Accounting For Partnership: Basic Concepts - Class 12 Commerce Accountancy - Extra Questions

A firm Maintains a Capital Account and a Current Account for each partner. What is the term used when this method of maintaining Capital Accounts is followed?

Interest on capital is credited to Partner's Current Account. Name the method of maintaining Capital Account.

If interest on capital, salary to the partner and share of profit are credited while interest on drawings, drawings and share of loss are debited to the Partners' Capital Accounts, what is the method followed to maintain the Capital Accounts?

Under which Capital Account Method, Current Accounts of partners are maintained?

What is meant by 'Fixed Capital' of a Partner?

State the provisions of Partnership Act, 1932, in the absence of a Partnership Deed regarding (i) Interest on Partner's Drawings, and (ii) Interest on Advances other than capital.

$$X$$ and $$Y$$ are partners sharing profits in the ratio of $$3 : 2$$ with capitals of $$Rs. 80,000$$ and $$Rs. 60,000$$ respectively. Interest on capital is agreed @ 5% p.a. $$Y$$ is to be allowed an annual salary of $$Rs. 6,000$$ which has not been withdrawn. Profit for the year ended 31st March, 2018 before interest on capital but after charging Y's salary amounted to $$Rs. 24,000$$.

A provision of 5% of the profit is to be made in respect of commission to the Manager. Prepare an account showing the allocation of profits.

B and M are partners in a firm. They withdrew Rs. 48,000 and Rs. 36,000 respectively during the year evenly in the middle of every month. According to the partnership agreement, interest on drawings is to be charged @ 10% p.a.

Calculate interest on drawings of the partners using the appropriate formula.

Give two circumstances in which the Fixed Capitals of partners may change.

List the item that may appear on the debit side of a Partner's Fixed Capital Account.

State one difference between Fixed Capital Account and Fluctuating Capital Account of partners.

Mention the items that may appear on the debit side of the Capital Account of a partner when the capitals are fluctuating.

Under which Capital Account Method, Current Accounts of partners are not maintained?

List any four items appearing on the Profit and Loss Appropriation Account.

Mention the items that may appear on the credit side of the Capital Account, when the partners capital are fixed.

Calculate interest on drawings of Rakesh @ $$10\%$$ p.a. for the year ended 31st March, 2018 in each of the following alternative cases:

CaseIf his drawings during the year were $$Rs. 30,000$$.

CaseIf he withdraws $$Rs. 2,500$$ per month during the year.

A and B are partners sharing profits equally. A drew regularly Rs. 4,000 at the end of every month for six months ended 30th September,Calculate interest on drawings @ 5% p.a. for a period of six months.

Explain the concept of mutual agency in partnership firm.

Name the partnership firm which is formed to carry on a special task or project.

Calculate interest on A's drawings @ $$10\%$$ if he withdraw Rs. $$2,50,000$$ during the year.

Explain any five merits and five demerits of partnership.

Define partnership.

A and B are partners sharing profits equally. A drew regularly Rs. 4,000 in the beginning of every month for six months ended 30th September,Calculate interest on drawings @ 5% p.a. for a period of six month

The business assets of an organisation amount to Rs.50,000 but the debts that remain unpaid are 80,What course of action can the creditors take if :

(a) The organisation is a sole proprietorship firm?

(b) The organisation is a partnership firm with Anthony and Akbar as partners? Which of the two, partners can the creditors approach for repayment of debt? Explain giving reasons.

In which form of organisation is a trade agreement made by one owner binding on the others? Give reasons to support your answer.

Is registration of partnership firm compulsory?

Are partners by estoppel held liable for the debts of the firm?

What values are involved in:

(a) Cooperative organisation.

(b) Partnership.

Distinguish between 'Fixed Capital Account' and 'Fluctuating Capital Account' on the basis of credit balance.

X, Y and Z are partners. The partnership agreement is silent. State whether the firm is dissolved in each of the following alternative cases:

Case (a): If X, Y, Z are declared as insolvent,

Case (b): If X and Y are declared as insolvent,

Case(c): If only X is declared as insolvent.

X, Y and Z are partners. On 01/01/1997, Z applies for insolvency. On 01/02/1997, He endorses a Bill of Exchange in favour of W. On 01/03/He is declared insolvent. Does W acquire a good title to the Bill?

X, Y and Z are partners. Z gives notice of retirement to, the other partners but does not give public notice of it. W gives credit to the firm without having notice of the change. Can W sue Z if (a) Z is an active partner, (b) Z is a dormant partner (sleeping partner)?

X, Y and Z are partners and there is no provision in the partnership agreement for duration of the partnership. State whether the firm is dissolved in each of the following alternative case:

Case (a) If X gives a notice in writing to Y of his intention to dissolve the firm on 31.03.99.

Case(b):If X gives a notice in writing to Y on 31.03.99 and to Z on 02.04.The notice contained X's intention to dissolve the firm. But the date of dissolution was not mentioned in the notice.

Case (C): If in case (b), it was mentioned in the notice that the firm will be dissolved from 1st May 1999.

X, Y and Z are partners. The majority of the partners decide t dissolve the firm. Discuss the legal position.in?each of the following alternative cases

Case (a): The partnership agreement is silent.

Case (b) The partnership agreement provides for dissolution by. Mutual. Agreement only.

Case(c): The partnership agreement provides for dissolution. By any. Majority of the partner

Answer briefly the following question:

Give the adjusting entry and closing entry for interest on loan taken by a partner from the firm, when the firm follows the Fluctuating Capital Method.

The capital accounts of Amar and Harsh stood at $$Rs. 20,000$$ and $$Rs. 30,000$$ respectively after the necessary adjustments in respect of drawings and net profit for the year ended 31$$^{st}$$ March,It was subsequently ascertained that interest on capital @ $$12\%$$ per annum was not taken into account while arriving at the divisible profits for the year

During the year 2016-17, Amar had withdrawn $$Rs. 2,000$$ and Harsh's drawings were $$Rs. 1,000$$.

The net profit for the year amounted to $$Rs. 15,000$$

The partners shared profits and losses in the ratio of $$3:2$$

You are required to pass the necessary journal entries to rectify the error in accounting.

