1/5^{th}$$ share on $$1^{st}$$April,On this day, the firm has reserve of $$Rs. 60,000$$. $$A$$ and $$B$$ demand that reserve should be shared in proportion of capital whereas $$C$$ is of the opinion that it should be shared equally as they do not have partnership deed. $$A$$ and $$B$$ agree to $$C's$$ viewpoint.

What argument must have been put by $$C$$ that convinced both $$A$$ and $$B$$?

Mohan and Sohan were partners in a firm sharing profits and losses in the ratio of $$3:2$$. they admitted Ram for $$1/4^{th}$$ share on $$1^{st}$$ April,It was agreed that goodwill of the firm will be valued at $$3$$ years purchase of the average profit of last $$4$$ years which were $$Rs. 50,000$$ for 2014-15, $$Rs. 60,000$$ for 2015-16, $$Rs. 90,000$$ for 2016-17 and $$Rs. 70,000$$ for 2017-Ram did not bring his share of goodwill premium in cash. Record the necessary Journal entries in the books of the firm on Ram's admission when:

(a) Goodwill appears in the books at $$Rs. 2,02,500$$

(b) Goodwill appears in the books at $$Rs. 2,05,500$$.

$$X$$ and $$Y$$ are partners sharing profits and losses equally. They admit $$Z$$ as partner for $$1/3^{rd}$$ share which he takes from $$Y$$. $$Z$$ brings $$Rs. 50,000$$ as his share of goodwill. $$X$$ is of the opinion that goodwill brought by $$Z$$ should be shared equally whereas $$Y$$ is of the opinion that $$Rs. 50,000$$ should be credited to his capital $$X$$ finally agrees to $$Y's$$ view.

What argument must been given by $$Y$$ that made $$X$$ agree?

$$A, B$$ and $$C$$ were partners sharing profits and losses in the ratio of $$6:3:1$$. They decide to take $$D$$ into partnership with effect from $$1^{st}$$April,The new profit-sharing ratio between $$A, B, C$$ and $$D$$ will be $$3:3:3:1$$. They also decided to record the effect of the following without affecting their book values, by passing a single adjustment entry:

| Book Value (Rs.) | |

| General Reserve | 1,50,000 |

| Contingency Reserve | 60,000 |

| Profit and Loss A/c(Cr.) | 90,000 |

| Advertisement Suspense A/c (Dr.) | 1,20,000 |

$$X$$ and $$Y$$ are partners in a firm, sharing profits and losses in the ratio of $$3:2$$. $$Z$$ is admitted as partner with $$1/4$$ share in profit. $$Z$$ acquires his share from $$X$$ and $$Y$$ in the ratio of $$2:1$$.

Calculate the new profit sharing ratio.

$$X$$ and $$Y$$ are partners with capitals of $$Rs. 50,000$$ each. They admit $$Z$$ as a partner with $$1/4^{th}$$ share in the profits of the firm. $$Z$$ brings in $$Rs. 80,000$$ as his share of capital. The Profit and Loss Account showed a credit balance of $$Rs. 40,000$$ as on date of admission of $$Z$$.

Give necessary Journal entries to record the goodwill.

$$X$$ and $$Y$$ are partners sharing profits and losses in the ratio of $$3:2$$. They admit $$Z$$ into partnership. $$X$$ gives $$1/3^{rd}$$ of his share, while $$Y$$ gives $$1/10^{th}$$ from his share to $$Z$$. Calculate new profit-sharing and sacrificing ratio.

$$A$$ and $$B$$, carrying on business in partnership and sharing profits and losses in the ratio of $$3:2$$, require a partner, when their Balance Sheet stood as:

| Liabilities | (Rs.) | Assets | (Rs.) |

| Creditors A's Capital 51,450 B's Capital 36,750 | 11,800 88,200 | Cash Stock Debtors Furniture Machinery | 1,500 28,000 19,500 2,500 48,500 |

| 1,00,000 | 1,00,000 |

(a) Goodwill of the firm be valued at twice the average of the last three years profits which amounted to $$Rs. 21,000; Rs. 24,000$$ and $$Rs. 25,560$$.

(b) $$C$$ is to bring in cash for the amount of his share of goodwill.

(c) $$C$$ is to bring in cash $$Rs. 15,000$$ as his capital.

Pass Journal entries recording these transactions, draw out the Balance sheet of the new firm and state new profit sharing ratio.

What are the assumptions in calculation of goodwill by average profit method ?

What are the assumptions in calculation of goodwill by super profit method?

What do you mean by joint life policy?

Jayant, Karthik and Leena were partners in a firm sharing profits and losses in the ratio of $$5:2:3$$. Kartik died and Jayant and Leena decided to continue the business. Their gaining ratio was $$2:3$$.

Calculate the new profit sharing ratio of Jayant and Leena.

X, Y and Z are partners in a business, sharing profits and losses equally. Z dies, and the firm is dissolved. On the date of dissolution, the capital of X, Y and Z were Rs. 20,000, 15,000 and Rs. 10,000 respectively and the outside liabilities amounted to Rs. 65,The total assets of the firm realized Rs. 50,What is the amount of deficiency and how the partners shall share such deficiency if the partnership agreement is silent?

X, Y and Z are partners. The partnership agreement is silent. State whether the firm is dissolved on 31.03.99 in each of the following alternative cases:

case (a): If the firm was constituted for 5 years and 5 years have expired on 31.03.99.

Case (b): If the firm was constituted for completion of a construction of a bridge and the construction completed on 31.03.99.

Case (C): If X died on 31.03.99.

Case (d): If X applies for insolvency on 31.03.99 and is declared insolvent on 30.04.99.

Case (e): If X retires on 31.03.99.

Case (f): If X is expelled as partner on 31 03.99 and the expulsion is invalid.

Solve.

X, Y and Z jointly promise to pay? Rs. 9,000 to W. Who is liable to pay the amount to W in each of the following alternative cases

Case (a) If X dies,

Case (b) X, Y and Z die?

X, Y and Z are partners in a business sharing profits and losses equally. X dies and the firm is dissolved. On the date of dissolution, the capitals of X, Y and Z were Rs. 20,000, Rs. 15,000 and Rs. 10,000 respectively and the outside liabilities amounted to Rs. 65,The assets of the firm realised Rs. 15,The private estate and debts of each partners were as follows:Private estate Rs. 1,00,000 Rs. 2,00,000, Rs. 3,00,000 Private debt Rs. 1,10,000, Y Rs. 1,90,000, Z Rs. 3,10,000 The outside creditors claim that the deficiency of Rs. 50,000 (i.e., Rs. 65,000 -Rs. 15,000) should be contributed by the partners out of their private estate which amounted to 6,00,000 because the partners are jointly and severally liable to

pay firms debts. Discuss the validity of their claim.

X, Y and Z are partners in a business, sharing profits and losses equally. Z dies, and the firm is dissolved. On the date of dissolution, the capitals of X, Y and Z were Rs. 20,000, Rs. 15,000 and 10,00 respectively and the outside liabilities amounted to Rs. 65,X had advanced Rs. 10,000 as loan to the firm. State how the amount realized shall be used if the assets realized (a) Rs. 1,35,000 (b)Rs. 1,05,000?

A, B C, D and E are partners of a banking firm. State the legal position Of the firm for the following acts of partners

(a) A borrow's money in the name of the firm.

(b) B orders for certain quantity of wine, on the firm's letter head.

(c) C receives money from a borrower of a firm and utilized this amount for personal use without informing other partners about the receipt of this money.

(d). D borrows money on his own credit by giving his own promissory note and utilizes subsequently this amount for firm's use.

How is gain ratio calculated?

Does partnership firm has a separate legal entity? Give reason in support of your answer.

State any three circumstances other than (i) admission of a new partner, (ii) retirement of a partner and (iii) death of a partner, when need for valuation of goodwill of a firm may raise.

List the items that are debited to Profit and Loss Appropriation Account.

What is meant by `unlimited liability of a partner'?

Manbir and Nimrat are partners and they admit Anahat into partnership. It was agreed to value Goodwill at three years purchase on weighted average profit method taking profits of last five years. Weights assigned to each year as 1,2,3,4 and 5 respectively to profits for the year ended 31st march 2014 toThe profits for these years were Rs.70,000, Rs 1,40,000, Rs.1,00,000, Rs. 1,60,000 and Rs. 1,65,000 respectively.

Scrutiny of books of account revealed following information:

(i) There was an abnormal loss of Rs.20,000 in the year ended 31st March,2014.

(ii) There was an abnormal gain (profit) of Rs.30,000 in the year ended 31st March ,2015.

(iii) Closing stock as on 31st March, 2017 was over valued by Rs.10,000.

Calculate the value of goodwill.

A and B are partners sharing profits and losses in the ratio of 5:3.On first 1st April,2018, C is admitted to the partnership for 1/4th share of profits. For this purpose, goodwill is to be valued at two years purchase of last three years profit (after allowing partners remuneration).Profits to be weighted 1:2:3,the greatest weight being given to last year. Net profit before partners remuneration were 2015-16 : Rs. 2,00,000; 2016-17: Rs 2,30,000; 2017-18 :Rs.2,50,000.The remuneration of the partners is estimated to be RS. 90,000 p.a.Calculate amount of goodwill.

Kumar, Lakshya, Manoj and Naresh are partners sharing profits in the ratio of $$3:2:1:4$$. Kumar retires and his share is acquired by Lakshya and Manoj in the ratio of $$3:2$$. Calculate new profit-sharing ratio and gaining ratio of the remaining partners.

Short notes:

Define Goodwill.

$$X, Y$$ and $$Z$$ are sharing profits and losses in the ratio of $$5:3:2$$ With effect from $$1st$$ April, $$2018$$ ,they decide to share profits and losses in the ratio of $$5:2:3$$ Calculate each partner's gain or sacrificed due to the change in ratio.

Calculate the value of firm's goodwill on the basis of one and half years purchase of the average profit of the last three years. the profit for first year was Rs. $$1,00,000$$, profit for the second year was twice the profit of the first year and for third year profit was one and half times of the profit of the second year.

Calculate value of goodwill on the basis of three years purchase of average profit of the preceding five years were as follows:

| year | 2017-18 | 2016-17 | 2015-16 | 2014-15 | 2013-14 |

| Profits(Rs) | $$8,00,000$$ | $$15,00,000$$ | $$18,00,000$$ | $$4,00,000$$(Loss) | $$13,00,000$$ |

$$A$$ and $$B$$ are sharing profits and losses equally. With effect from $$1st$$ April, 2018, they agree to sharing-profits in the ratio $$4:3$$ .Calculate individual partner's gain or sacrifice due to the change in ratio.

How does the nature of business affect the value of Goodwill of a firm?

State any two factors affecting the value of Goodwill of a firm.

Why is the value of goodwill determined when a firm is reconstituted?

$$X, Y$$ and $$Z$$ are sharing profits and losses in the ratio of $$5:3:2$$ With effect from $$1st$$ April, $$2018$$ ,they decide to share profits and losses equally. Calculate each partner's gain or sacrifice due to the change in ratio.

Do you distribute Reserves at the time of Reconstitution of a firm? Why?

The average net profit expected in future by $$XYZ$$ firm is Rs.$$36,000$$ per year. Average capital employed in the business by the firm is Rs. $$2,00,000$$. The normal rate of return from capital invested in his class of business is $$10%$$. Remuneration of the partners is estimated to be Rs. $$6,000$$ p.s. Find out the value of goodwill on the basis of two years purchase of super profit.

$$A$$ and $$B$$ are partners in a firm sharing profits in the ratio of $$2:1$$ . They decided with effect from $$1st$$ April, $$2017$$ ,that they would share profits in the ratio of $$3:2$$ .But, this decision was taken after the profit for the year $$2017-18 $$ amounting to Rs. $$90,000$$ was distributed in the old ratio.

Value of firm's goodwill was estimated on the basis of aggregate of two years' profits preceding the date decision became effective.

