Dissolution Of Partnership Firm - Class 12 Commerce Accountancy - Extra Questions

Distinguish between 'Dissolution of partnership' and 'Dissolution firm' on the basis of court's intervention.

What Journal entry is passed when an asset is given to any of the firm's creditors towards partial payment of dues?

Distinguish between 'Dissolution of partnership' and 'Dissolution of partnership firm' on the basis of settlement of assets and liabilities.

What is meant by Dissolution?

In case of dissolution of firm which liabilities are to be paid first?

Distinguish between 'Dissolution of Partnership' and 'Dissolution of Partnership Firm' on the basis of closure of books.

Explain dissolution of a firm by (i) Agreement and (ii) Notice

Record necessary Journal entries in the following cases:

(a) Creditors worth Rs. 85,000 accepted Rs. 40,000 as cash and investment worth Rs. 43,000, in full settlement of their claim.

(b) creditors were Rs. 16,They accepted Machinery valued at Rs. 18,000 in settlement of their claim.

(c) Creditors were Rs. 90,They accepted building valued at Rs. 1,20,000 and paid cash to the firm Rs. 30,000.

If a loan from a partner appears on the liabilities side of the Balance Sheet of the firm and the Capital Account of such partner shows a debit balance after all adjustment, how is loan dealt with?

Differentiate between 'Dissolution of Partnership' and 'Dissolution of Partnership Firm' on the basis of 'Continuity of Business'.

A and B are partners in a firm sharing profits in the ration 3:2. Mrs. A has given a loan of Rs. 20,000 to the firm and the firm also obtained a loan of Rs. 10,000 from B. The firm was dissolved and its assets were realised for Rs.25,State the order of payment of Mrs. A's loan and B's loan with reason, if there were no creditors of the firm.

Given any one difference between reconstitution of a firm and dissolution of firm.

Distinguish between 'Dissolution of Partnership' and 'Dissolution of Partnership Firm' on the basis of Court's intervention.

Give any two objects of the partners share gain (profit) or loss on realisation of various assets and payment of various liabilities.

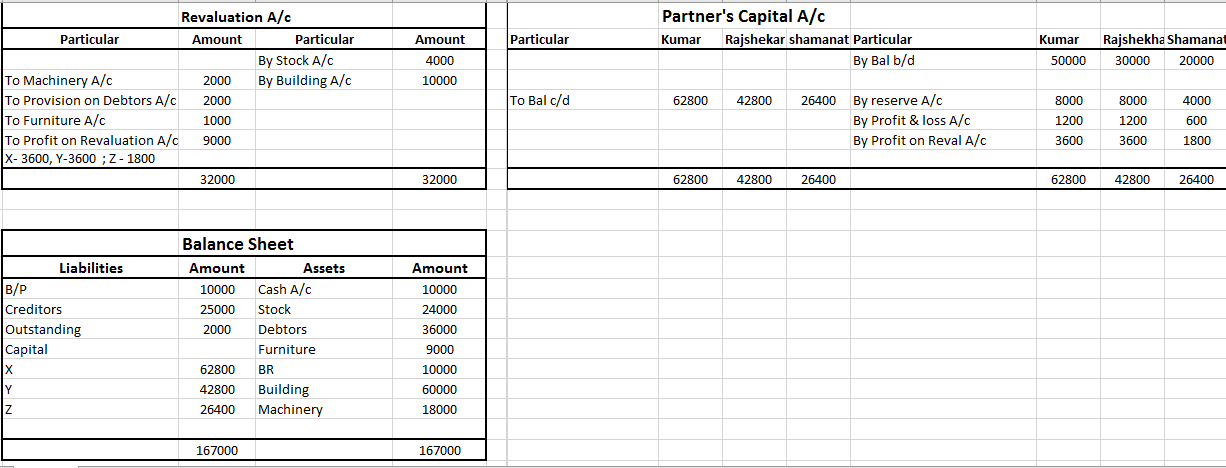

X,Y and Z were partners sharing profits and losses in the ratio of 2:2:1 respectively. Their Balance Sheet as on 31-03-2016 was as under.

Balance Sheet as on 31-3-2016

| Liabilities | Rs. | Assets | Rs. |

| Creditors | 25,000 | Cash at Bank | 10,000 |

| Bills Payable | 10,000 | Bills receivable | 10,000 |

| Reserves fund | 20,000 | Debtors 40,000 Less: PBD 2,000 | 38,000 |

| Profit and loss A/c | 3,000 | ||

| Capitals: X 50,000 Y 30,000 Z 20,000 | 1,00,000 | Stock | 20,000 |

| Machinery | 20,000 | ||

| Furniture | 10,000 | ||

| Building | 50,000 | ||

| 1,58,000 | 1,58,000 |

a) Stock to be increased by 20%

b) Maintain P.B.D. at 10% on debtors.

c) Depreciate machinery and furniture by 10% each,

d) Building to be revalued at Rs. 60,000

e) Goodwill of the firm is created Rs. 25,000 and written off immediately.