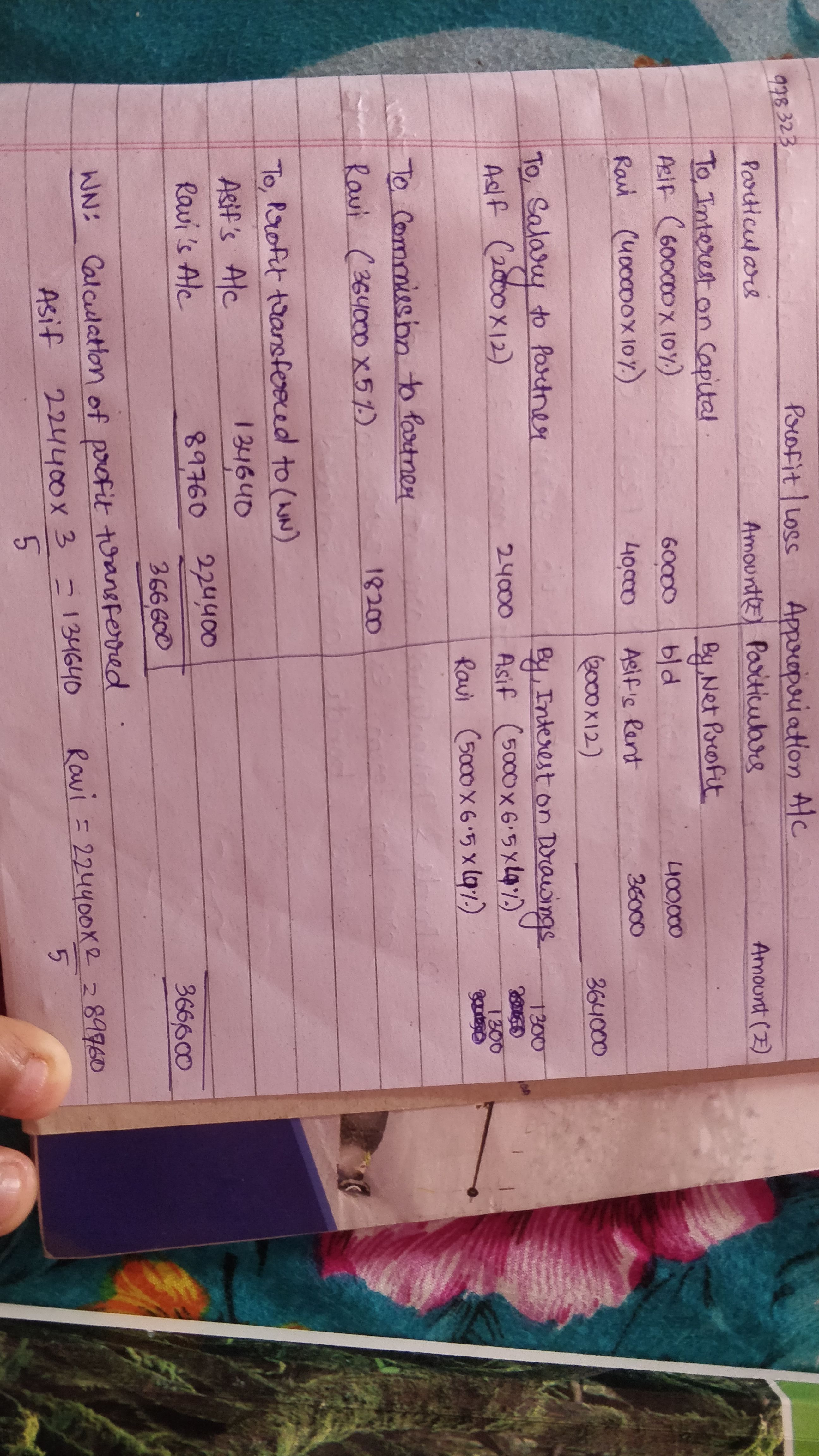

Asif and Ravi are partners in a firm, sharing profits and losses in the ratio of $$3:2$$. Their fixed capitals as on 1$$^{st}$$ April, 2016, were $$Rs. 6,00,000$$ and $$Rs. 4,00,000$$ respectively.

Their partnership deed provides for the following:

(a) Partners are to be allowed interest on their capital @ $$10\%$$ per annum.

(b) They are to be changed interest on drawings @ $$4\%$$ per annum

(c) Asif is entitled to a salary of $$Rs. 2,000$$ per month.

(d) Ravi is entitled to a commission of $$5\%$$ of the correct net profit of the firm before charging such commission.

(e) Asif is entitled to a rent of $$Rs. 3,000$$ per month for the use of his premises by the firm.

The net profit of the firm for the year ended 31$$^{st}$$ March, 2017, before providing for any of the above clauses was $$Rs. 4,00,000$$

Both partners withdrew $$Rs. 5,000$$ at the beginning of every month for the entire year.

You are required to prepare a Profit and Loss Appropriation Account for the year ended 31$$^{st}$$ March, 2017.

Answer the question.

What is Profit and Loss Appropriation Account?

What is the maximum number of partners that a partnership firm can have? Name the Act that provides for the maximum number of partners in a partnership firm.

X and Y contribute Rs 20,000 and Rs.10,000 respectively towards capital. They decide to allow interest on capital @ 6% p.a. Their respective share of profits is 2:3 and the net profit for the year is Rs.1,Show distribution of profits:

(i) where there is no agreement except for interest on capitals and

(ii) where there is an agreement that the interest on capital as a charge.

Why is Profit and Loss Appropriation Account prepared?

Is Interest on Loan by partner debited to Profit and Loss Appropriation Account?

List the items that are credited to Profit and Loss Appropriation Account.

A group of 40 people want to form a partnership firm. They want your advice regarding the maximum number of persons that can be there in a partnership firm and name of the Act under whose provision it is given.

Pratibha, partner of a firm, has advanced loan to the firm of $$Rs. 1,00,000$$. The firm does not have a Partnership Deed. Will Pratibha get interest on the loan? If yes, at which rate and why?

State the two methods of maintaining Capital Accounts of partners.

M/s. RSA maintains Partners' Capital Accounts under Fixed Capital Accounts Method. Accountant of the firm has credited their salary and interest on capital to their Capital Accounts. Do you agree with the treatment? Give reasons for your answer.

Is there any restriction on maximum number of partners? If yes, name the Act under which it is prescribed.

Neha, a partner, owns a building in which the firm carries its business. The firm pays her $$Rs. 10,000$$ as rent of the building. To which account rent will be debited?

State the provisions of Indian Partnership Act regarding the payment of remuneration to a partner for the services rendered.

How will you calculate interest on the drawings of equal amount made on the last day of every month of a calendar year?

If a fixed amount is withdrawn on 15th day of every month of a calendar year, for what period will the interest on total amount withdrawn be calculated?

When the partners' capitals are fixed, where will the drawings made by a partner be recorded?

To which account salary and commission to partners and interest on capital be debited? Why?

How is interest on drawings calculated, if the drawings are made at regular intervals, as on the 15th day of each month?

Under what circumstances Average Method of calculating interest on drawings is applied?

Name the method of calculating Interest on Drawings of the partner if different amounts are withdrawn on different dates.

Why is it that the Capital Account of a partner does not show a 'Debit Balance' in spite of regular and consistent losses year after year?

If the partners' capitals are fixed, where will you record interest charged on drawings?

If A draws $$Rs. 15,000$$ every month at the end of the month, what will be the Interest $$@ 5\% p.a.$$?

$$A$$ and $$B$$ are partners in a firm sharing profits equally. They had advanced to the firm equally a total sum of Rs. 30,000 as a loan in their profit-sharing ratio on 1st October,The Partnership Deed is silent on the question of interest on the loan from partners. Compute the interest payable by the firm to the partners, assuming the firm closes its books on 31st March each year.

$$X$$ and $$Y$$ are partners sharing profits and losses in the ratio of $$2 :3$$ with capitals of $$Rs. 2,00,000$$ and $$Rs. 3,00,000$$ respectively. On 1st October, 2017, $$X$$ and $$Y$$ granted loans of $$Rs. 80,000$$ and $$Rs. 40,000$$ respectively to the firm. Show distribution of profits/losses for the ended 31st March, 2018 in each of the following alternative cases:

CaseIf the profits before interest for the year amounted to Rs. 21,

CaseIf the profits before interest for the year amounted to t Rs. 3,000.

CaseIf the profits before interest for the year amounted to Rs. 5,00,

CaseIf the loss before interest for the year amounted to Rs. 1,400.

Following differences have arisen among $$P, Q$$ and $$R$$. State who is correct in following case:

$$P$$ and $$Q$$ want to purchase goods from A Ltd., $$R$$ does not agree?

Following differences have arisen among $$P, Q$$ and $$R$$. State who is correct in following case:

$$Q$$ and $$R$$ want to admit $$C$$ as partner, $$P$$ does not agree?

Distinguish between Fixed and Fluctuating Capitals.

State the two situations in which interest on Partners' Capital is generally provided.

State any four features of a Partnership.