The profits for $$2015-16$$ and $$2016-17$$ were Rs. $$60,000$$ and Rs. $$75,000$$ respectively. It was decided that Goodwill Account will not be opened in the books of the firm and necessary adjustment be made through Capital Accounts which, on $$31st$$ $$ stood, at Rs. 1,50,000 and Rs. $$90,000$$ for B. Pass necessary Journal entries and prepare Capital Accounts.

$$X, Y$$ and $$Z$$ are partners sharing profits and losses in the ratio of $$ 5:3:2$$, decided to share future profits equally with effect from $$1st$$ April, $$2018$$. On that date, the goodwill appeared in the books at Rs. $$12,000$$. But it was revalued at Rs. $$3,000$$ . Pass journal entries assuming that goodwill will not appear in the books of account.

A business has earned average profit of Rs.$$4,00,000$$ during the last few years and the normal rate of return in similar business is $$10\%$$. Find value of goodwill by:

(i) Capitalisation of Super Profit Method, and

(ii) Super Profit Method if the goodwill is valued at $$3$$ years purchase of super profits.

Assets of the business were Rs. $$40,00,000$$ and its external liabilities Rs.$$7,20,000$$.

$$X$$ and $$Y$$ are partners in a firm sharing profits and losses in the ratio of $$3:2$$, With effect from $$1st$$ April, $$2018$$, they decided to share future profits equally. On the date of change in the profit-sharing ratio, the Profit and Loss Account showed a credit balance of Rs. $$1,50,000$$. Record the Journal entry for the distribution of the balance in the profit and Loss Account immediately before the change in the profit-sharing ratio.

A firm earns profit of Rs$$5,00,000$$. Normal rate of Return in a similar type of business is $$10%$$. The value of total assets (excluding goodwill) and total outsider liabilities as on the date of goodwill are Rs.$$55,00,000$$ and Rs.$$14,00,000$$ respectively. Calculate value of goodwill according to Capitalisation of Super Profit Method as well as Capitalisation of Average Profit Method.

$$A, B$$ and $$C$$ are partners sharing profit and losses in the ratio $$5:4:1$$ . Calculate new profit sharing ratio, sacrificing ratio in each of the following cases :

Case $$1.C$$ acquires $$1/5th$$ share from $$A$$.

Case $$2.C$$ acquires $$1/5th$$ share from $$A$$ and $$B$$ $$ $$

Case $$A, B$$ and $$C$$ will share future profits and losses equally.

Case $$C$$ acquires $$1/10th$$ share of $$A$$ and $$1/2$$ share of $$B$$ .

Jay and Raj are partners sharing profits in the ratio of $$3:2$$ , with effect from $$1st$$ April, $$2018$$ , they decided to share profits equally. Goodwill appeared in the books at Rs. $$25,000$$ . As on $$1st$$ April, $$2018$$ , it was valued at Rs. $$ 1,00,000$$ . They decided to carry goodwill in the books of the firm.

Pass the Journal entry giving effect to the above.

$$A, B$$ and $$C$$ shared profits and losses in the ratio of $$3:2:1$$ respectively. With effect from $$1st$$ April, $$2018$$ ,they agreed to share profits equally. The goodwill of the firm was valued at Rs. $$18000.$$ Pass necessary Journal entries when

(a) Goodwill Account is not opened

(b) Goodwill Account is opened.

$$A$$ and $$B$$ are partners in a firm, sharing profits in the ratio of $$4:1$$. They decided to share future profit in the ratio of $$3:2$$ w.e.f. $$1st$$ April, $$2018$$. On that day, Profit and Loss Account showed a debit balance of Rs. $$1,00,000$$. Pass Journal entry to give effect to the above.

$$X, Y$$ and $$Z$$ are partners sharing profits and losses in the ratio of $$5:3:2$$ . From $$1st$$ April, $$2018$$ , they decided to share profits and losses equally. The Partnership Deed provides that in the event of any change in the profit-sharing ratio, the goodwill should be valued at two years' purchase of the average profit of the preceding five years. The profits and losses of the preceding years are :

| Year | $$2013-14$$ | $$2014-15$$ | $$2015-16$$ | $$2016-17$$ | $$2017-18$$ |

| Profit (Rs.) | $$70,000$$ | $$85,000$$ | $$45,000$$ | $$35,000$$ | $$10,000$$ (Loss) |

(i) When goodwill account is opened

(ii) When goodwill account is not opened

$$A, B$$ and $$C$$ who are presently sharing profits and losses in the ratio of $$5:3:2$$ decided to share future profits and losses in the ratio of $$2:3:4$$ . Give the Journal entry to distribute 'Investments Fluctuation Reserve' of Rs. $$20,000$$ at the time of change in profit sharing ratio, when Investment (market value Rs. $$95,000$$ ) appears in the books at Rs. $$1,00,000$$ .

Anita, Bimla and Cherry are three partners. On 1st April 2017, their Capitals stood as: Anita Rs. 1,00,000, Bimla Rs. 2,00,000 and Cherry Rs. 3,00,It was decided that: (a) they would receive interest on Capital @ 5% pa., (b) Anita would get a salary of Rs. 5,000 per month, (c) Bimla would receive commission @ 5% of net profit after deduction of commission, (d) 10% of the divisible profit would be transferred to the General Reserve. Before the above items were taken into account, the profit for the year ended 31st March 2018 was Rs. 5,00,Prepare Profit and Loss Appropriation Account and the Capital Accounts of the Partners.

$$X$$ and $$Y$$ are in partnership sharing profits in the ratio $$2:3.$$ With effect from $$1st$$ April, $$2018$$ , they agreed to share profits in the ratio of $$1:2$$ . For the purpose, goodwill of the firm is to be valued at two years' purchase of the average profit of last three years, which were Rs. $$1,50,000 ; 1,60,000 ; $$ and Rs. $$2,00,000$$ respectively. The reserves appear in the books at Rs. $$1,10,000$$ Partners decide to continue showing reserves in the books. You are required to give effect to the change by passing a single Journal entry.

The goodwill of a firm is valued at $$Rs. 1,35,000$$ at $$3$$ years purchase of super profit. Determine the missing values:

Average Profit $$ = \dfrac{3,60,000}{3} = Rs. 1,20,000$$

Normal Profit $$= Rs. ...\times \dfrac{15}{100} = Rs. ...$$

Super Profit $$=$$ Average Profit $$-$$ Normal Profit

$$= Rs. 1,20,000 - Rs. ... = Rs. ..$$

Goodwill $$=$$ Super Profit $$\times$$ No. of year's purchase.

Anshul and Asha are partners, sharing profits and losses in the ratio of 3 :Anshul being a non-working a - partner contributed Rs. 8,00,000 as her capital. Asha being a working partner did not contribute capital. The Partnership Deed provides for interest on capital @ 5% and salary to every working partner @ Rs.2,000 per month. Net profit before providing for interest on capital and partner's salary for the year ended 31st March 2018 was Rs. 32,Show distribution of profits.

P and Q were partners in a firm sharing profits and losses equally. Their fixed capitals were Rs. 3,00,000 each respectively. The Partnership Deed provided for interest on capital @ 12% per annum. For the year ended 31st March, 2016, the profits of the firm were distributed without providing interest on capital. Pass necessary adjustment entry to rectify the error.

$$X, Y$$ and $$Z$$ who are presently sharing profits and losses in the ratio of $$5:3:2$$ decide to share future profits and losses in the ratio of $$2:3:5$$ . Give the Journal entry to distribute 'Workmen Compensation Reserve' of Rs. $$ 1,20,000$$ at the time of change in profit-sharing ratio, when there is a claim of Rs. $$80,000$$ against it.

Nitin, Tarun and Amar are partners sharing profits equally and decide to share profits in the ratio of $$2:2:1$$ w.e.f. $$1st$$ April, $$2018$$ . The extract of their Balance Sheet as at $$31st$$ March, $$2018$$ is as follows :

| Liabilities | Rs. | Assets | Rs. |

| Investments Fluctuation | $$60,000$$ | Investments (At cost) | $$4,00,000$$ |

(i) When its Market Value is not given

(ii) When its Market Value is given as Rs. $$4,00,000$$ ;

(iii) When its Market Value is given as Rs. $$4,24,000$$ ;

(iv) When its Market Value is given as Rs. $$3,70,000$$ ;

(v) When its Market Value is given as Rs. $$3,10,000.$$

$$X, Y$$ and $$Z$$ who are sharing profits and losses in the ratio of $$5:3:2$$ decide to share future profits and losses in the ratio of $$2:3:5$$ with effect from $$1st$$ April, $$2018$$ . Workmen Compensation Reserve appears at Rs. $$ 1,20,000$$ in the Balance Sheet as on $$31st$$ March, $$2018$$ and Workmen Compensation Claim is estimated at Rs. $$1,50,000$$ Pass Journal entries for the accounting treatment of Workmen Compensation Reserve.

A, B and C are partners sharing profits and losses in the ratio $$5:3:2$$ . Their Balance Sheer as $$31st$$ March, $$2017$$ stood as follows :

| Liabilities | Rs. | Assets | Rs. |

| Capital A/cs' : A 2,50,000 B 2,50,000 C 2,00,000 | 7,00,000 | Land and Building | 3,50,000 |

| General Reserve | 60,000 | Machinery | 2,40,000 |

| Investments Fluctuation Reserve | 30,000 | Computers | 70,000 |

| Sundry Creditors | 90,000 | Investments (Market Value Rs. 90,000) | 1,00,000 |

| Sundry Debtors | 50,000 | ||

| Cash in Hand | 10,000 | ||

| Cash at Bank | 55,000 | ||

| Advertisement Suspense | 5,000 | ||

| 8,80,000 | 8,80,000 |

(i) Value of Land and Building be decreased by $$5 \%$$

(ii) Value of Machinery be decreased by $$5 \%$$

(iii) A Provision for Doubtful Debts be created @ $$5 \% $$ on Sundry Debtors.

(iv) A motor cycle valued at Rs. $$ 20,000$$ was unrecorded and is now to be recorded in the books.

(v) Out of Sundry Creditors, Rs. $$10,000$$ is not payable.

(vi) Goodwill is to be valued at $$2$$ years' purchase of last $$3$$ years profits. Profits being for $$2016-17$$ - Rs. $$50,000$$ (Loss) ; $$2015-16$$ - Rs. $$2,50,000$$ and $$2014-15$$ - Rs. $$2,50,000$$

(vii) $$C$$ was to carry out the work for reconstituting the firm at a remuneration (including expenses) of Rs. $$5,000$$ . Expenses came to Rs. $$3,000$$.

Pass Journal entries and prepare Revaluation Account.

$$R$$ and $$S$$ are partners sharing profits in the ratio of $$5:3$$. $$T$$ joins the firm as a new partner. $$R$$ gives $$1/4^{th}$$ of his share and $$S$$ gives $$1/5^{th}$$ of his share to the new partner.

Find out new profit-sharing ratio.

$$A$$ and $$B$$ are partners sharing profits and losses in the proportion of $$7:5$$. They agree to admit $$C$$, their manager, into partnership who is to get $$1/6^{th}$$ share in the profit. He acquires this share as $$1/24^{th}$$ from $$A$$ and $$1/8^{ht}$$ from $$B$$. Calculate new profit-sharing ratio.

State whether Revaluation Account is debited or credited to record the increase in the value of Plant and Machinery.

Kabir and Farid are partners in a firm, sharing profits and losses in the ratio of $$7:3$$. Kabir surrenders $$2/10^{th}$$ from his share and Farid surrenders $$1/10^{th}$$ from his share in favour of Jyoti new partner.

Calculate new profit-sharing ratio and sacrifice ratio.

Find new Profit-Sharing Ratio:

(i) $$R$$ and $$T$$ are partners in a firm sharing profits in the ratio of $$3:2$$. $$S$$ joins the firm. $$R$$ surrenders $$1/4^{th}$$ of his share and $$T$$ surrenders $$1/5^{th}$$ of his share in favour of $$S$$.