Prepare:

i) Revaluation A/c

ii) Partners capital A/c

iii) Balance Sheet as on 1-4-2016

A and B dissolve their partnership. Their position as at 31st March, 2018 was:

| Particulars | Rs. |

| A's Capital | 25,000 |

| B's Capital | 15,000 |

| Sundry Creditors | 20,000 |

| Cash in Hand and at Bank | 750 |

You are required to close the books of the firm.

Give the formula for calculation of new profit sharing ratio on retirement of a partner.

A firm Manufacturing Spices adultrate spices and sell at low price to various restaurants, hotels and shops. What values are being violated?

What is Realisation account ?

State any two differences between dissolution of partnership and dissolution of partnership firm.

The partnership between A and B was dissolved on 31st March,On that date the respective credits to the capitals were A - Rs. 1,70,000 and B - Rs. 30,Rs. 20,000 were owed by B to the firm; Rs. 1,00,000 were owed by the firm to A and Rs. 2,00,000 were due to the Trade Creditors. Profits and losses were shared in the proportions of 2/3 to A, 1/3 to B.

The assets represented by the above stated net liabilities realised Rs. 4,50,000 exclusive of Rs. 20,000 owed by B. The liabilities were settled at book figures. Prepare Realisation Account, Partners' Capital Accounts and Cash Account showing the distribution to the partners.

Distinguish between 'Dissolution of partnership ' and Dissolution of partnership Firm' on the basis of closure of books.

Pass the Journal entries, for the following transactions on the dissolution of the firm of P and Q after various assets (other than cash) and outside liabilities have been transferred to Realisation Account

(a) Stock Rs. 2,00,'P' took over 50% of stock at a discount of 10%. Remaining stock was sold at a profit of 25% on cost.

(b) Debtors Rs. 2,25,Provision for Doubtful Debts Rs. 25,Rs. 20,000 of the book debts proved bad.

(c) Land and Building (Book value Rs. 12,50,000) sold for Rs. 15,00,000 through a broker who charged 2% commission.

(d) Machinery (Book value Rs. 6,00,000) was handed over to a creditor at a discount of 10%

(e) Investment (Book value Rs. 60,000) ranted at 125%.

(f) Goodwill of Rs. 75,000 and prepaid fire insurance of 10,000.

(g) There was an old furniture in the firm which had been written off completely in the books. This was sold for Rs. 10,000.

(h) 'Z' an old customer whose account for Rs. 20,000 was written off as bad in the previous year, paid 60%.

(i) 'P' undertook to pay Mrs. P's loan of Rs. 50,000.

(j) Trade creditors Rs. 1,60,Half of the trade cretlitors accepted Plant and Machlnery at an agreed valuation of Rs. 54,000 and cash in full settlement of their claims after allowing a discount of Rs. 16,000.

Remaining trade creditors were paid 90% in final settlement

Pass neceisaly Journal. entries on the dissolution of a firm in the fondling cases:

(a) Dharam, a partner, was appointed to Iook after the process of dissolution at a remuneration of Rs. 12,000 and he had to bear the dissolution expenses. Dissolution expenses Rs. 11,000 were paid by Dharam.

(b) Jay, a partner, was appointed to look after the process of dissolution and was allowed a remuneration of Rs. 15,Jay agreed to bear dissolution expenses Rs. 16,000 were paid by Vijay another partner on behalf of Jay.

(c) Deepa, a partner, was to look after the process of dissolution and for this work she was allowed a remuneration of Rs. 7,deepa agreed to bear dissolution expenses. Actual dissolution expenses Rs. 6,000 were paid from the firm's bank account.

(d) Dev, a partner, agreed to do the work of dissolution for Rs. 7,He took away stock of the same amount as his commission. The stock had already been transferred to realisation Account.

(e) Jeev, a partner, agreed to do the work of dissolution for which he was allowed a commission of Rs. 10,He agreed to dissolution expenses. Actual dissolution expenses paid by Jeev were Rs. 12,These expenses were paid by Jeev by drawing cash from the firm.

(f) A debtor of Rs. 8,000 already transferred to Realisation Account agreed to pay the realisation expenses of Rs. 7,800 in full Settlement of his account.