Discuss the main provisions of the Indian Partnership Act, 1932 that are relevant to partnership accounts if there is no partnership deed.

$$A$$ and $$B$$ are partners from 1st April, 2017, without a Partnership Deed and they introduced capitals of $$Rs. 35,000$$ and $$Rs. 20,000$$ respectively. On 1st October, 2017, $$A$$ advances a loan of $$Rs. 8,000$$ to the firm without any agreement as to interest. The Profit and Loss Account for the year ended 31st March, 2018 shows a profit of $$Rs.15,000$$ but the partners cannot agree on payment of interest and on the basis of division of profits.

You are required to divide the profits between them giving reasons for your method.

Bat and Ball are partners sharing the profits in the ratio of $$2 : 3$$ with capitals of $$Rs. 1,20,000$$ and $$Rs. 60,000$$ respectively. On 1st October, 2017, Bat and Ball granted loans of $$Rs. 2,40,000$$ and $$Rs. 1,20,000$$ respectively to the firm. Bat had allowed the firm to use his property for business for a monthly rent of $$Rs. 5,000$$. The loss for the year ended 31st March, 2018 before rent and interest amounted to $$Rs. 9,000$$. Show distribution of profit/loss.

Prem and Manoj are partners in a firm sharing profits in the ratio of $$3: 2$$. The Partnership Deed provided that Prem was to be paid salary of $$Rs. 2,500$$ per month and Manoj was to get a commission of $$Rs. 10,000$$ per year. Interest on capital was to be allowed @ 5% p.a. and interest on drawings was to be charged @ 6% p.a. Interest on Prem's drawings was $$Rs.1,250$$ and on Manoj's drawings was $$Rs. 425$$. Interest on Capitals of the partners were $$Rs. 10,000$$ and $$Rs. 7,500$$ respectively. The firm earned a profit of $$Rs. 90,575$$ for the year ended 31st March,

Prepare Profit and Loss Appropriation Account of the firm.

Ashish and Aakash are partners sharing profit in the ratio of $$3 : 2$$. Their Capital Accounts showed a credit balance of $$Rs. 5,00,000$$ and $$Rs. 6,00,000$$ respectively as on 31st March, 2018 after debit of drawings during the year of $$Rs. 1,50,000$$ and $$Rs. 1,00,000$$ respectively. Net profit for the year ended 31st March was $$Rs. 5,00000$$. Interest on capital is to be allowed @ 10% p.a.

Pass the journal entry for interest on capital and prepare Profit and Loss Appropriation Account.

Naresh and Sukesh are partners with capitals of $$Rs. 3,00,000$$ each as on 31st March,Naresh had withdrawn $$Rs.50,000$$ against capital on 1st October, 2017 and also $$Rs. 1,00,000$$ besides the drawings against capital. Sukesh also had drawings of $$Rs. 1,00,000$$.

Interest on capital is to be allowed @ 10% p.a.

Net profit for the year was $$Rs.2,00,000$$, which is yet to be distributed.

Pass the Journal entries for interest on capital and distribution of profit.

X and Y are partners in a firm. X is entitled to a salary of Rs. 10,000 per month and commission of 10% of the net profit after partners' salaries but before charging commission. Y is entitled to a salary of Rs. 25,000 p.a. and commission of 10% of the net profit after charging all commission and partners' salaries. Net profit before providing for partners' salaries and commission for the year ended 31st March, 2018 was Rs. 4,20,Show, distribution of profit.

Amar and Bimal entered into partnership on 1st April, 2017 contributing $$Rs. 1,50,000$$ and $$Rs. 2,50,000$$ respectively towards capital. The Partnership Deed provided for interest on capital @ 10% p.a. it also provided that Capital Accounts shall be maintained following Fixed Capital Accounts method. The firm earned net profit of $$Rs. 1,00,000$$ for the year ended 31st Match,

Pass the Journal entry for interest on capital.

$$A$$ and $$B$$ are partners. A's Capital is $$Rs. 1,00,000$$ and B's Capital is $$Rs. 60,000$$. Interest on capital is payable @ 6% p.a. $$B$$ is entitled to a salary of $$Rs. 3,000$$ per month. Profit for the current year before interest and salary to B is $$Rs. 80,000$$.

Prepare Profit and Loss Appropriation Account.

X and Y shared profit and losses in the ratio of $$3:2$$ . With effect from 1st April, 2018 they agreed to share profits equally. The goodwill of the firm was valued at Rs. $$ 60,000$$ . The necessary single adjustment entry will be :

Simran and Reema are partners sharing profits in the ratio of $$3 : 2$$. Their capitals as on 31st March, 2017 were $$Rs. 2,00,000$$ each whereas Current Accounts had balances of $$Rs. 50,000$$ and $$Rs. 25,000$$ respectively. Interest is to be allowed @ 5% p.a. on balances in Capital Accounts. The firm earned net profit of $$Rs. 3,00,000$$ for the year ended 31st March, 2018.

Pass the Journal entries for interest on capital and distribution of profit. Also prepare Profit and Loss Appropriation Account for the year.

$$X, Y$$ and $$Z$$ are sharing profit and losses in the ratio of $$5:3:2$$ . They decide to share future profits and losses in the ratio of $$2:3:5$$ with effect from $$1st $$ April, $$2018$$ . They also decided to record the effect of the following accumulated profits, losses and reserves without affecting their book values by passing a single entry.

Book value (Rs.)

| General Reserve | $$6,000$$ |

| Profit and Loss A/c (Credit) | $$2,40,000$$ |

| Advertisement Suspense A/c | $$12,000$$ |

X and Y are partners sharing profits in the ratio of 2:On 31st March, 2018 their Balance Sheet showed General Reserve of Rs. 60,It was decided that in future they will share profits and losses in the ratio of 3:Pass necessary Journal entry in each of the following alternative cases:-

(i) If General Reserve is not be shown in the new Balance Sheet.

(ii) If General Reserve is to be shown in the new Balance Sheet.

Calculate interest on drawings of Mr. Ashok @ 10% p.a. for the year ended 31st March, 2018, in each of the following alternative cases:

CaseIf he withdrew Rs. 7,500 in the beginning of each quarter. CaseIf he withdrew Rs. 7,500 at the end of each quarter.

CaseIf he withdrew Rs. 7,500 during the middle of each quarter.

CaseIf he withdrew Rs. 7,500 during the middle of each quarter.

Kanika and Gautam are partners doing a dry cleaning business in Lucknow, sharing profits in the ratio 2 : 1 with capitals Rs. 5,00,000 and Rs. 4,00,000 respectively. Kanika withdrew the following amounts during the year to pay the hostel expenses of her son:

1st April Rs. 10,000

1st June Rs. 9,000

1st November Rs. 14,000

1st December Rs. 5,000

Gautam withdrew Rs. 15,000 on the first day of April, July; October and January to pay rent for the accommodation of his family. He also paid Rs. 20,000 per month as rent for the office of partnership which was in a nearby shopping complex.

Calculate interest on drawings @ 6% p.a.

Ram and Mohan are partners in a business. Their capitals at the end of the year were Rs. 24,000 and Rs. 18,000 respectively. During the year, Ram's drawings and Mohan's drawings were Rs. 4,000 and Rs. 6,000 respectively. Profit (before charging interest on capital) during the year was Rs. 16,Calculate interest on capital @ 5% p.a. for the year ended 31st March, 2018.

A and B are partners sharing Profit and Loss in the ratio of 3 : 2 having Capital Account balances of Rs. 50,000 and Rs. 40,000 on 1st April,On 1st July, 2017, A introduced Rs. 10,000 as his additional capital whereas B introduced only Rs. 1,Interest on capital is allowed to partners @ 10% p.a.

Calculate interest on capital for the financial year ended 31st March, 2018.