(ii) $$A$$ and $$B$$ are partners.They admit $$C$$ for $$1/4^{th}$$ share. In future, the ratio between $$A$$ and $$B$$ would be $$2:1$$.

(iii) $$A$$ and $$B$$ are partners sharing profits and losses in the ratio of $$3:2$$. They admit $$C$$ for $$1/5^{th}$$ share in profit. $$C$$ acquires $$1/5^{th}$$ of his share from $$A$$ and $$4/5^{th}$$ share from $$B$$.

(iv) $$X, Y$$ and $$Z$$ are partners in the ratio of $$3:2:1$$. $$W$$ joins the firm as a new partners for $$1/6^{th}$$ share in profits. $$Z$$ would retain his original share.

(v) $$A$$ and $$B$$ are equal partners. they admit $$C$$ and $$D$$ as partners with $$1/5^{th}$$ and $$1/6^{th}$$ share respectively.

(vi) $$A$$ and $$B$$ are partners sharing profits/losses in the ratio of $$3:2$$. $$C$$ is admitted for $$1/4^{th}$$ share. $$A$$ and $$B$$ decide to share equally in future.

State whether Revaluation Account is debited or credited to record the decrease in the value of Plant and machinery.

$$A$$ and $$B$$ are partners sharing profits in the ratio of $$4:3$$ . Their Balance Sheet as at $$31st$$ March, $$2018$$ stood as :

| Liabilities | Rs. | Assets | Rs. |

| Sundry Creditors | 28,000 | Cash | 20,000 |

| Reserve | 42,000 | Sundry Debtors | 1,20,000 |

| Capital A/cs $$A$$ 2,40,000 $$B$$ 1,20,00 | 3,60,000 | Stock | 1,40,000 |

| Fixed Assets | 1,50,000 | ||

| 4,30,000 | 4,30,000 | ||

(i) Fixed Assets are to be depreciated by $$10 \%$$

(ii) A Provision for Doubtful Debts of $$6 \% $$ be made on Sundry Debtors.

(iii) Stock be valued at Rs. $$1,90,000$$

(iv) An amount of Rs. $$3,700$$ included in Creditors is not likely to be claimed.

Partners decided to record the revised values in the books. However, They do not want to disturb the Reserve. You are required to pass Journal entries, prepare Capital Accounts of Partners and the revised Balance Sheet.

$$A$$ and $$B$$ are in partnership sharing profits and losses as $$3:2$$. $$C$$ is admitted for $$1/4^{th}$$ share. Afterwards, $$D$$ enters for $$20$$ paise in the rupee. Compute profit-sharing ratio of $$A, B, C$$ and $$D$$ after $$D's$$ admission.

$$A$$ and $$B$$ are partners in a firm, sharing profits and losses in the ratio of $$3:2$$. $$A$$ new partner $$C$$ is admitted. $$A$$ surrender $$1/5^{th}$$ of his share and $$B$$ surrender $$2/5^{th}$$ of his share in favour of $$C$$. For the purpose of $$C's$$ admission, goodwill of the firm is valued at $$Rs. 75,000$$ and $$C$$ brought in his share of goodwill in cash, which is retained in the firm's books. Journalize the above transactions.

$$M$$ and $$J$$ are partners in a firm, sharing profits in the ratio of $$3:2$$. They admit $$R$$ s a new partner. The new profit sharing ratio between $$M, J$$ and $$R$$ will be $$5:3:2$$. $$R$$ brought in $$Rs. 25,000$$ for his share of premium for goodwill. Pass necessary Journal entries for the treatment of goodwill.

$$A, B, C$$ and $$D$$ are in partnership sharing profits and losses in the ratio of $$36:24:20:20$$ respective $$E$$ joins the partnership for $$20\%$$ share and $$A, B, C$$ and $$D$$ in future would share profits among themselves as $$3/10:4/10:2/10:1/10$$. Calculate new profit sharing ratio after $$E's$$ admission.

$$A$$ and $$B$$ are partners sharing profits and losses in the ratio of $$2:1$$. They take $$C$$ as a partner for $$1/5^{th}$$ share. The Goodwill Account appears in the books at its full value, $$Rs. 15,000$$. $$C$$ is to pay proportionate amount as premium for goodwill, which he pays to $$A$$ and $$B$$ privately.

Pass necessary entries.

$$A$$ and $$B$$ are partners sharing profits and losses in the ratio of $$2:5$$. They admit $$C$$ on the condition that he will bring in $$Rs. 14,000$$ as his share of goodwill in cash, to be distributed between $$A$$ and $$B$$. $$C's$$ share in the future profits or losses will be $$1/4^{th}$$. What will be the new profit-sharing ratio, and what amount of goodwill brought in by $$C$$ will be received by $$A$$ and $$B$$?

$$B$$ and $$C$$ are in partnership sharing profits and losses as $$3:1$$. They admit $$D$$ into the firm, $$D$$ paying a premium of $$Rs. 15,000$$ for $$1/3^{rd}$$ share of the profits. As between themselves, $$B$$ and $$C$$ agree to share the future profits and losses equally. Draft journal entries showing appropriation of the premium money.

$$X$$ and $$Y$$ were partners sharing profits in the ratio of $$3:2$$. They admitted $$P$$ and $$Q$$ as new partner. X $$X$$ surrendered $$1/3^{rd}$$ of his share in favour of $$P$$ and $$Y$$ surrendered $$1/4^{th}$$ of his share in favour $$Q$$. Calculate new profit-sharing ratio $$X, Y, P$$ and $$Q$$.

Give journal entries to record the following arrangements in the books of the firm:

(a) $$B$$ and $$C$$ are partners sharing profits in the ratio of $$3:2$$. $$D$$ is admitted, paying a premium (goodwill) of $$Rs. 2,000$$ for $$1/4^{th}$$ share of the profits, shares of $$B$$ and $$C$$ remain as before.

(b) $$B$$ and $$C$$ are partners sharing profits in the ratio of $$3:2$$. $$D$$ is admitted, paying a premium of $$Rs. 2,100$$ for $$1/4^{th}$$ share of profits which he acquires $$1/6^{th}$$ from $$B$$ and $$1/12^{th}$$ from $$C$$.

$$X$$ and $$Y$$ are partners in a firm sharing profits in the ratio of $$3:2$$. On $$1^{st}$$April, 2018, they admit $$Z$$ as a new partner for $$1/4^{th}$$ share in the profits. $$Z$$ contributes the following assets towards his capital and for his share of goodwill:

Stock $$Rs. 60,000$$, Debtors $$Rs. 80,000$$, Land $$Rs. 1,00,000$$, Plant and machinery $$Rs. 40,000$$. On the date of admission of $$Z$$, the goodwill of the firm was valued at $$Rs. 6,00,000$$.

Pass necessary Journal entries in the books of the firm on $$Z's$$ admission.

$$A$$ and $$B$$ are partners sharing profits and losses in the proportion of $$7:5$$. They agree to admit $$C$$, their Manager, into partnership who is to get $$1/6^{th}$$ share in the business. $$C$$ brings in $$Rs. 10,000$$ for his capital and $$Rs. 3,600$$ for the $$1/6^{th}$$ share of goodwill which he acquire $$1/24^{th}$$ from $$A$$ and $$1/8^{th}$$ from $$B$$. The profits for the first year of the new partnership amount to $$Rs. 24,000$$. Pass necessary journal entries in connection with $$C's$$ admission and apportion the profits between the partners.

Simrat and Manbir are partners in a firm. They being in a large unskilled labour is employed. The employees largely lived in slum area. They, in order to improve their hygiene, entered into agreement with a doctor to do routine medical check-up. They also set up a canteen in the business premises to provide hygienic food at a subsidised rate. Identify the values in their action.

Short answer type question:

For which share of goodwill a partner is entitled at the time of retirement?

Short answer type question:

Why the value of goodwill need to be determined on retirement or death of a partner?

Short answer type question:

Give any one distinction between sacrificing ratio and gaining ratio.

$$A$$ and $$B$$ are partners in firm sharing profits and losses in the ratio of $$3:2$$. They admit $$C$$ into partnership for $$1/5^{th}$$ share. $$C$$ brings in $$Rs. 30,000$$ as capital and $$Rs. 10,000$$ as goodwill. At the time of admission of $$C$$, goodwill appears in the Balance Sheet of $$A$$ and $$B$$ at $$Rs. 3,000$$. The new profit sharing ratio of the partners will be $$5:3:2$$. Pass necessary Journal entries.

$$X$$ and $$Y$$ are partners in a firm sharing profits in the ratio of $$3:2$$ . They decided to share profits equally w.e.f. $$1st$$ April, $$2018$$ and also that they will use $$10 \%$$ of the net profit in keeping the neighbourhood clean. Identify the values in their action.

$$A$$ and $$B$$ are partners in a business, sharing profits and losses in the ratio of $$1/3^{rd}$$ and $$2/3^{rd}$$. On $$1^{st}$$April,2018, their capitals are $$Rs. 8,000$$ and $$Rs. 10,000$$ respectively. On that date, they admit $$C$$ in partnership and give him $$1/4^{th}$$ share in the future profits. $$C$$ brings in $$Rs. 8,000$$ as his capital and $$Rs. 6,000$$ as goodwill. The amount of goodwill is immediately withdrawn by the old partners in cash. Draft the Journal entries and show the Capital Accounts of all the Partners. Calculate the proportion in which partners would share profits and losses in future.

$$X$$ and $$Y$$ are partners in a firm sharing profits in the ratio of $$3:2$$ With effect from, $$1st$$ April, $$2018$$ , they agreed to share profits equally. For this purpose, goodwill of the firm is valued at Rs. $$75,000$$ . You are required to fill up the following Journal entry :

| Date | Particulars | L.F. | Dr. (Rs.) | Cr. (Rs.) |

| 2018 April 1 | $$Y's$$ Capital A/c ...Dr To $$X's$$ Capital A/c (Being ?) | ? | ? |

Short answer type question:

State the ratio in which the partners share gain or loss from revaluation of assets and liabilities.

Distinguish between the sacrificing ratio and the gaining ratio among partners.

On the admission of Rao, it was agreed that the goodwill of Murty and Shah should be valued at $$Rs. 30,000$$. Rao is to get $$1/4^{th}$$ share of profits. Previously Murty and Shah shared profits in the ratio of $$3:2$$. Rao cannot bring in any cash. Give Journal entries in the books of Murty and Shah when: (a) there is no Goodwill Account and (b) Goodwill appears in the books at $$Rs. 7,500$$.

$$A$$ and $$B$$ are partners sharing profit and losses in the ratio of $$3:2$$. They admit $$C$$ into the firm for $$1/4^{th}$$ share in profits which he takes $$1/6^{th}$$ from $$A$$ and $$1/12^{th}$$ from $$B$$. $$C$$ brings in only $$60\%$$ of his share of firm's goodwill. Goodwill of the firm has been valued at $$Rs. 1,00,000$$. Pass necessary Journal entries to record this arrangement.

Kangli, Mangli and Sanvali are partners, sharing profits in the ratio of $$4:3:2$$. Kangali retires. Assuming Mangli and Sanvali will share profits in future in the ratio of $$5:3$$, determine the gaining ratio.

$$A$$ and $$B$$ are partners sharing profits in the ratio of $$3:2$$. Their books show goodwill at $$Rs. 2,000$$. $$C$$ is admitted with $$1/4^{th}$$ share of profits and brings in $$Rs. 10,000$$ as his capital but is not able to bring in cash for his share of goodwill $$Rs. 3,000$$. Draft Journal entries.

$$A$$ and $$B$$ are partners sharing profits in the ratio of $$2:1$$. They admit $$C$$ for $$1/4^{th}$$ share in profits. $$C$$ brings in $$Rs. 30,000$$ for his capital and $$Rs. 8,000$$ out of his share of $$Rs. 10,000$$ for goodwill. Before admission, goodwill appeared in books at $$Rs. 18,000$$. Give Journal entries to give effect to the above arrangement.

$$A$$ and $$B$$ were partners in a firm sharing profits and losses in the ratio of $$3:2$$. They admitted $$C$$ as a new partner for $$3/7^{th}$$ share in the profit and new profit sharing ratio will be $$2:2:3$$. $$C$$ brought $$Rs. 2,00,000$$ as his capital and $$Rs. 1,50,000$$ as premium for goodwill. Half of their share of premium was withdrawn by $$A$$ and $$B$$ from the firm. Calculate sacrificing ratio and pass necessary Journal entries for the above transaction in the books of the firm.

$$X, Y$$ and $$Z$$ are partners in a firm sharing profits and losses in the ratio in the ratio of $$3:2:1$$. $$Z$$ retires from the firm on 31st march,On the date of $$Z's$$ retirement, the following balance appeared in the books of the firm:

General Reserve $$Rs. 1,80,000$$

Profit and Loss Account (Dr.) $$Rs. 30,000$$

Workmen Compensation Reserve $$Rs. 24,000$$ which was no more required.