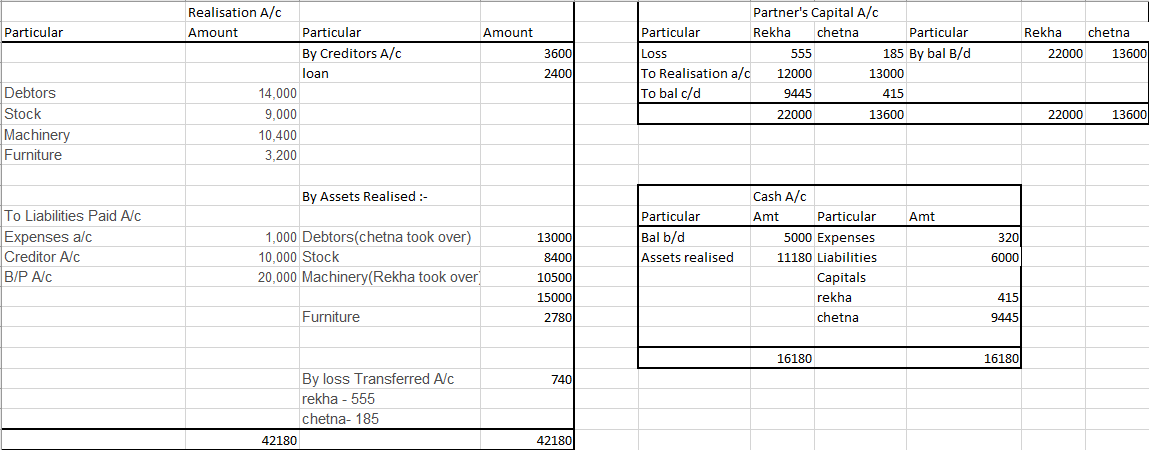

Rekha and Chetana sharing profits as 3:1 and they agree upon dissolution. The balance sheet as on 31 March, 2018 is as under :

Balance sheet of Rekha and Chetana as on 31 March, 2018

| Liabilities | Rs. | Assets | Rs. | |

| Loan Creditors Capital : Rekha Chetana | 22,000 13,600 | 2,400 3,600 35,600 | Cash at Bank Stock Furniture Debtors Plant and Machinery | 5,000 9,000 3,200 14,000 10,400 |

| 41,600 | 41,600 |

a) Rekha took over plant and Machinery at an agreed value of Rs.12,000

b) Stock and furniture were sold for Rs.8,400 and Rs.2,780 respectively

c) Debtors were took over by Chetana at Rs.13,000

d) Liabilities were paid in full by the firm

e) Realisation expenses were Rs.320.

Prepare :

1) Realisation account

2) Partners capital accounts and

3) Bank account.

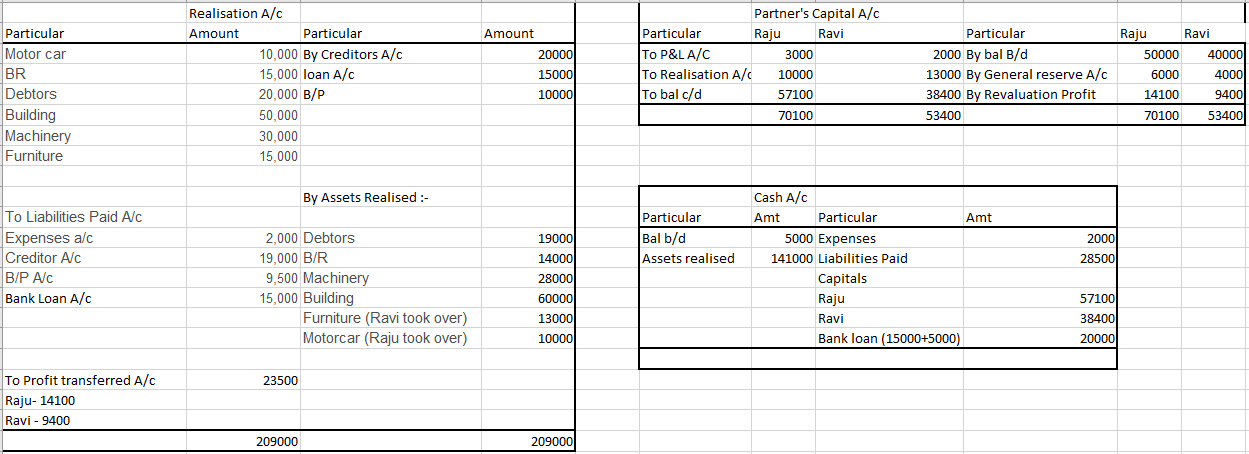

Raju and Ravi are partners sharing profits and losses in the ratio of 3:2. Their Balance Sheet as on 31-3-2016 was as follows:

Balance Sheet as on 31-3-2016

| Liabilities | Rs. | Assets | Rs. |

| Creditors | 20,000 | Cash at hand | 5,000 |

| Bills Payable | 10,000 | Bills receivable | 15,000 |

| Bank loan A/c | 15,000 | Debtors | 20,000 |

| Raju's loan A/c | 5,000 | Motor car | 10,000 |

| General Reserves | 10,000 | Machinery | 30,000 |

| Capitals: Raju 50,000 Ravi 40,000 | 90,000 | Furniture | 15,000 |

| Buildings | 50,000 | ||

| Profit and loss A/c | 5,000 | ||

| 1,50,000 | 1,50,000 |

a) Buildings Rs. 60,000, Machinery Rs. 28,000, Bills Recivable Rs. 14,Debtors Rs. 19,000 and unrecorded assets realised Rs. 20,000.

b) Motor car is taken over by Raju at book value.

c) Furniture is taken over by Ravi for Rs. 13,000.

d) Creditors and Bills payable were paid off at a discount of 5% and Bank loan paid in full.

e) Dissolution expenses Rs. 2,000.