A partnership firm earned net profit during the last three years ended $$31^{st}$$March, as follows:

2016 - Rs. $$17,000$$ 2017 - Rs.$$20,000$$ 2018 - Rs. $$23,000$$. The capital investment in the firm throughout the above mentioned period has been Rs. $$80,000$$. Having regard to the risk involved, $$15%$$ is considered to be a fair return on the capital. Calculate value of goodwill on the basis of two years purchase of average super profit earned during the above mentioned three years.

Following is the extract of the Balance Sheet of Neelkant and Mahadev as on 31st March, 2018.

| Liabilities | Rs. | Assets | Rs. |

| Neelkant's Capital Mahadev's Capital Neelkan't Curent A/c Mahadev's Current A/c Profit and Loss Appropriation A/c (March 2018) | 10,00,000 10,00,000 1,00,000 1,00,000 8,00,000 | Sundry Assets | 30,00,000 |

| 30,00,000 | 30,00,000 |

Ram and Mohan, two partners, drew for their personal use Rs. 1,20,000 and Rs. 80,Interest is chargeable @ 6% p.a. on the drawings. What is the amount of interest chargeable from each partner?

A and B started business on 1st April, 2017 with capitals of Rs. 15,00,000 and Rs. 9,00,000 respectively. On 1st October, 2017, they decided that their capitals should be Rs. 12,00,000 each. The necessary adjustments in capitals were made by introducing or withdrawing by cheque. Interest on capital is allowed@ 8% p.a. Compute interest on capital for the year ended 31st March, 2018.

Sajal and Kajal are partners, sharing profits and losses in the ratio of 2 :On 1 st April, 2017 their Capitals were: Sajal Rs. 50,000 and Kajal Rs. 40,

Prepare Profit and Loss Appropriation Account and the Partners' Capital Accounts at the end of the year after considering the following items:

(a) Interest on Capital is to be allowed @ 5% p.a.

(b) Interest on the loan advanced by Kajal for the whole year, the amount of loan being Rs. 30,

(c) Interest on partners' drawings @ 6% p.a. Drawings: Sajal Rs. 10,000 and Kajal Rs. 8,

(d) 10% of the divisible profit is to be transferred to reserve. The net profit for the year ended 31st March 2018 Rs. 68,460.

Amal, Bimal and Kamal are three partners. On 1st April 2017, their Capitals stood as: Amal Rs. 40,000, Bimal Rs. 30,000 and Kamal Rs. 25,It was decided that:

(a) they would receive interest on Capital @ 5% p.a.,

(b) Amal would get a salary of Rs. 250 per month,

(c) Bimal would receive commission @ 4% on net profit after deducting commission, interest on capital and salary, and

(d) After deducting all of these, 10% of the profit should be transferred to the General Reserve.

Before the above items were taken into account, the profit for the year ended 31st March 2018 was Rs. 33,Prepare Profit and Loss Appropriation Account and the Capital Accounts of the Partners.

Ali and Bahadur are partners in a firm, sharing profits and losses as Ali 70% and Bahadur 30%. Their respective capitals as at 1st April 2017 stand as Ali Rs. 25,000 and Bahadur Rs. 20,The partners are allowed interest on capitals @ 5% p.a. Drawing's of the partners during the year ended 31st March 2018 amounted to Rs. 3,500 and Rs. 2,500 respectively.

Profit for the year, before charging interest on capital and annual salary of Bahadur @ Rs. 3,000, amounted to Rs. 40,000, 10% of divisible profit is to be transferred to reserve.

You are asked to show partners' Current Accounts and Capital Accounts recording the above transactions.

$$X$$ and $$Y$$ are partners in a firm sharing profits and losses in the ratio of 3 : 2. On 31st March 2018 after closing the books of account, their Capital Accounts stood at Rs. 4,80,000 and Rs. 6,00,000 respectively. On 1st May 2017, $$X$$ introduced an additional capital of Rs. 1,20,000 and Y withdrew Rs. 60,000 from his capital. On 1st October 2017, X withdrew Rs. 2,40,000 from his capital and Y introduced Rs. 3,00,Interest on capital is allowed at 6% p.a. Subsequently, it was discovered that interest on capital @ 6% p.a. had been omitted. The profits for the year ended 31st March 2018 amounted to Rs. 2,40,000 and the partners drawings had been: X- R. 1,20,000 and Y - Rs. 60,Compute the interest on capital if the capitals are

(a) fixed, and (b) fluctuating.

(a) fixed, and (b) fluctuating.

C and D are partners in a firm; C has contributed Rs. 1,00,000 and D Rs. 60,000 as capital. Interest is payable @ 6% p.a. and D is entitled to a salary of 3,000 per month. In 2017-18, the profit was Rs. 80,000 before interest and salary. Divide the amount between C and D.

A and B are partners sharing profits in the ratio of 3 :with capitals of Rs. 50,000 and Rs. 30,000 respectively. Interest on capital is agreed @ 6% p.a. B is to be allowed an annual salary of Rs. 2,During the year profit prior to interest on capital but after charging B's salary amounted to Rs. 12,A provision of 5% of the profits is to be made in respect of Manager's Commission. Prepare an account showing the allocation of profits and the Partners' Capital Accounts.

A, B and C were partners in a firm having capitals of Rs. 50,000; Rs. 50,000 and Rs.1,00,000 respectively. Their Current Account balances were. A: Rs. 10,000; B: Rs. 5,000 and C: Rs. 2,000 (Dr.). According to the Partnership Deed the partners were entitled to an interest on Capital @ 10% p.a. C being the working partner was also entitled to a salary of Rs.12,000 p.a. The profits were to be divided as:

(a) The first Rs. 20,000 in proportion to their capitals.

(b) Next Rs. 30,000 in the ratio of 5 :3 :

(c) Remaining profits to be shared equally.

The firm earned net profit of Rs.1,72,000 before charging any of the above items.

Prepare Profit and Loss Appropriation Account and pass necessary Journal entry for the appropriation of profits.

Show how the following will be recorded in the Capital Accounts of the Partners Sohan and Mohan when their capitals are fluctuating:

| Sohan (Rs.) | Mohan (Rs.) | |

| Capitals on 1st April 2017 | 4,00,000 | 3,00,000 |

| Drawings during 2017-18 | 50,000 | 30,000 |

| Interest on Capital | 5% | 5% |

| Interest on Drawings | 1,250 | 750 |

| Share of Profit for 2017-18 | 60,000 | 50,000 |

| Partner's Salary | 36,000 | .... |

| Commission | 5,000 | 3,000 |

A and B are partners, sharing profits and losses In the ratio of 3 :On 1st April 2017; their capitals were: A Rs. 50,000 and B Rs. 30,During the year ended 31st March 2018 they earned a net profit of Rs. 50,The terms of partnership are:

(a) Interest on capital is to be allowed @ 6% p.a.

(b) A will get a commission @ 2% on turnover.

(c) B will get a salary of Rs. 500 per month.

(d) B will get commission of 5% on profits after deduction of all expenses including such commission.

Partners' drawings for the year were: A Rs. 8,000 and B Rs. 6,Turnover for the year was Rs. 3,00,

After considering the above facts, you are required to prepare Profit and Loss Appropriation Account and Partners' Capital Accounts.

Profits earned by a partnership firm for the year ended 31st March, 2017 were distributed equal between the partners Pankaj and Anu without allowing interest on capital. Interest due on capital was - Pankaj: 3,000 and Anu: 1,Pass necessary adjustment entry.

Ram and Mohan are equal partners, Their capitals are 40,000 and 78,000 respectively. After the account for the year are prepared, it is discovered that interest @ 5% p.a. on capital as provided in the Partnership Deed has not been credited to Capital Accounts before distribution of profits. If it is decided to make an adjusting entry in the beginning of the next year. Give necessary adjustment entry.