Employee's Provident Fund $$Rs. 20,000$$

Pass necessary Journal entries for the adjustment of these items on $$Z's$$ retirement.

Bhuwan and Shivam were partners in a firm, sharing profits in the ratio of $$3:2$$. Their capitals were $$Rs. 50,000$$ and $$Rs. 75,000$$ respectively. They admitted Atul on $$1^{st}$$April, 2018 as new partner for $$1/4^{th}$$ share in the future profits. Atul brought $$Rs. 75,000$$ as his capital. Calculate the value of goodwill of the firm and record necessary Journal entries for the above transactions on Atul's admission.

$$A, B$$ and $$C$$ are partners sharing profits in the ratio of $$\dfrac{4}{9}:\dfrac{3}{9}:\dfrac{2}{9}$$. $$B$$ retired and his capital after making adjustment for reserves and gain (profit) on revaluation stands at $$Rs. 1,39,200$$. $$A$$ and $$C$$ agreed to pay him $$Rs. 1,50,000$$ in full settlement of his claim. Record necessary Journal entry for adjustment of goodwill if the new profit-sharing ratio is decided at $$5:3$$.

Anil and Sunil are partners in a firm with fixed capitals of $$Rs. 3,20,000$$ and $$Rs. 2,40,000$$ respectively. They admitted Charu as a new partner for $$1/4^{th}$$ share in the profits of the firm on $$1^{st}$$April,Charu brought $$Rs. 3,20,000$$ as her share of capital. Give the necessary journal entries on Charu's admission with regard to capital and goodwill.

$$A, B$$ and $$C$$ were partners in a firm sharing profits in the ratio of $$8:4:3$$. $$B$$ retires and his share is taken up equally by $$A$$ and $$C$$. Find the new profit-sharing ratio.

$$W, X, Y$$ and $$Z$$ are partners sharing profits and losses in the ratio of $$\dfrac{1}{3}, \dfrac{1}{6}, \dfrac{1}{3}$$ and $$\dfrac{1}{6}$$ respectively. $$Y$$ retires and $$W, X$$ and $$Z$$ decide to share the profit and losses equally in future. Calculate gaining ratio.

$$A, B$$ and $$C$$ were partners, sharing profits and losses in the ratio of $$2:2:1$$. $$B$$ decides to retire on 31st March, 2018. On the date of his retirement, some of the assets and liabilities appeared in the books as follows:

Creditors $$Rs. 70,000$$; Building $$Rs. 1,00,000$$; Plant and Machinery $$Rs. 40,000$$; Stock of Raw Materials $$Rs. 20,000$$ Stock of Finished Goods $$Rs. 30,000$$ and debtors $$Rs. 20,000$$.

The following was agreed among the partners on B's retirement:

(a) Building to be appreciated by $$20\%$$.

(b) Plant and Machinery to be depreciated by $$10\%$$

(c) A provision of $$5\%$$ on Debtors to be created for Doubtful Debt.

(d) Stock of Raw Material to be valued at $$Rs. 18,000$$ and finished Goods at $$Rs. 35,000$$

(e) An Old Computer previously written off was sold for $$Rs. 2,000$$ as scrap.

(f) Firm had to pay $$Rs. 5,000$$ to an injured employee.

Pass necessary Journal entries to record the above adjustments and prepare the Revaluation Account.

Ramesh wants to retire from the firm. The gain (profit) on revaluation on that date was $$Rs. 12,000$$. Mohan and Rahul want to share this in their new profit-sharing ratio of $$3:2$$. Ramesh wants this to be shared equally. How is the profit to be shared? Given reasons.

$$A, B, C$$ and $$D$$ were partners in a firm sharing in $$5:3:2:2$$ ratio. $$B$$ and $$C$$ retired from the firm. $$B's$$ share was acquired by $$D$$ and $$C's$$ share was acquired by $$A$$. Calculate new profit-sharing ratio of $$A$$ and $$D$$.

$$E$$ and $$F$$ were partners in firm sharing profits in the ratio of $$3:1$$. They admitted $$G$$ and will share future profits equally. $$G$$ brought $$Rs. 50,000$$ in cash and machinery worth $$Rs. 70,000$$ fir his share of profit as premium of goodwill.

pass necessary Journal entries in the books of the firm.

$$X$$ and $$Y$$ are partners sharing profits in the ratio of $$3:2$$. They admitted $$Z$$ as new partner for $$1/4^{th}$$ share of profits. At the time of admission of $$Z$$, investment appeared at $$Rs. 80,000$$. Half of the investments to be taken over by $$X$$ and $$Y$$ in their profit-sharing ratio at book value. Remaining investment were valued at $$Rs. 50,000$$. Pass the necessary Journal entries.

Mr. $$A$$ commenced business with a capital $$Rs. 2,50,000$$ on $$1^{st}$$April,During the five years ended $$31^{st}$$March,2018, the following profits and losses were made:

$$31^{st}$$March,2014 $$=$$ Loss $$Rs. 5,000$$

$$31^{st}$$March,2015 $$=$$ Profit $$Rs. 13,000$$

$$31^{st}$$March,2016 $$=$$ Profit $$Rs. 17,000$$

$$31^{st}$$March,2017 $$=$$ Profit $$Rs. 20,000$$

$$31^{st}$$March,2018 $$=$$ Profit $$Rs. 25,000$$

During this period he had drawn $$Rs. 40,000$$ for his personal use. On $$1^{st}$$April,2018, he admitted $$B$$ into partnership on the following terms:

$$B$$ to bring for his half share in the business, capital equal to $$A's$$ Capital on $$31^{st}$$March,2018 and to pay for the one-half share of goodwill of the business, on the basis of three times the average profit of the last five years. Prepare the statement showing what amount $$B$$ should invest to become a partner and pass entries to record the transaction relating to admission.

$$X$$ and $$Y$$ are partners in firm sharing profits in the ratio of $$3:2$$. They admitted $$Z$$ as a new partner and fixed the new profit-sharing ratio as $$3:2:1$$. At time of admission of $$Z$$, Debtors and Provision for Doubtful Debts appeared at $$Rs. 50,000$$ and $$Rs. 5,000$$ respectively All debtors are good. Pass the necessary Journal entries.

$$A$$ and $$B$$ were partners in a firm sharing profit in $$4:3$$ ratio. On $$1^{st}$$April,2018, they admitted $$C$$ as a new partner. On the date of $$C's$$ admission, the Balance Sheet of $$A$$ and $$B$$ showed a General Reserve of $$Rs. 84,000$$ and a debit balance of $$Rs. 8,400$$ in the 'Profit and Loss Account'. Pass necessary Journal entries.

Following was the Balance Sheet of $$A$$ and $$B$$ who were sharing profits in the ratio of $$2:1$$ as at $$31^{st}$$March,2018:

| Liabilities | (Rs.) | Assets | (Rs.) |

| Capital A/c: A 15,000 B 10,000 Sundry Creditors | 25,000 32,950 | Building Plant and Machinery Stock Sundry Debtors Cash in Hand | 25,000 17,500 10,000 4,850 600 |

| 57,950 | 57,950 |

(a) $$C$$ was to bring in $$Rs. 7,500$$ as his capital and $$Rs. 3,000$$ as goodwill for $$1/4^{th}$$ share in the firm.

(b) Values of the Stock and Plant and Machinery were to be reduced by $$5%$$.

(c) A provision for Doubtful Debts was to be created in respect of Sundry Debtors $$Rs. 375$$.

(d) Building Account was to be appreciated by $$10%$$.

Pass necessary Journal entries to give effect to the arrangements. Prepare Profit and Loss Adjustment Account (or Revaluation Account), Capital Accounts and Balance Sheet of the new firm.

Give the Journal entry to distribute "Workmen Compensation Reserve" of $$Rs. 72,000$$ at the time of admission of $$Z$$ When there is claim of $$Rs. 48,000$$ against it. The firm has two partners $$X$$ and $$Y$$.

$$X, Y$$ and $$Z$$ are equal partners with capitals of $$Rs. 1,500; Rs. 1,750$$ and $$Rs. 2,000$$ respectively. They agree to admit $$W$$ into equal partnership upon payment in cash $$Rs. 1,500$$ for $$1/4^{th}$$ share of the goodwill and $$Rs. 1,800$$ as his capital, both sums to remain in the business. The liabilities of the old firm amounted to $$Rs. 3,000$$ and the assets, apart from cash, consist of Motors $$Rs. 1,200$$, Furniture $$Rs. 400$$, Stock $$Rs. 2,650$$ and Debtors $$Rs. 3,780$$. The Motors and Furniture were revalued at $$Rs. 950$$ and $$Rs. 380$$ respectively.

Pass Journal entries to give effect to the above arrangement and also show Balance Sheet of the new firm.

$$X$$ and $$Y$$ are partners in a firm sharing profits in the ratio of $$3:2$$. They admitted $$Z$$ as a new partner for $$1/4^{th}$$ share. At the time of admission of $$Z$$, Stock (Book Value $$Rs. 1,00,000$$) is to be reduced by $$40\%$$ and Furniture (Book Value $$Rs.60,000$$) is to be reduced to $$40\%$$. Pass the necessary Journal entries.

(a) $$X, Y$$ and $$Z$$ are partners sharing profits and losses in the ratio of $$5:3:2$$. They decided to admit $$W$$ for $$1/6^{th}$$ share. Following is the extract of the Balance Sheet on the date of admission:

| Liabilities | (Rs.) | Assets | (Rs.) |

| General Reserve | 36,000 | Advertisement Suspense A/c | 24,000 |

| Contigency Reserve | 6,000 | ||

| Profit and Loss A/c | 18,000 |

$$A$$ and $$B$$ are partners sharing profits and losses in ratio of $$2 :3$$ with capitals of $$Rs.2,00,000$$ and $$Rs. 1,00,000$$ respectively. On 1st October, 2017, $$A$$ and $$B$$ granted loans of $$Rs. 4,00,000$$ and $$Rs. 2,00,000$$ respectively to the film. The Partnership Deed is silent as to the interest on

Partner's Loan. Determine the amount of profit/loss for the year ended 31st March, 2018 in each of the following cases to be distributed among partners:

Case 1: If the Profit before interest for the year amounted to $$Rs. 25,000$$.

Case 2: If the Profit before interest for the year amounted to $$Rs. 15,000$$.

Case 3: If the Loss before interest for the year amounted to $$Rs. 25,000$$.

$$X$$ and $$Y$$ are partners sharing profits and lossesin the ratio of $$3:2$$. $$X$$ is a non-working partner and contributes $$Rs. 20,00,000$$ as his capital. $$Y$$ is a working partner of the firm. The Partnership Deed provides for interest on capital @ 8% P.a. and salary to every working partner @ $$Rs. 8,000$$ per month. Net profit before providing for interest on capital and patner's salary for the year ended 31st March, 2018 was $$Rs. 80,000$$. Show the distribution of profit.

$$A$$ and $$B$$ are partners sharing profits and losses in the ratio of $$3 : 2$$ with capitals of $$Rs. 4,00,000$$ and $$Rs. 3,00,000$$ respectively. Interest on capital is agreed @ $$5\%$$ p.a. $$B$$ is to be allowed an annual salary of $$Rs. 30,000$$ which has not been withdrawn. Profit for the year ending 31st March, 2018 prior to calculation of interest on capital but after charging B's salary is $$Rs.1,20,000$$. A provision of $$5\%$$ of the profit is to be made in respect of commission to the manager. Prepare an account showing the appropriation of profit.