Prepare:

i) Realisation A/c

ii) Partners capital A/c

iii) Cash A/c

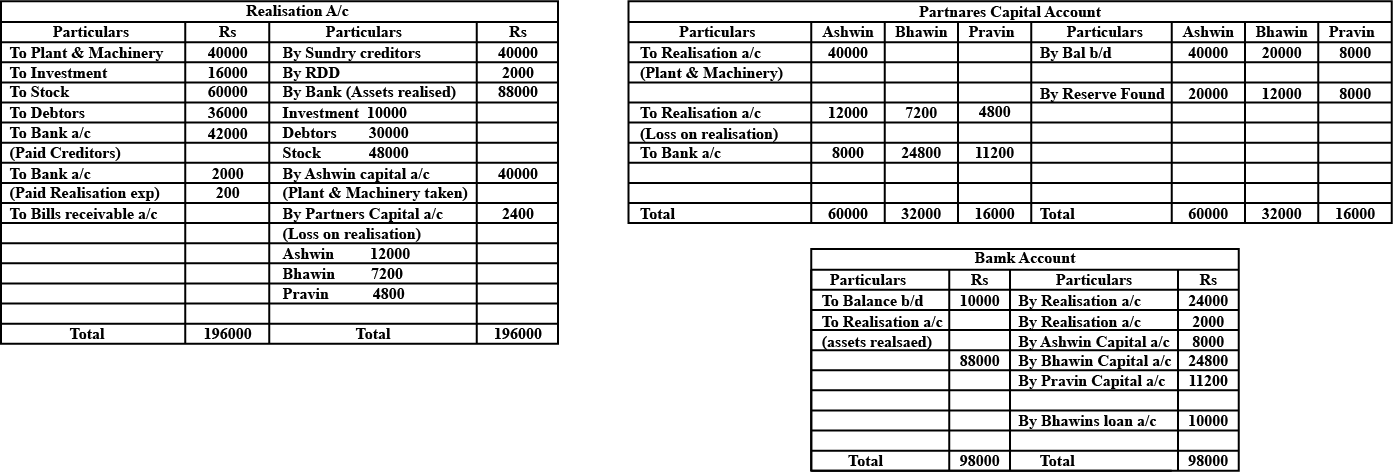

Ashwin, Bhavin and Pravin carried on business. They share profits and losses in the ratio of 5:3:2 respectively. Their Balance Sheet as on 31st March, 2016 was as under:

Balance Sheet as on 31st March, 2016

| Liabilities | Amount (Rs.) | Assets | Amount(Rs.) |

| Sundry creditors | 42,000 | Plant and machinery | 40,000 |

| Bhavin's loan | 10,000 | Investment | 16,000 |

| Reserve fund | 40,000 | Stock | 60,000 |

| Capital accounts: | Debtors 36,000 | ||

| Ashwin | 40,000 | Less: R.D.D. 2,000 | 34,000 |

| Bhavin | 20,000 | Bank | 10,000 |

| Pravin | 8,000 | ||

| 1,60,000 | 1,60,000 |

(1) Investment Rs. 10,000, Stock Rs. 48,000, and Debtors Rs. 30,000

(2) Plant and machinery were taken over by Ashwin at book value.

(3) Sundry creditors and Bhavin's loan were paid in full.

(4) Realisation expenses incurred Rs. 2,000.

Prepare:

(1) Realisation Account

(2) Partner's Capital Account

(3) Bank Account

Class 12 Commerce Accountancy Extra Questions

- Accounting For Not-For-Profit Organisations Extra Questions

- Accounting For Partnership: Basic Concepts Extra Questions

- Accounting For Share Capital Extra Questions

- Accounting Ratios Extra Questions

- Analysis Of Financial Statements Extra Questions

- Cash Flow Statement Extra Questions

- Dissolution Of Partnership Firm Extra Questions

- Financial Statements Of A Company Extra Questions

- Issue And Redemption Of Debentures Extra Questions

- Reconstitution Of A Partnership Firm - Admission Of A Partner Extra Questions

- Reconstitution Of A Partnership Firm - Retirement / Death Of A Partner Extra Questions