Mannu and Shristhi are partners in a firm sharing profit in the ratio of 3 :Following is the balance sheet of the firm as on 31st March 2018: Mannu's capital:- 30,000 Mannu;s drawings:- 4000Shristhi's capital:- 10,000 Shristhi's drawings:- 2000

(a) Profit for the year ended 31st March 2018 was Rs. 5,000 which was divided in the agreed ratio, (b) Interest @ 5% p.a. on capital and @ 6% pa. on drawings was inadvertently enquired. (c) Adjust interest on drawings on an average basis for 6 months. Give the adjustment entry. Notes;- Drawings already adjusted in the capital.

(a) Profit for the year ended 31st March 2018 was Rs. 5,000 which was divided in the agreed ratio,

(b) Interest @ 5% p.a. on capital and @ 6% pa. on drawings was inadvertently enquired.

(c) Adjust interest on drawings on an average basis for 6 months.

Give the adjustment entry. Notes;- Drawings already adjusted in the capital.

Reya, Mona and Nisha shared profits in the ratio of 3 : 2 :The profits for the last three years was 1,40,000; 84,000 and 1,06,000 respectively. These profits were by mistake shared equally for all three years. It is now decided to correct the error. Give necessary Journal entry for the same.

The firm of Harry, Potter and Ali, who have been sharing profits in the ratio of 2 : 2 : 1, have existed for same years. Ali wants that he should get equal share in the profits with Harry and Potter and he further wishes that the change in the profit-sharing ratio should come into effect retrospectively were for the three years. Harry and Potter have agreement on this account. The profits for the last three years were: Year 2015-16, 2016-17 & 2017-18 Profit Rs. 2,20,000 2,40,000 2,90,000. Show adjustment of profits by means of a single adjustment Journal entry.

Ram, Mohan and Sohan sharing profits and losses equally have capitals of 70,000, 90,000 and 60,For the year ended 31st March 2018, interest was credited to them @ 6% instead of 5%. Give adjustment Journal entry.

Piya and Bina are partners in a firm sharing profits and losses in the ratio of 3 :Following was the Balance Sheet of the firm as on 31st March 2016: Capitals of Piya and Bina are 30,000 and 20,000.

The profit was Rs. 30,000 for the year ended 31st March 2016 were divided between the partners without allowing interest on capital @ 12%. p.a. and salary to.Piya @ Rs. 1,000 per month., During the year Piya withdrew 8,000 and Bina withdrewShowing your working notes clearly, pass the necessary rectifying entry.

The Capitals of. A, B and C as on 31st March 2018 amounted to 90,000, 3,30,000 and 6,60,000 respectively. The profits amounting to $$Rs.$$ 1,80,000 for the year 2017-18 were distributed in the ratio of 4 :1 :1 after allowing Interest on Capital @ 10% p.a. During the year, each partner withdrew the amount of $$Rs.$$ 3,60,The Partnership Deed was silent as to profit-sharing ratio but provided for interest on capital @ 12%. Pass the necessary adjustment entry showing the working clearly.

Ram, Shyam and Mohan were partners in a firm, sharing profits and losses in the ratio of 2 : 1 :The capitals were fixed at Rs. 3,00,000, 1, 00,000, and 2,00,For the year ended 31st March 2018, interest on capital was credited to them @ 9% instead of 10% p.a. The profit for the year before charging interest was Rs. 2,50,Show your working notes clearly and pass necessary adjustment entry.

On 31st March 2018, after the closing of the accounts, the capital Accounts of P, Q and R stood in the books of the firm at Rs.40,000, Rs. 30,000 and Rs. 20,000 respectively. Subsequently, it was discovered that interest on capital @ 5% had been omitted. Profit for the year ended 31st March 2018 amounted to Rs. 60,000 and the partners drawings had been P- Rs. 10,000, Q- Rs. 7,500 and R - Rs. 4,The profit-sharing ratio of P, Q and R is 3 : 2 :Give necessary adjustment entry.

A, B and C are partners sharing profits in the ratio of 5 :4:C is given a guarantee that his minimum share of profit in any given year would be at least Rs. 5,Deficiency, if any, would be borne by A and B equally. The profit for the year 2017-18 amounted to Rs. 40,Pass necessary Journal entries in the books of the firm.

$$X, Y$$ and $$Z$$ are partners in a firm sharing profits in $$3:3:2$$ ratio. They decide to share profits equally w.e.f. April $$1, 2018$$ On that date, the Profit and Loss Account shows the credit balance of Rs. $$60,000$$ They decide that Profit and Loss Account will remain as it is. You are required to fill up the following Journal entry:

| Date | Particulars | L.F. | Dr. (Rs.) | Cr. (Rs.) |

| 2018 April 1 | ? ....Dr To ? To ? (Being adjustment made for credit balance of Profit and Loss Account due to change in profit-sharing ratio) | ? | ? ? |

A and B are partners, sharing profits in the ratio of 3 :C was admitted for 1/6th share of profit With minimum guaranteed amount of Rs. 10,At the close of the first financial year, the firm earned a profit of Rs. 7,54,Find out the share of profit which A, B and C will get.

X and Y are partners in a firm sharing profits in the ratio of 3 :2.They have a manager, Z, who gets Rs.10,0000 salary plus commission of 5% of the profit after charging his salary and commission. Now, they decided to admit Z as a partner, giving him 1/5th share in the profits of the firm. Any excess amount which Z received as a partner (over his salary and commission) will be borne by X. The profit for the year ended 31st Ma 2018 amounted to Rs. 8,40,000 after charging Z's salary. Prepare Profit and Loss Appropriation Account showing the division of profit for the year.

The Capital Accounts of A and B stood at Rs. 4,00,000 and Rs. 3,00,000 respectively after necessary adjustments in respect of the drawings and the net profit for the year ended 31st March,It was subsequently discovered that 5% p.a. Interest on capital and also drawings were not taken into account in arriving at the distributable profit. The drawings of the partners had been: A-Rs. 12,000 drawn at the end of each quarter and B- Rs. 18,000 drawn at the end of each half year. The profit for the year as adjusted amounted to Rs. 2,00,The partners share profits in the ratio of 3 :You are required to pass Journal entries and show adjusted Capital Accounts of the partners.

A, B and C were in partnership sharing profits and losses In the ratio of 4 : 2 : 1 respectively. It was provided that C's share in profit for a year would not be less than Rs. 7,The profit for the year ended 31st March 2018 amounted to Rs. 31,500; You are required to show the appropriation among the partners The Profit and Loss Appropriation Account is not required.

A, B, and C are partners in a firm. Their profit sharing ratio is 2 : 2 :C is guaranteed a minimum amount of Rs. 10,000 as share of profit every year. Any deficiency arising on that amount shall be met by B. The profits for the two years-ended 31st MarchAnd 2018 were Rs. 40,000 and Rs. 60,000 respectively. Prepare Profit and Loss Appropriation Account for the years.

Does the loan from an outsider have priority over the loan from a partner as to repayment?

Pranshu and Himanshu are partners, sharing profits and losses in the ratio of 3 :2 respectively. They admit Arishu as partner with 1/6th share in the profits of the firm. Pranshu personally guaranteed that Anshu's share of Profit would not be less than Rs. 30,000 in any year. The net profit of the firm for the year ending 31st March 2013 was Rs. 90,Prepare Profit and Loss Appropriation Account

A and B are partners sharing profits in the ratio of 2 :They decided to admit C, their manager, as a partner from 1st April, 2017, giving him 1/5th share of profit. C, while a manager, was getting a salary of Rs. 50,000 p.a. plus a commission of 10% of the net profit after charging such salary and commission. It also agreed that any excess amount which C receives as a partner (over his salary and commission), be borne by A. Profit for the year ended 31st March, 2018 amounted to Rs. 6,44,000, before payment of salary and commission. Prepare Profit and Loss Appropriation Account.