(Profit and Loss Appropriation Account). $$X$$ and $$Y$$ started business on 1st April, 2017 with capitals of $$Rs. 5,00,000$$ each As per the Partnership Deed, both $$X$$ and $$Y$$ are to get monthly salary of $$Rs. 10,000$$ each and interest on capitals @ $$10\%$$ p.a. Drawings during the year were $$X- Rs. 60,000$$ and $$Y- Rs.1,00,000$$; interest being chargeable @ $$10\%$$ p.a.

During the year, the firm incurred a loss of $$Rs. 2,00,000$$.

Pass Journal entries for the above and prepare Profit and Loss Appropriation Account. The Finn closes its accounts on 31st March, every year.

(When drawings are made for a period of 6 months only). $$A, B$$ and $$C$$ are partners sharing profits equally. $$A$$ drew regularly $$Rs. 6,000$$ in the beginning .of every month for the six months ended 30th September,$$B$$ drew regularly $$Rs. 6,000$$ at the end of every month for the six months ended 30th September,$$C$$ drew regularly $$Rs. 6,000$$ in the middle of every month for the six months ended 30th September,Calculate interest on drawings @ $$5\%$$ p.a. when the books are closed on 31st March every year.

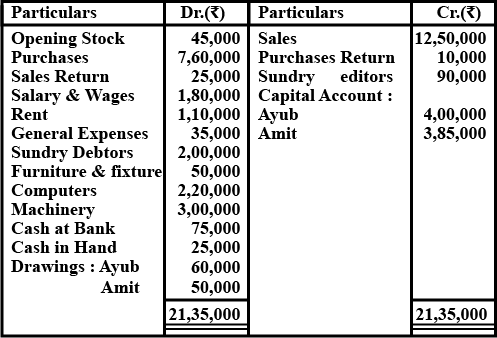

Ayub and Amit are partners in M/s amit Papers sharing profits and losses equally. Following trial balance is prepared from the books of account as at 31st March, 2018.

Prepare Trading Account, Profit and Loss Account and Profit and Loss Appropriation Account for the year ended 31st March, 2018 and Balance Sheet as at that date accounting the following adjustments:

(i) Stock as at 31st March, 2018 was $$Rs. 50,000$$;

(ii) Rent is $$Rs. 10,000$$ per month;

(iii) Depreciate Furniture and Fixture and Computers @ $$20\%$$ p.a., Machinery @ $$10\%$$ p.a.; and

(iv) Interest on Capitals is allowed @ $$6\%$$ p.a.

(Profit and Loss Appropriation Account). $$A$$ and $$B$$ started a business on 1st April, 2017 with capitals of $$Rs. 3,00,000$$ and $$Rs. 2,00,000$$ respectively. According to the Partnership Deed, B is to get salary of $$Rs. 5,000$$ per month, $$A$$ is to get $$10\%$$ commission on Profit after allowing salary to $$B$$ and interest is to be allowed on capitals @ $$6\%$$ p.a. Profit-sharing ratio`between the two partners is $$3 : 2$$. During the year, the firm earned a profit of $$Rs. 2,50,000$$.

Pass Journal entries for division of profits and prepare Profit and Loss Appropriation Account. The firm doses its accounts on 31st March every year.

X, Y and Z are partners in a firm sharing profits in the ratio of 3:2:1 respectively. The firm was dissolved on 1st March,After transferring assets (other than cash) and third party liabilities to the 'Realisation Account' you are provided with the following information:

(a) There was a balance of Rs. 18,000 in the firm's Profit and Loss Account.

(b) There was an unrecorded bike of Rs. 50,000 which was taken over by X.

(c) Creditors of Rs. 5,000 were paid Rs. 4,000 in full settlement of accounts.

Pass necessary Journal entries for the above at the time of dissolution of firm.

$$A, B$$ and $$C$$ are partners sharing profits and losses equally. $$A$$ and $$C$$ have granted loan to the firm on 1st October, 2016 of $$Rs. 1,00,000$$ and $$Rs.1,50,000 $$ respectively. It is agreed that interest @$$ 9\%$$ p.a. will be paid on loan. Books of account of the firm are closed on 31st March every year. Interest on loan is yet to be paid as on 31st March,You are required to pass Journal entries in the books of account of the firm and prepare ledger accounts of the two partners.

The Balance Sheet of Madhu and Vidhi who are sharing profits in the ratio of $$2:3$$ as at $$31^{st}$$March, 2016 is given below:

| Liabilities | (Rs.) | Assets | (Rs.) |

| Madhu's Capital Vidhi's Capital General Reserve Bills Payable | 5,20,000 3,00,000 30,000 1,50,000 | Land and Building Machinery Stock Debtors 3,00,000 Less: Provision (10,000) Bank | 3,00,000 2,80,000 80,000 2,90,000 50,000 |

| 10,00,000 | 10,00,000 |

(a) Goodwill of the firm was valued at $$Rs. 3,00,000$$.

(b) Land and Building was found undervalued by $$Rs. 26,000$$.

(c) Provision for doubtful debts was to be made equal to $$5\%$$ of the debtors.

(d) There was a claim of $$Rs. 6,000$$ on account of workmen compensation.

Prepare Revaluation Account, Partners Capital Account and the Balance Sheet of the reconstituted firm.

$$A$$ and $$B$$ started business on 1st April, 2017 with capitals of $$Rs. 6,00,000$$ and $$Rs. 4,00,000$$ respectively During the year, A introduced $$Rs.1,00,000$$ to the firm as additional capital on 1st October,They withdrew $$Rs.50,000$$ per month for household expenses against profits. Interest on capital is to be allowed @ $$10\%$$ per annum. Calculate interest payable to $$A$$ and $$B$$ for the year ended 31st March, 2018.

Ramesh and Naresh are partners in a firm. Their capitals as on 1st April, 2017 were $$Rs.150,000$$ and $$Rs. 1,50,000$$ respectively. They share profits equally. On 1st July, 2017, they decided that their capitals should be $$Rs.2,00,000$$ each. The necessary adjustment in the capitals were made by introducing or withdrawing capital. Interest on capital is allowed @ $$8\%$$ p.a. Compute interest on capital for both the partners for the year ended 31st March, 2018.

$$A$$ and $$B$$ are partners in a business and their capitals at the end of the year were $$Rs. 7,00,000$$ and $$Rs 6,00,000$$ respectively. Calculate their opening capitals considering the following information:

(a) Drawings of $$A$$ and $$B$$ for the year were $$Rs. 75,000$$ and $$Rs. 50,000$$ respectively.

(b) $$B$$ introduced capital of $$Rs.1,00,000$$ during the year.

(c) Interest on capital credited to the Capital Accounts of $$A$$ and $$B$$ were $$Rs.15,000$$ and $$Rs. 10,000$$ respectively.

(d) Interest on drawings debited to the Capital Accounts of $$A$$ and $$B$$ were $$Rs.7,500$$ and $$Rs. 5,000$$ respectively.

(e) Share of profit credited to Capital Accounts was $$Rs. 1,00,000$$ each.

Ram and Mohan are partners in a firm. They admitted Rakhi as a partner without capital for 1/3rd share in the profit of the firm. She is blind by birth but having good management qualities. The new partnership agreement provides for the following:

(i) $$10\%$$ of the trading profit will be donated to Prime Minister's Relief Fund.

(ii) $$5\%$$ of the trading profit will be donated to the National Blind Relief Fund.

(iii) Products will be sold at a discount of $$15\%$$ on Maximum Retail Price to the people living below poverty line.

(iv) New retail shops will be opened in the Naxal affected areas of the country.

(v) New jobs of sales persons will be reserved for the girls belonging to Scheduled Castes and Scheduled Tribes.

Trading profit of the firm for the year ended 31st March, 2012 was $$Rs. 10,00,000$$, identify any four values considered by Ram, Mohan and Rakhi while preparing new Partnership Deed and also prepare 'Profit and Loss Appropriation Account' of Ram, Mohan and Rakhi for the year ended 31st March, 2012.

$$X$$ and $$Y$$ are partners sharing profits and losses in the ratio of $$7 : 3$$. Their Capital Accounts as at 1st April, 2017 stood at $$X - Rs.5,00,000; \, Y- Rs. 4,00,000$$. The partners are allowed interest on capital @ $$5\%$$ .p.a. The drawings of the partners during the year ended 31st March, 2018 amounted to $$Rs. 72,000$$ and $$Rs.50,000$$ respectively. The profit for the year before allowing interest on capital and salary to $$Y$$ @ $$Rs.5,000$$ per month amounted to $$Rs. 8,00,000$$. $$10\%$$ of the divisible profit is to be set aside as General Reserve.

Prepare an account showing the allocation of profits, Partners' Capital and Current Accounts.

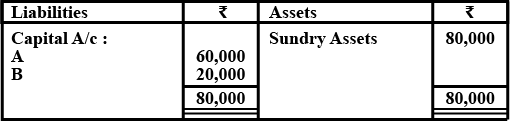

From the following Balance Sheet of $$X$$ and $$Y$$, calculate interest on capital $$5\%$$ pa. for the year ended 31st March, 2018:

During the year ended 31st March, 2018, $$X's$$ drawings were $$Rs. 10,000$$ and $$Y's$$ drawings were $$Rs. 30,000$$. Profit for the year ended 31st March, 2018 was $$Rs. 60,000$$. The amount of Reserve, i.e., $$Rs.40,000$$ is transferred from Current Year's profit to strengthen the financial position of the firm.

$$P$$ and $$Q$$ were partners in a firm sharing profits equally. Their fixed capitals were $$Rs.1,00,000$$ and $$Rs.50,000$$ respectively. The Partnership Deed provided for Interest on Capital at the rate of $$10\%$$ per annum. For the year ended 31st March, 2016, the profits of the firm were distributed without providing Interest on Capital.

Pass necessary adjustment entry to rectify the error.

$$X$$ and $$Y$$ are partners sharing profits in the ratio of $$3 : 2$$. On 31st March, 2017 after closing the books of account, their capitals are $$Rs. 10,00,000$$ and $$Rs. 12,50,000$$ respectively. On 1st May, 2016, $$X$$ had introduced an additional capital of $$Rs. 2,50,000$$ and $$Y$$ withdrew $$Rs. 1,25,000$$ from his capital. On 1st October, 2016, $$X$$ withdrew $$Rs. 5,00,000$$ from his capital and $$Y$$ introduced $$Rs. 6,25,000$$. After closing the accounts, it was discovered that Interest on Capital @ $$6\%$$ p.a. has been omitted. During the year ended 31st March, 2017, $$X's$$ drawings and $$Y's$$ drawings were $$Rs. 2,50,000$$ and $$Rs. 1,25,000$$. Profits (before interest on Capital) during the year were $$Rs. 5,00,000$$.

Calculate Interest on Capital if the capitals are (a) fixed and (b) fluctuating.

$$X$$ and $$Y$$ are partners sharing profits and losses in the ratio of $$7 : 3$$. Their Capital Accounts as at 1st April, 2017 stood at $$X - Rs. 5,00,000; \, Y- Rs. 4,00,000$$. The partners are allowed interest on capital @ $$5\%$$ p.a. The drawings of the partners during the year ended 31st March, 2018 amounted to $$Rs. 72,000$$ and $$Rs. 50,000$$ respectively. The profit for the year before allowing interest on capital and salary to $$Y$$ @ $$Rs. 5,000$$ per month amounted to $$Rs. 8,00,000$$. $$10\%$$ of the net profit is to be set aside as General Reserve.

Pass the Journal entries for Appropriation. Prepare Profit and Loss Appropriation Account for the year ended 31st March, 2018, and Capital and Current Accounts of the partners.

$$X$$ and $$Y$$ are partners sharing profits and losses in the ratio of $$2 : 3$$ with capitals of $$Rs. 2,00,000$$ and $$Rs. 1,00,000$$ respectively. Pass the necessary Journal entry or entries for distribution of profit/loss for the year ended 31st March, 2018 in each of the alternative cases:

CaseIf Partnership Deed is silent as to the interest on capital and the profit for the year is $$Rs. 20,000$$.

CaseIf Partnership Deed provides for interest on capital @ $$6\%$$ p.a. and loss for the year is $$Rs. 15,000$$.

CaseIf Partnership Deed provides for-interest on capital @ $$6\%$$ p.a. and the profit for the year is $$Rs. 21,000$$.

CaseIf Partnership Deed provides for interest on capital @ $$6\%$$ p.a. as a charge on profit and the profit for the year is $$Rs. 20,000$$.

CaseIf Partnership Deed provides for interest on capital @ $$6\%$$ p.a. as a charge on profit and the profit for the year is $$Rs. 2,000$$.

CaseIf Partnership Deed provides for interest on capital @ $$6\%$$ p.a. as a charge on profit and the profit for the year is $$Rs. 18,000$$.

$$A$$ and $$B$$ are partners sharing profits and losses in the ratio of $$3 : 2$$. At the end of the year, i.e., on 31st March, 2018,(after division of the year's profit), they decided to take $$C$$ into partnership with effect from 1st April,As $$C$$ was getting annual salary of $$Rs. 45,000$$, he had also advanced $$Rs. 3,00,000$$ to the firm by way of a loan on which he is getting interest @$$10\%$$,p.a. During the three financial years, firm's profits after adjusting salary to $$C$$, interest on loan and interest on the capital of the partners were:

| Year Ended | ||

| 31st March, 2016 | Profit | Rs. 4,00,000 |

| 31st March, 2017 | Loss | Rs. 2,00,000 |

| 31st March, 2018 | Profit | Rs. 6,00,000 |

Record necessary entries to give effect to the above arrangement.

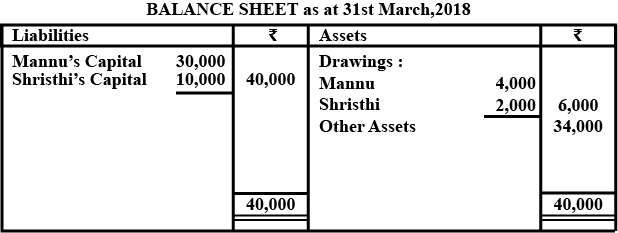

Mannu and Shristhi are partners in a firm sharing profits in the ratio of $$3:2$$. Following is the Balance Sheet of the firm as on 31st March,(Ref. image)

Profit for the year ended 31st March, 2018 was Rs. 5,000 which was divided in the agreed ratio, but interest @ $$5\%$$ p.a. on capital and $$6\%$$ p.a. on drawings was inadvertently omitted. Adjust interest on drawings on an avarage basis for 6 months. Give the adjustment entry.

Anwar, Biswas and Divya are partners in a firm. Their Capital Accounts stood at : $$Rs. 8,00,000;\, Rs. 6,00,000$$ and $$Rs.4,00,000$$ respectively on 1st April,They shared profits and losses in the ratio of $$3 : 2 :1$$ respectively. Partners are entitled to interest on capital @ $$6\%$$ per annum and salary to Biswas and Divya @ $$Rs. 4,000$$ per Month and $$Rs. 6,000$$ per quarter respectively as per the provisions of Partnership Deed.

Biswas's share of profit including interest on capital but excluding salary is guaranteed at a minimurn of $$Rs. 82,000$$ p.a. Any deficiency arising on that account shall be met by Divya. Profit for the year ended. 31st March, 2014 amounted to $$Rs. 3,12,000$$. Prepare Profit and Loss Appropriation Account for the year ended 31st March, 2014.

$$X, Y$$ and $$Z$$ entered into partnership on 1st July, 2016 to share Profit and Losses in the ratio of $$3 : 2 :1$$. $$X$$ personally guaranteed that $$Z's$$ share of profit after charging interest on capital @ $$6\%$$ per annum would not be less than $$Rs. 36,000$$ p.a. The capital contributed by :$$X- Rs. 2,00,000;\, Y- Rs. 1,00,000$$ and $$Z- Rs. 1,00,000$$. Profit for the year ended on 31st March, 2017 was $$Rs. 1,38,000$$. Prepare Profit and Loss Appropriation Account.

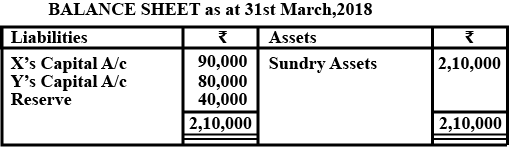

$$A$$ and $$B$$ are partners in a firm sharing profits and losses in the ration of $$3:2$$. Follwoing was the Balance Sheet of the firm as at 31st March,(Ref. image)

Profit $$Rs. 30,000$$ for the year ended 31st March, 2018 was divided between the partners without allowing interest on capitals @ $$12\%$$ p.a. and salary to $$A$$ @ $$Rs.1,000$$ per month. During the year, $$A$$ withdrew $$Rs. 10,000$$ and $$B$$ $$Rs. 20,000$$.

Pass necessary adjustment Journal entry and show your working dearly.

$$A, B$$ and $$C$$ were partners. Their capitals were $$A- Rs. 30,000;\, B-Rs. 20,000$$ and $$C-Rs. 10,000$$ respectively. According to the Partnership Deed, they were entitled to an interest on capital at $$5\%$$ p.a. In addition, $$B$$ was also entitled to draw a salary of $$Rs. 500$$ per month. $$C$$ was entitled to a commission of $$5\%$$ on the profits after charging the interest on capital, but before charging the salary payable to $$B$$. Net profit for the year was $$Rs. 30,000$$ distributed in the ratio of capitals without providing for any of the above adjustments. The profits were to be shared in the ratio of $$5 : 2 : 3$$.

Pass necessary adjustment entry showing the Workings clearly.

On 31st March, 2014, balances in the Capital Accounts of Eleen, Monu and Ahmad after making adjustments for profits and drawings were $$Rs. 1,60,000, \, Rs.1,20,000$$ and $$Rs. 80,000$$ respectively. Subsequently, it was discovered that the interest on capital and drawings had been omitted.

(i) The profit for the year ended 31st March, 2014 was $$Rs. 40,000$$.

(ii) During the year, Eleen and Monu each withdrew a total sum of $$Rs. 24,000$$ in equal instalments in the beginning of each month and Ahmad withdrew a total sum of $$Rs. 48,000$$ in equal instalments at the end of each month.

(iii) The interest on drawings was to be charged @ $$5\%$$ p.a. and interest on capital was to be allowed @ $$10\%$$ p.a.

(iv) The profit-sharing ratio among the partners was $$2 :1 : 1$$. Showing your working notes clearly, pass the necessary rectifying entry.

$$P, Q$$ and $$R$$ are partners sharing profits in the ratio of $$5 : 4 :1$$ respectively. $$R$$ is guaranteed that his share of profit in any year will not be less than $$Rs.50,000$$. The profit for the year ending 31st March, 2018 is $$Rs. 3,50,000$$. Amount of shortfall in the profits of $$R$$ will be borne by $$P$$ and $$Q$$ in the ratio of $$3 : 2$$ respectiyely. Pass necessary Journal entry regarding deficiency borne by $$P$$ and $$Q$$.

$$P$$ and $$Q$$ were partners in a firm sharing profits in the ratio of $$5 : 3$$. On 1st April, 2014 they admitted $$R$$ as a new partner for $$\dfrac{1}{8}th$$ share in the profits with a guaranteed profit of $$Rs.75,000$$. The new profit-sharing ratio between $$P$$ and $$Q$$ will remain the same but they agreed to bear any deficiency on account of guarantee to $$R$$ in the ratio $$3 : 2$$. The profit of the firm for the year ended 31st March, 2015 was $$Rs. 4,00,000$$.

Prepare Profit and Loss Appropriation Account of $$P, Q$$ and $$R$$ for the year ended 31st March, 2015.

$$A, B$$ and $$C$$ are partners'in a firm sharing profits and losses in the ratio of $$4 : 2 :1$$; It is provided that $$C's$$ share in profit would not be less than $$Rs. 37,500$$. The profit for the year ended 31st March; 2018 amounted to $$Rs.1,57,500$$.

Pass Journal entries in the books of firm and prepare Profit and Loss Appropriation Account.

State any two methods of valuing goodwill.

Goodwill of the firm is valued at two years purchase of the average profit of last four years. The total profits for last four years is $$Rs. 40,000$$.

Calculate the goodwill of the firm.

Ankit, Suchita and Chandru are partners in a firm sharing profits and losses in the ration $$4:3:2$$. Ankit retires from the firm. Suchit and Chandru agreed to share in the ratio of $$5:3$$ in future.

Calculate gain ration of suchita and chandru.

Swarna, Swapna and Vidya are partners in a firm sharing profits and losses in the ratio of $$4:3:2$$. Vidya retires fro the firm. Swarna and Swapna agreed to share equally in future.

Calculate the gain ratio of swarna and Swapna.

Anurag and Bhawana entered into partnership on $$1.4.2014$$. On $$1.1.2015$$ they admitted Monika as a new partner for $$\dfrac{3}{10} th$$ share in the profits which she acquired equally from Anurag and Bhawana. The new profit sharing ratio of Anurag, Bhawana and Monika was $$4:3:3$$. Calculate the profit sharing ratio of Anurag and Bhawana at the time of forming the partnership.

Chhavi and Neha were partners in the firm sharing profits and losses equally. Chhavi withdrew a fixed amount at the beginning of each quarter. Interest on drawing is charged $$@6\% p.a.$$ At the end of the year, interest on Chhavi's drawing amounted to $$Rs.900$$.Pass necessary journal entries for charging interest on drawings.

Raja, Rani and Mantri are partners sharing profits and losses in the ratio of $$2:2:1$$. The Balance sheet of the firm as on $$31.03.2017$$ was as follows:

Balance sheet as on $$31.03.2017$$

| Liabilities | Rs | Assets | Rs |

| Creditors Bills payable Capitals: Raja Rani Mantri | 40,000 20,000 1,00,000 60,000 40,000 | Cash Stock Debtors Building Plant and Machinery | 20,000 40,000 90,000 1,00,000 10,000 |

| 2,60,000 | 2,60,000 |

Raja died on $$31.12.2017$$. His executors are entitled to the following :

a) His capital on the date of his death.

b) His share of profit till the date of his death. Estimated profit for the current years is $$Rs.80,000$$.

c) Interest on capital is allowed at $$10\%$$ p.a.

d) His drawing till death amounted to $$Rs.20,000$$.

e) Salary of Raja is $$Rs. 1,000$$ per month.

Prepare Raja's capital account.

Three Chartered Accountants $$X, Y$$ and $$Z$$ form a partnership sharing profits and losses in the ratio of $$3 : 2 : 1$$ subject to the following conditions:

(1) $$Z's$$ share of profits is guaranteed to be not less than $$Rs. 30,000$$ p.a.

(ii) $$Y$$ gives a guarantee to the effect that the gross fee earned by him for the firm shall not be less than the average gross fee earned by him during the preceding five years when he was carrying on the profession alone (the average ofwhich works out at $$Rs.50,000$$).

Profit for the first year (year ended 31st March, 2018) of the partnership is $$Rs.1,50,000$$. The gross fee earned by $$Y$$ for the firm is $$Rs. 32,000$$.

Prepare Profit and Loss Appropriation Account after giving effect to the above.

Write the journal entry to close Revaluation account when there is profit .

Sheenu, Shankar and Sharan are partners sharing profits and losses in the ratio of $$4: 3 : 3$$. Their capital balance on 01-04-2016 stood at $$Rs. 1,00,000;\, Rs. 80,000$$ and $$Rs. 50,000$$ respectively.