Calculate interest on drawings of Mr. Siddhant @ $$10\%$$ p.a. for the year ended 31st March, 2018 in each of the following alternative cases:

CaseIf he withdrew $$Rs. 6,000$$ in the beginning of each quarter.

CaseIf he withdrew $$Rs. 6,000$$ at the end of each quarter:

CaseIf he withdrew $$Rs. 9,000$$ in the middle of each quarter.

$$A, B$$ and $$C$$ started a firm on 1st October, 2017 sharing profits equally. $$A$$ drew regularly $$Rs. 4,000$$ in the beginning of every month for the six months ended 31st March,$$B$$ drew regularly $$Rs. 4,000$$ at the end of every month for the six months ended 31st March,$$C$$ drew regularly $$Rs. 4,000$$ in the middle of every month for the six months ended 31st March, 2018.

Calculate interest on drawings @ $$5\%$$ p.a. for the period ending 31st March, 2018.

Arun and Arora were partners in a firm sharing profits in the ratio of $$5 : 3$$. Their fixed capitals on 1st April, 2010 were: Arun $$Rs. 60,000$$ and Arora $$Rs. 80,000$$. They agreed to allow interest on capital @ 12% p. a. and to charge on drawings @ 15% p.a. The profit of the firm for the year ended 31st March, 2011 before all above adjustments was $$Rs. 12,600$$. The drawings made by Arun were $$Rs. 2,000$$ and by Arora $$Rs. 4,000$$ during the year.' Prepare Profit and Loss Appropriation Account of Arun and Arora. Show your calculations clearly. The interest on capital will be allowed even if the firm incurs a loss.

On 31st March, 2018, Capital Accounts of $$E, M$$ and $$A$$ after making adjustments for profits, drawings, etc., were as $$E - Rs. 8,00,000; \, M- Rs. 6,00,000$$ and $$A- Rs. 4,00,000$$. Subsequently, it was found that interest on capital and interest on drawings had been omitted. The partners were entitled to interest on capital @ $$5\%$$ p.a. Drawings during the year were: $$E- Rs. 2,00,000; \, M- Rs. 1,50,000$$ and $$A- Rs. 90,000$$. Interest on drawings chargeable to the partners were: $$E-Rs. 5,000; \, M- Rs. 3,600$$ and $$A- Rs. 2,000$$. The net profit during the year amounted to $$Rs. 12,00,000$$. The profit-sharing ratio of the partners was $$3 : 2 :1$$.

Pass necessary adjustment entry for rectifying the above errors of omission. Show your workings.

(Calculation of Interest on Drawings by Simple Method and Product Method). In a partnership, partners are charged interest on drawings @ $$15\%$$ p.a. During the year ended 31st March, 2018, a partner drew as follows:

| Date | 1st May, 2017 | 1st August 2017 | 30th September, 2017 | 31st January, 2018 | 31st March, 2018 |

| Amount (Rs.) | 2,000 | 5,000 | 2,000 | 6,000 | 2,000 |

A partner draws $$Rs.$$ 1,000 per month. Under the Partnership Deed, interest on drawings is to be charged @ $$15\%$$ p.a. Calculate interest that should be charged to the partner if the drawings are made:

(i) in the beginning of the month,

(ii) in the middle of the month, or

(iii) at the end of the month.

$$X, Y$$ and $$Z$$ are partners. They have omitted interest on capital @ $$10\%$$ p.a. for three years ended 31st March, Their fixed capitals on which interest was to be calculated throughout were: $$X- Rs. 10,000; \, Y- Rs. 8,000$$ and $$Z -Rs. 7,000$$. Their profit-sharing ratios were: $$2016-1 : 2 : 2; \, 2017-5 : 3 : 2; \, 2018- 4 : 5 :1$$. The firm earned profit of $$Rs.2,500$$ in each year. Pass necessary adjustment Journal entry.

(Rent Payable to a Partner). $$A$$ and $$B$$ are partners sharing profits equally. Business is being carried from the property owned by $$A$$ on a yearly rent of $$Rs. 24,000$$. $$A$$ is to get salary of $$Rs. 1,20,000$$ p.a. and $$B$$ is to get commission @5% of net sales, which during the year was $$Rs. 30,00,000$$. Net profit for the year ended 31st March, 2018 before providing for rent was $$Rs. 5,00,000$$.

You are required to draw Profit and Loss Appropriation Account for the year ended 31stMarch, 2018.

$$X, Y$$ and $$Z$$ are partners in a firm sharing profits and losses in the ratio of $$5 : 3 : 2$$. Their fixed capitals were $$Rs. 3,00,000;\, Rs. 2,00,000$$ and $$Rs. 1,00,000$$ respectively. For the year ended 31st March, 2018, interest on capital was credited to them @ $$10\%$$ p.a. instead of $$8\%$$ p.a.

Showing your working notes clearly, pass necessary adjustment Journal entry.

(Commission to Partners and Distribution of Profit). $$X$$ and $$Y$$ are partners in a firm. $$X$$ is to get a commission of $$10\%$$ of net profit before charging any commission. $$Y$$ is to get a commission of $$10\%$$ on net profit after charging all commissions. Net profit for the year ended 31st March, 2018, before charging any commission was $$Rs. 55,000$$.

Find the commission of $$X$$ and $$Y$$. Also, show the distribution of profit.

Name the following:

A person who lends his name and goodwill for the benefits of a partnership film.

A person who contributes capital but does not take part in the business of the firm.

A document containing terms and conditions of partnership.

A partnership set up for a specific project

A person who contributes capital, participates in the business but whose identity is not disclosed to outsiders.

The partner of a partnership entered into a contract with an outsider favouring him personally, ignoring the interest of partnership firm. What value is ignored?

$$A, B, C$$ and $$D$$ are partners sharing profits and losses in the ratio of $$4 : 3 : 3 : 2$$ and their respective capitals on 31st March, 2018 were $$Rs. 30,000;\, Rs. 45,000;\, Rs. 60,000$$ and $$Rs. 45,000$$. After closing and finalising the accounts, it was found that interest on capital @ $$6\%$$ p.a. was omitted. Instead of altering the signed accounts it was decided to pass a single adjustment entry on 1st April, 2018 crediting or debiting the respective Partners' Capital/Current Accounts.

Suresh, Sahil and Sumit are partners sharing profits in the ratio of $$5 : 3: 2$$. During the year ended 31st March, 2018, the firm earned profit of $$Rs. 3,50,000$$. Prepare Profit and Loss Appropriation Account giving effect to the following:

(i) Each of the partner is to get remuneration of $$Rs. 60,000$$ p.a.

(ii) Interest on Capital is to be allowed @ $$10\%$$ p.a. Capitals of Suresh, Sahil and Sumit as on 1st April, 2017 were - $$Rs. 5,00,000; \, Rs.5,00,000$$ and $$Rs. 7,50,000$$ respectively.

(iii) Interest on Drawings charged was: Suresh- $$Rs.10,000$$; Sahil - $$Rs. 20,000$$; and Sumit - Rs. $$25,000$$.

(iv) Sumit is guaranteed minimum profit of $$Rs. 1,50,000$$ after above appropriations.

If registration is optional, why do partnership firms willingly go through this legal formality and get themselves registered? Explain.