Sheenu died on 01-10-The partnership deed provides the followings:

a) Interest on capital at $$12\%$$ p.a.

b) He had withdrawn $$Rs. 5,000$$ upto date death.

c) Sheenu's share of goodwill $$Rs. 5,000$$

d) His share of profit upto the date of death on the basis of previous year profits. Previous year profits $$Rs. 20,000$$

Prepare Sheenu's Executors account.

$$A$$ and $$B$$ are partners sharing profits and losses in the ratio of $$6:4$$. They admit '$$C$$' into the partnership, giving him $$\dfrac{6}{20}th$$ share, which he acquires in the proportion of $$\dfrac{4}{20}$$ and $$\dfrac{2}{20}$$ from $$A$$ and $$B$$.

Calculate the new profit sharing ratio of all the partner's.

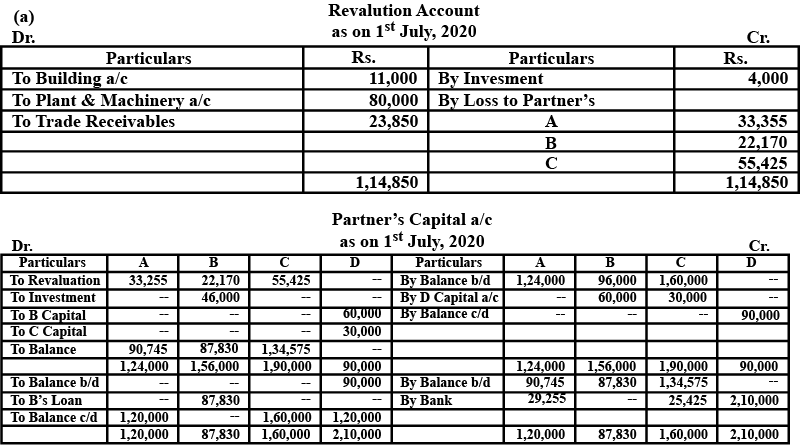

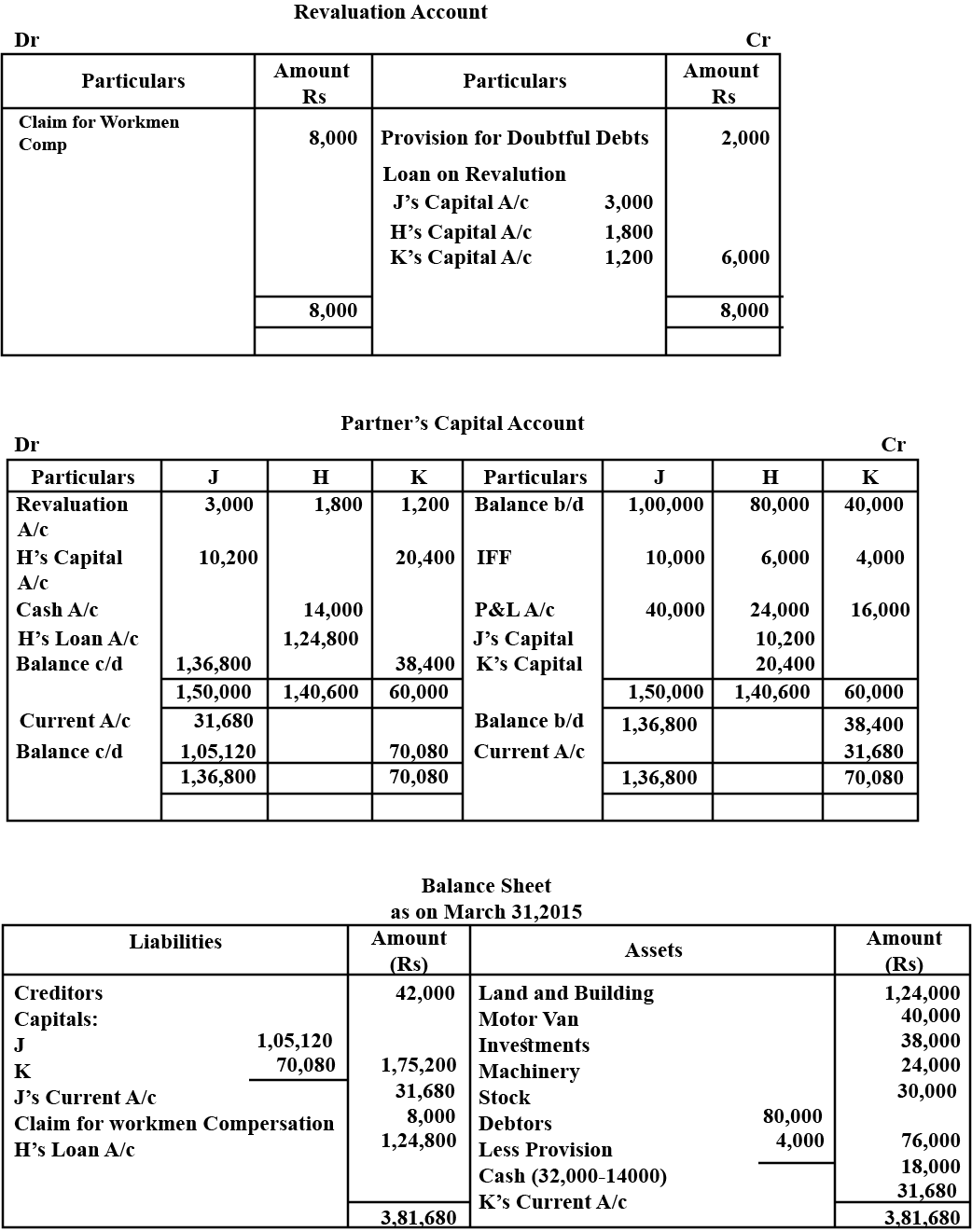

M/s. TB is a partnership firm with the partners A , B and C sharing profits and losses in the ratio $$3 : 2 : 5 $$. The balance sheet of the firm as on $$30^{th}$$ June, $$2020$$ was an under :

Balance Sheet of M/s. TB as on $$30-6-2020$$

| Liabilities | Amount (Rs.) | Assets | Amount (Rs.) |

| A's capital A/c B's Capital A/c C's Capital A/c Long Term Loan Bank Overdraft Trade Payables | $$1,24,000$$ $$96,000$$ $$1,60,000$$ $$4,20,000$$ $$64,000$$ $$2,13,000$$ $$\overline{10,77,000}$$ | Land Building Plant & Machinery Investments Inventories Trade receivables | $$1,20,000$$ $$2,20,000$$ $$4,00,000$$ $$42,000$$ $$1,36,000$$ $$1,59,000$$ $$\overline{10,77,000}$$ |

It was mutually agreed that B will retire from partnership and in his place D will be admitted as a partner with effect from $$1^{st}$$ July, $$2020$$. For this purpose, following adjustments are to be made:

(a) Goodwill of the firm is to be values at $$Rs. 3 $$ lakhs due to the firm's location advantage but the same will not appear as an asset in the books of the reconstituted firm.

(b) Building and plant & Machinery are to be valued at $$95\%$$ and $$80\%$$ of the respective balance sheet values. Investments are to be taken over by the retiring partner at $$Rs. 46,000$$. Trade receivables are considered good only up to $$85\%$$ of the balance sheet figure. Balance to be considered bad.

(c) In the reconstituted firm, the total capital will be $$Rs. 4$$ lakhs, which will be contributed by A , C and D in their new profit sharing ratio, which is $$3 : 4 : 3 $$.

(d) The amount due to retiring partner shall be transferred to his loan account.

You are required to prepare Revaluation Account and Partners' Capital; Accounts after reconstitution, along with working notes.

Shobha, Sudha and Rathna are partners. Sharing profits and losses in the ratio of $$2:2:1$$.

Their Balance sheet as on $$31.3.2018$$ was as follows:

Balance Sheet as on $$31.3.2018$$

| Liabilities | Rs. | Assets | Rs. | |

| Sundry Creditors | $$30,000$$ | Cash in hand | $$10,000$$ | |

| Capitals: Shobha Sudha Rathna | $$15,000$$ $$25,000$$ $$30,000$$ | $$70,000$$ | Debtors | $$25,000$$ |

| Reserve fund | $$15,000$$ | Stock | $$40,000$$ | |

| Plant and Machinery | $$40,000$$ | |||

| $$1,15,000$$ | $$1,15,000$$ |

a) Her capital on the date of last Balance sheet.

b) Her share of reserve fund on the date of last Balance sheet

c) Her share of profit up to the date of death, on the basis of previous year's profit. Previous year profit is $$Rs.20,000$$.

d) Her share of goodwill. Goodwill of the firm is valued at $$Rs.40,000$$

e) Interest on capital at $$10\%$$ p.a.

You are required to ascertain amount payable executors of Rathna by preparing Rathna's capital account.

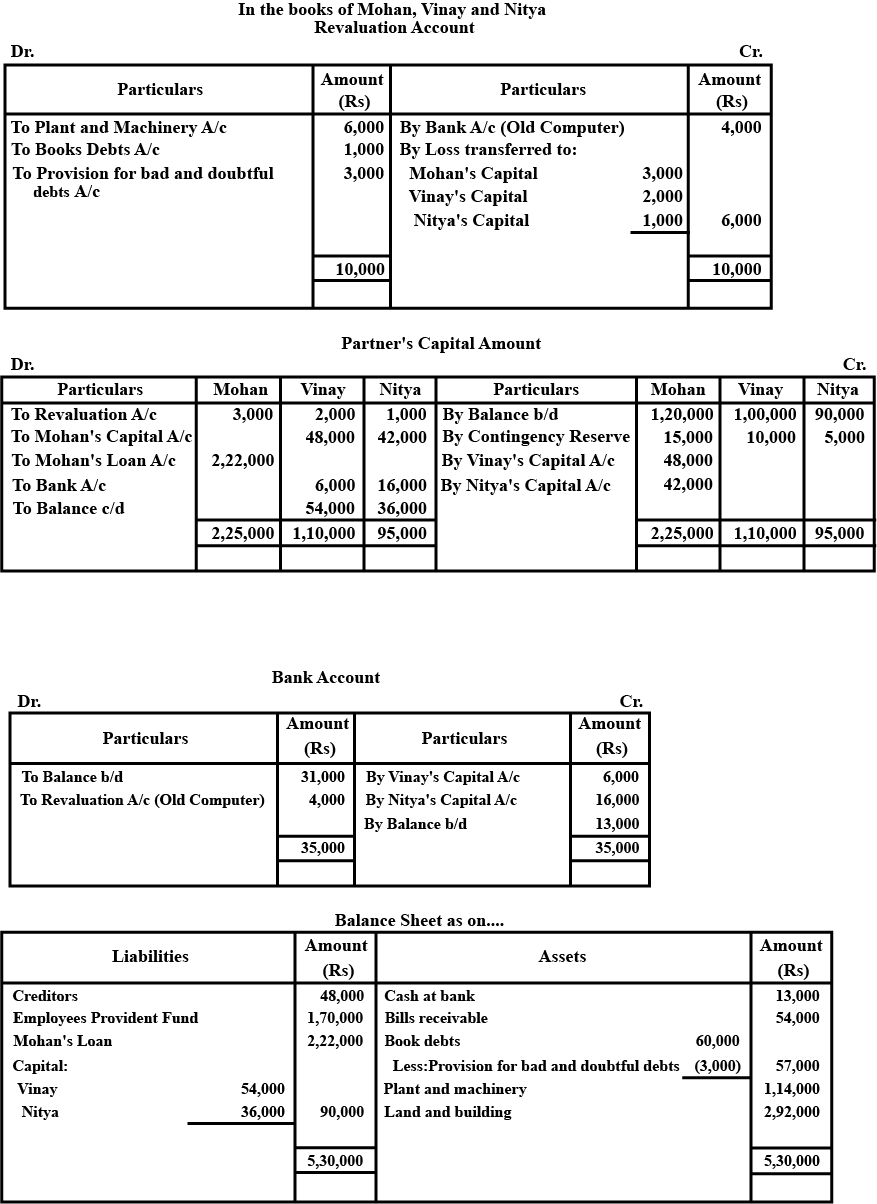

Mohan, Vinay and Nitya were partners in a firm sharing profits and losses in the proportion of $$\dfrac{1}{2},\dfrac{1}{3}$$ and $$\dfrac{1}{6}$$ respectively. On 31st March,2018, their Balance Sheet was as follows.

Balance Sheet of Mohan, Vinay and Nitya as at 31st March, 2018

| Liabilities | Amount Rs. | Assets | Amount Rs. |

| Creditors Employees' Provident Fund Contingency Reserve Capital: Mohan 1,20,000 Vinay 1,00,000 Nitya 90,000 | 48,000 1,70,000 30,000 3,10,000 | Cash at Bank Bills Receivable Book Debts 63,000 Less: Provision for doubtful debts 2,000 Plant and Machinery Land and Building | 31,000 54,000 61,000 1,20,000 2,92,000 |

| 5,58,000 | 5,58,000 |

(i) Plant and machinery will be depreciated by $$5\%$$.

(ii) An old computer previously written off was sold for $$Rs.4,000$$.

(iii) Bad debts amounting to $$Rs.3,000$$ will be written off and a provision of $$5\%$$ on debtors for bad and doubtful debts will be maintained.

(iv) Goodwill of the firm was valued at $$Rs.1,80,000$$ and Mohans share of the same was credited in his account by debiting Vinays and Nityas accounts.

(v) The capital of the new firm was to be fixed at $$Rs.90,000$$ and necessary adjustments were to be made by bringing in or paying off cash as the case may be.

(vi) Vinay and Nitya will share future profits in the ratio of $$3 : 2$$.

Prepare Revaluation Account, Partners Capital Accounts and the Balance Sheet of the reconstituted firm.

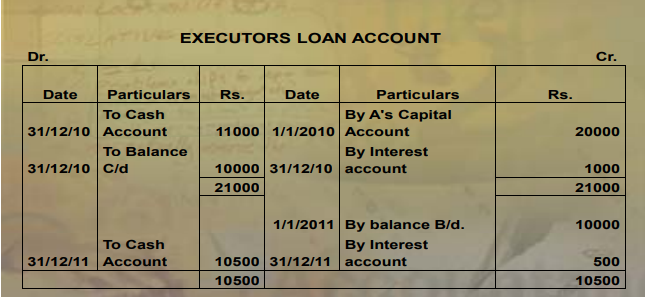

Prepare Executor's Loan Account with imaginary figures showing the repayment of loan in two annual equal installments along with interest.

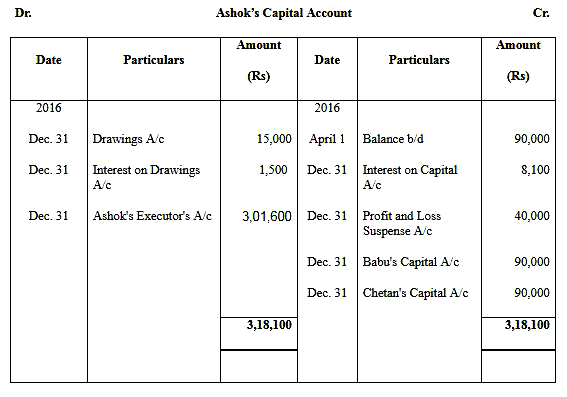

Ashok, Babu and Chetan were partners in a firm sharing profits in the ratio of $$4 : 3 : 3$$. The firm closes its books on 31$$^{st}$$ March every year. On 31$$^{st}$$ December, 2016 Ashok died. The partnership deed provided that on the death of a partner his executors will be entitled to the following :

(i) Balance in his capital account. On 1/4/2016, there was a balance of $$Rs. 90,000$$ in Ashok's Capital Account.

(ii) Interest on capital $$@ 12\%$$ per annum.

(iii) His share in the profits of the firm in the year of his death will be calculated on the basis of rate of net profit on sales of the previous year, which was $$25\%$$. The sales of the firm till 30$$^{st}$$ December, 2016 were $$Rs. 4,00,000$$.

(iv) His share in the goodwill of the firm. The goodwill of the firm on Ashok's detah was valued at $$Rs. 4,50,000$$.

The partnership deed also provided for the following deductions from the amount payable to the executor of the deceased partner:

(i) His drawings in the year of his death. Ashok's drawings till 31/12/2016 were $$Rs 15,000$$.

(ii) Interest on drawing $$@ 12\%$$ per annum which was calculated as $$Rs. 1,500$$.

The accountant of the firm prepared Ashok's Capital Account to be presented to the executor of Ashok but in a hurry he left in incomplete. Ashok's Capital Account as prepared by the firm's accountant is given below :

Dr. Ashok's Capital Account Cr.

| Date | Particulars | Amount (Rs) | Date | Particulars | Amount (Rs) |

| 2016 | 2016 | ||||

| Dec 31 | ..... | 15,000 | April 1 | ..... | 90,000 |

| Dec 31 | ..... | ..... | Dec 31 | .... | 8,100 |

| Dec 31 | ..... | ..... | Dec 31 | ..... | 40,000 |

| Dec 31 | ..... | 90,000 | |||

| Dec 31 | ..... | 90,000 | |||

| 3,18,100 | 3,18,100 |

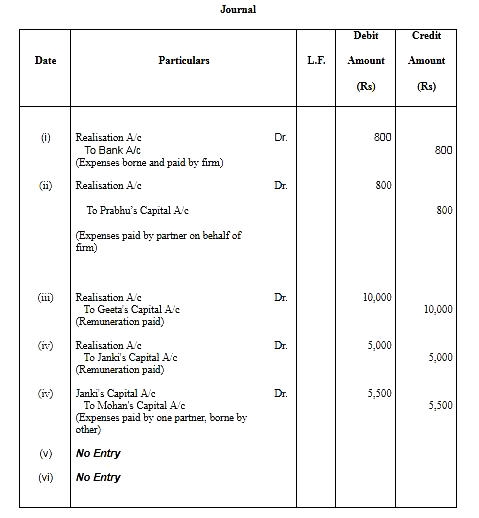

Pass necessary journal entries on the dissolution of a partnership firm in the following cases :

(i) Dissolution expenses were $$Rs. 800$$.

(ii) Dissolution expenses $$Rs. 800$$ were paid by Prabhu, a partner.

(iii) Geeta, a partner, was appointed to look after the dissolution work, for which she was allowed a remuneration of $$Rs. 10,000$$. Geeta agreed to bear the dissolution expenses. Actual dissolution expenses $$Rs. 9,500$$ were paid by Geeta.

(iv) Janki, a partner, agreed to look after the dissolution work for a commission of $$Rs.5,000$$. Janki agreed to bear the dissolution expenses. Actual dissolution expenses $$Rs. 5,500$$ were paid by Mohan, another partner, on behalf of Janki.

(v) A partner, Kavita, agreed to look after the dissolution process for a commission of $$Rs. 9,000$$. She also agreed to bear the dissolution expenses. Kavita took over furniture of $$Rs 9,000$$ for her commission. Furniture had already been transferred to realisation account.

(vi) A debtor, Ravinder, for $$Rs. 19,000$$ agreed to pay the dissolution expenses which were $$Rs. 18,000$$ in full settlement of his debt.

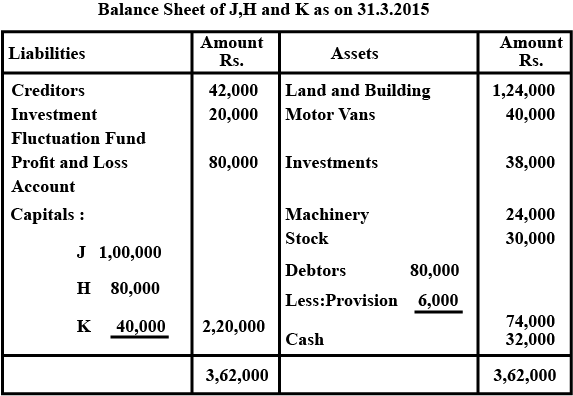

Pranav, Karan and Rahim were partners in a firm sharing profits and losses in the ratio of $$2:2:1$$. On 31st March, 2017 their Balance Sheet was as follows:Balance Sheet of Pravan, Karan and Rahim as on 31.3.2017

Liabilities

Amount

Rs. Assets

Amount

Rs. Creditors $$30,00,000$$ Fixed Assets $$4,50,000$$ General Reserve $$1,50,000$$ Stock $$1,50,000$$ Capitals:

Pranav $$2,00,000$$

Karan $$2,00,000$$

Rahim $$\underline{1,00,000}$$

_________

$$5,00,000$$Debtors

Bank

$$2,00,000$$

$$1,50,000$$

$$9,50,000$$

$$9,50,000$$

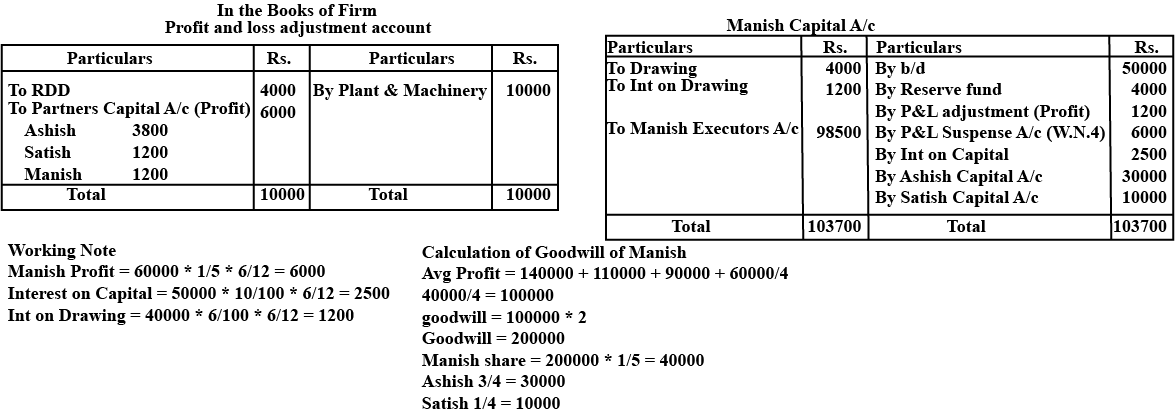

Karan died on 12.06.According to the partnership deed, the legal representative of the deceased partner were entitled to the following:

(i) Balance in his Capital Account

(ii) Interest on Capital @ $$12$$% p.a

(iii) Share of goodwill. Goodwill of the firm on Karan's death was valued at Rs. $$60,000$$

(iv) Share in the profits of the firm till the date of this death, calculated on the basis of last year's profit. The profit of the firm for the year ended 31.3.2017 was Rs. $$5,00,000$$

Prepare Karan's Capital a/c to be presented to his representatives.

| Liabilities | Amount Rs. | Assets | Amount Rs. |

| Creditors | $$30,00,000$$ | Fixed Assets | $$4,50,000$$ |

| General Reserve | $$1,50,000$$ | Stock | $$1,50,000$$ |

| Capitals: Pranav $$2,00,000$$ Karan $$2,00,000$$ Rahim $$\underline{1,00,000}$$ | _________ $$5,00,000$$ | Debtors Bank | $$2,00,000$$ $$1,50,000$$ |

| $$9,50,000$$ | $$9,50,000$$ |

Karan died on 12.06.According to the partnership deed, the legal representative of the deceased partner were entitled to the following:

(i) Balance in his Capital Account

(ii) Interest on Capital @ $$12$$% p.a

(iii) Share of goodwill. Goodwill of the firm on Karan's death was valued at Rs. $$60,000$$

(iv) Share in the profits of the firm till the date of this death, calculated on the basis of last year's profit. The profit of the firm for the year ended 31.3.2017 was Rs. $$5,00,000$$

Prepare Karan's Capital a/c to be presented to his representatives.