Which feature of partnership binds all the partners to the agreement signed by one partner?

$$A, B$$ and $$C$$ are partners having capitals of $$Rs.10,00,000; \, Rs. 8,00,000$$ and $$Rs.6,00,000$$ respectively in a firm and sharing profits and losses equally. $$C$$ is guaranteed a mininimum profit of $$Rs. 1,00,000$$ as share of profit every year. The firm incurred a loss of $$Rs. 3,00,000$$ for the year ended 31st March,You are required to show the necessary accounts for division of loss and giving effect to minimum guaranteed profit to $$C$$.

$$A, B$$ and $$C$$ are partners in a firm sharing profits and losses in the ratio of $$2 : 2 : 1$$. Their capitals (fixed) are $$Rs.1,00,000;\, Rs. 80,000$$ and $$Rs. 70,000$$ respectively. For the year 2017-18; it credited interest on capital @ $$9\%$$ p.a. instead of $$12\%$$. Give the adjustment Journal entry.

Explain the procedure for registration of a partnership firm?

$$X$$ and $$Y$$ are partners in a firm sharing profits in the ratio of $$4 : 1$$. They decide to admit $$Z$$, their manager, as a partner with effect from 1st April, 2017 for $$\dfrac{1}{8}th$$ share in profits. $$Z$$, as a manager, was getting salary of $$Rs. 8,000$$ per month and commission of $$5\%$$ of the net profits after charging such salary and commission.

As per the terms of the Partnership Deed, any excess amount which $$Z$$ shall be entitled to receive as a partner over the amount which have been due to hint as a manager, would be borne by $$X$$ out of his share of profit.

Profit for the year ended 31st March, 2018, amounted to $$Rs. 13,56,000$$ before salary and commission. Prepare the Profit and Loss Appropriation Account for the period ending 31st March, 2018.

When the partners current accounts are prepared in partnership firm ?

Shiva and Shankar are partners are partners in a firm. Shiva's drawing for the year $$2016-17$$ are given as under.

$$Rs.5,000\,on\,01-05-2016$$

$$Rs.7,000\,on\,31-08-2016$$

$$Rs.3,000\,on\,31-12-2016$$

$$Rs.4,000\,on\,01-02-2017$$

Calculate interest on drawing at $$12\%$$ p.a for the year ending $$31-03-2017$$ under product method.

How do you treat the followings in the absence of partnership deed ?

a) Interest on Capital.

b) Interest on Drawings.

c) Interest on Partner's Loan

d) Distribution of profits losses

e) Salary to partners.

Radha and Rani are partners in a firm. Radha's drawings for the year 2015-16 are given under:

Rs. 5,000 on 01-04-2015

Rs. 8,000 on 30-06-2015

Rs. 3,000 on 01-12-2015

Rs. 2,000 on 31-03-2016

Calculate interest on Radha's drawings at $$10\%$$ p.a. for the year ending 31-03-2016 under product method.

Akul, Bakul and Chandan were partners in a firm sharing profits in the ratio of $$2:2:1$$ on $$31^{st}$$ March, 2018 their Balance Sheet was as follows: Balance Sheet of Akul, Bakul and Chandan as on 31-2-2018

Liblities Amount

(Rs.) Assets Amount

(Rs.) Sundry Creditors

Employees Provident Fund

General reserve

Capital:

Akul $$1,60,000$$

Bakul $$1,20,000$$

Chandan $$\underline{ \,\,\,\,\,92,000}$$

$$45,000$$

$$13,000$$

$$20,000$$

$$3,72,000$$

Cash at Bank

Debtors $$60,000$$

Less: Provision for doubtful debts $$\underline{2,000}$$

Stock

Furniture

Plant and Machinary

$$42,000$$

$$58,000$$

$$80,000$$

$$90,000$$

$$1,80,000$$

$$\overline{\underline{4,50,000}}$$ $$\overline{\underline{4,50,000}}$$

Bakul retired on the above date and it was agreed that : (i) Plant and Machinery was undervalued by 10%. (ii) Provision for doubtful debts was to be increased to 15% on debtors. (iii) Furniture was to be decreased to Rs. 87,000. (iv) Goodwill of the firm was valued at Rs. 3,00,000 and Bakul's share was to be adjusted through the capital accounts of Akul and Chandan. (v) Capital of the new firm was to be in the new !profit sharing ratio of the continuing partners. Prepare Revaluation account, Partners' Capital accounts and the Balance Sheet of the reconstituted firm.

| Liblities | Amount (Rs.) | Assets | Amount (Rs.) |

| Sundry Creditors Employees Provident Fund General reserve Capital: Akul $$1,60,000$$ Bakul $$1,20,000$$ Chandan $$\underline{ \,\,\,\,\,92,000}$$ | $$45,000$$ $$13,000$$ $$20,000$$ $$3,72,000$$ | Cash at Bank Debtors $$60,000$$ Less: Provision for doubtful debts $$\underline{2,000}$$ Stock Furniture Plant and Machinary | $$42,000$$ $$58,000$$ $$80,000$$ $$90,000$$ $$1,80,000$$ |

| $$\overline{\underline{4,50,000}}$$ | $$\overline{\underline{4,50,000}}$$ |

Bakul retired on the above date and it was agreed that :

(i) Plant and Machinery was undervalued by 10%.

(ii) Provision for doubtful debts was to be increased to 15% on debtors.

(iii) Furniture was to be decreased to Rs. 87,000.

(iv) Goodwill of the firm was valued at Rs. 3,00,000 and Bakul's share was to be adjusted through the capital accounts of Akul and Chandan.

(v) Capital of the new firm was to be in the new !profit sharing ratio of the continuing partners.

Prepare Revaluation account, Partners' Capital accounts and the Balance Sheet of the reconstituted firm.

Yashas and Abhi are partners in a firm, sharing profits and losses in the ratio of $$2:1$$. Yashas withdrew the following amounts during the year $$2017-18$$ are given as under :

Rs.4,000 on 1.5.2017

Rs.10,000 on 30.9.2017

Rs.6,000 on 30.11.2017

Rs.12,000 on 1.1.2018

Interest on drawings is to be charged at 8% p.a.

Calculate the amount of interest to be charged on Yashas drawings for the year ending 31.3.2018.

A, B, C are partners sharing profits in the ratio of $$3:2:1$$. Their Balance Sheet as at 31st March, 2018 stood as:

| Liabilities | 'Rs. | Assets | Rs. | ||

| Capital Accounts | Building | $$10,00,000$$ | |||

| A | $$8,00,000$$ | Furniture | $$2,40,000$$ | ||

| B | $$4,20,000$$ | Office equipments | $$2,80,000$$ | ||

| C | $$4,00,000$$ | $$16,20,000$$ | Stock | $$2,50,000$$ | |

| Sundry Creditors | $$3,70,000$$ | Sundry debtors | $$3,00,000$$ | ||

| General Reserves | $$3,60,000$$ | Less: Provision for Doubtful debts | $$30,000$$ | $$2,70,000$$ | |

| Joint Life Policy | $$1,60,000$$ | ||||

| Cash at Bank | $$1,50,000$$ | ||||

| $$23,50,000$$ | $$23,50,000$$ |

(i) Office Equipments revalued at Rs. $$3,27,000$$

(ii) Building revalued at Rs. $$15,00,000$$. Furniture is written down by Rs. $$40,000$$ and Stock is reduced to Rs. $$2,00,000$$

(iii) Provision for Doubtful Debts is to be created @ $$5$$% on Debtors

(iv) Joint Life Policy will appear in the Balance Sheet at surrender value after B's retirement. The surrender value is Rs. $$1,50,000$$

(v) Goodwill was to be valued at 3 years purchase of average 4 years profit which were:

| Year | Rs |

| 2014 | $$90,000$$ |

| 2015 | $$1,40,000$$ |

| 2016 | $$1,20,000$$ |

| 2017 | $$1,30,000$$ |

Prepare the Revaluation Account, Partners' Capital Accounts and the Balance Sheet immediately after B's retirement.

A new partner acquires two main rights in the partnership firm which he joins. State one of these rights.

Prepare current account of partners under fixed capital system with five imaginary figures.

Write two partners capital accounts under fluctuating capital system with 5 imaginary figures.

Ritesh and Hitesh are childhood friends. Ritesh is a consultant whereas Hitesh is an architect. They contributed equal amounts and purchased a building for Rs. $$2$$ crores. After a year, they sold it for Rs. $$3$$ crores and shared the profits equally. Are they doing the business in partnership? Give reason in support of your answer.

Mita and Usha are partners in a firm, sharing profits in the ratio of 2 :Their Capital Accounts as on 1st April 2015 showed balances of Rs. 1,40,000 and Rs. 1,20,000 respectively. The drawings of Mita and Usha during the year 2015-16 were Rs. 32,000 and 24,000 respectively. Both the amounts were withdrawn on 1st JanuaryIt was subsequently found that the following items had been omitted while preparing the final accounts for the year ended 31st March 2016:

(a) Interest on Capital @ 6% p.a. (b) Interest on Drawings @ 6% p.a. (c) Mita was entitled to a commission of Rs. 8,000 for the whole year. Showing your working clearly, pass a rectifying entry in the books of the firm.

Ankur and Bobby were, into the business of providing software solutions in India. They were sharing profits and losses in the ratio of 3 :They admitted Rohit for 1/5 share in the firm. Rohit, an alumni of Chennai would help them, to expand their business to various South African countries where he been working earlier. Rohit is guaranteed a minimum profit of 2,00,000 for the year. In case of any deficiency, Rohit's share is to be borne by Ankur and Bobby in the ratio 4 :Loss for the year was Rs. 10,00,Pass the necessary Journal entries.

$$A, B$$ and $$C$$ were partners in a firm sharing profits in the ratio of $$3:2:1$$ . Their Balance Sheet as on $$31st$$ March, $$2015$$ was as follows :

| Liabilities | Rs. | Assets | Rs. |

| Creditors | 50,000 | Land | 50,000 |

| Bills Payable | 20,000 | Building | 50,000 |

| General Reserve | 30,000 | Plant | 1,00,000 |

| Capital A/cs: $$A$$ 1,00,000 $$B$$ 50,000 $$C$$ 25,000 | 1,75,000 | Stock | 40,000 |

| Debtors | 30,000 | ||

| Bank | 5,000 | ||

| 2,75,000 | 2,75,000 |

(i) Goodwill of the firm will be valued at Rs. $$1,50,000$$

(ii) Land will be revalued at Rs. $$80,000$$ and building be depreciated by $$6\%$$

(iii) Creditors of Rs. $$6,000$$ were not likely to be claimed and hence should be written off.

Prepare Revaluation Account, Partners' Capital Accounts and Balance Sheet of the reconstituted firm.

Mohan, Vijay and Anil are partners, the balances of their Capital Accounts being Rs. 30,000, Rs. 25,000 and Rs. 20,000 respectively. In arriving at these figures, the profits for the year ended 31st March 2016, Rs. 24,000 had already been credited to partners in the proportion in which they shared profits. Their drawings were Rs. 5,000 (Mohan), Rs. 4,000 (Vijay) and Rs. 3,000 (Anil) during the year. Subsequently, the following omissions were noticed, and it was decided to bring them into account: (a) Interest on capital @ 10% pa. (b) interest on drawings: Mohan Rs. 250, Vijay, Rs. 200 and Anil Rs. Make necessary corrections through a Journal entry and show your workings clearly.

X and Y entered into partnership On 1st April, 2017 X and Y contributed Rs. 2,00,000 and Rs. 1,50,000 respectively as their capitals. On 1st October, 2017, X provided Rs. 50,000 as loan to the firm. As per the provisions of the Partnership: Deed:.(i) 20% of Profits before charging Interest on Drawings but after making appropriations to be transferred to General Reserve.(ii) Interest on capital at 12% pa. and Interest on Drawings @ 10% p.a.(iii) X get Monthly salary of Rs. 5,000 and Y to get salary of Rs. 22,500 per quarter.(iv) X is entitled to a commission of 5% on sales. Sales for the year was Rs. 3,50,000. (v) Profit and Loss to be shared in the ratio of their capital contribirtion up to Rs. 1,75,000 and above Rs. 1,75,000 equally. The profit for the year ended 31st March, 2018, before 'Providing for any interest was Rs. 4,61,The drawings of X and Y were Rs. 1,00,000 and Rs. 1,25,000 respectively. Pass the necessary Journal entries relating to appropriation out of profits. Prepare Profit and Loss Appropriation Account and the Partners' Capital Accounts.

(ii) Interest on capital at 12% pa. and Interest on Drawings @ 10% p.a.

(iii) X get Monthly salary of Rs. 5,000 and Y to get salary of Rs. 22,500 per quarter.

(iv) X is entitled to a commission of 5% on sales. Sales for the year was Rs. 3,50,000.

(v) Profit and Loss to be shared in the ratio of their capital contribirtion up to Rs. 1,75,000 and above Rs. 1,75,000 equally.

The profit for the year ended 31st March, 2018, before 'Providing for any interest was Rs. 4,61,The drawings of X and Y were Rs. 1,00,000 and Rs. 1,25,000 respectively. Pass the necessary Journal entries relating to appropriation out of profits. Prepare Profit and Loss Appropriation Account and the Partners' Capital Accounts.

From the following prepare an account current, as sent by Avinash to Bhuvanesh on 31st March, 2018 by means of products method charging interest @ $$5$$% per annum:

| Date | Particulars | Amount (Rs.) |

| 2018 January 1 | Balance due from Bhuvanesh | $$1,800$$ |

| January 10 | Sold goods to Bhuvanesh | $$1,500$$ |

| January 15 | Bhuvanesh returned goods | $$650$$ |

| February 12 | Bhuvanesh paid by cheque | $$1,000$$ |

| February 20 | Bhuvanesh accepted a bill drawn by Avinash for one month | $$1,500$$ |

| March 11 | Sold goods to Bhuvanesh | $$720$$ |

| March 14 | Received cash from Bhuvanesh | $$800$$ |

From the following particulars prepare an account current, as sent by Mr. AB to Mr. XY as on $$31^{st}$$ October, $$2018$$ by means of product method charging interest $$@ 5\%$$ p.a.

| Date | Particulars | (Rs.) |

| $$1^{st}$$ July | Balance due from XY | $$1,500$$ |

| $$20^{th}$$ August | Sold goods to XY | $$2,500$$ |

| $$28^{th}$$ August | Goods returned by XY | $$400$$ |

| $$25^{th}$$ September | XY paid by cheque | $$1,600$$ |

| $$20^{th}$$ October | Received cash form XY | $$1,000$$ |

Class 12 Commerce Accountancy Extra Questions

- Accounting For Not-For-Profit Organisations Extra Questions

- Accounting For Partnership: Basic Concepts Extra Questions

- Accounting For Share Capital Extra Questions

- Accounting Ratios Extra Questions

- Analysis Of Financial Statements Extra Questions

- Cash Flow Statement Extra Questions

- Dissolution Of Partnership Firm Extra Questions

- Financial Statements Of A Company Extra Questions

- Issue And Redemption Of Debentures Extra Questions

- Reconstitution Of A Partnership Firm - Admission Of A Partner Extra Questions

- Reconstitution Of A Partnership Firm - Retirement / Death Of A Partner Extra Questions