Accounting For Share Capital - Class 12 Commerce Accountancy - Extra Questions

What do you mean by unissued capital?

What do you mean by equity shares?

What is an unlimited company?

What do you mean by reserved capital?

What do you mean by uncalled capital?

What do you mean by minimum subscription?

What is under-subscription of shares?

What do you mean by a public company?

What is a One Person Company?

Explain :- Over subscription.

What do you mean by unlisted company?

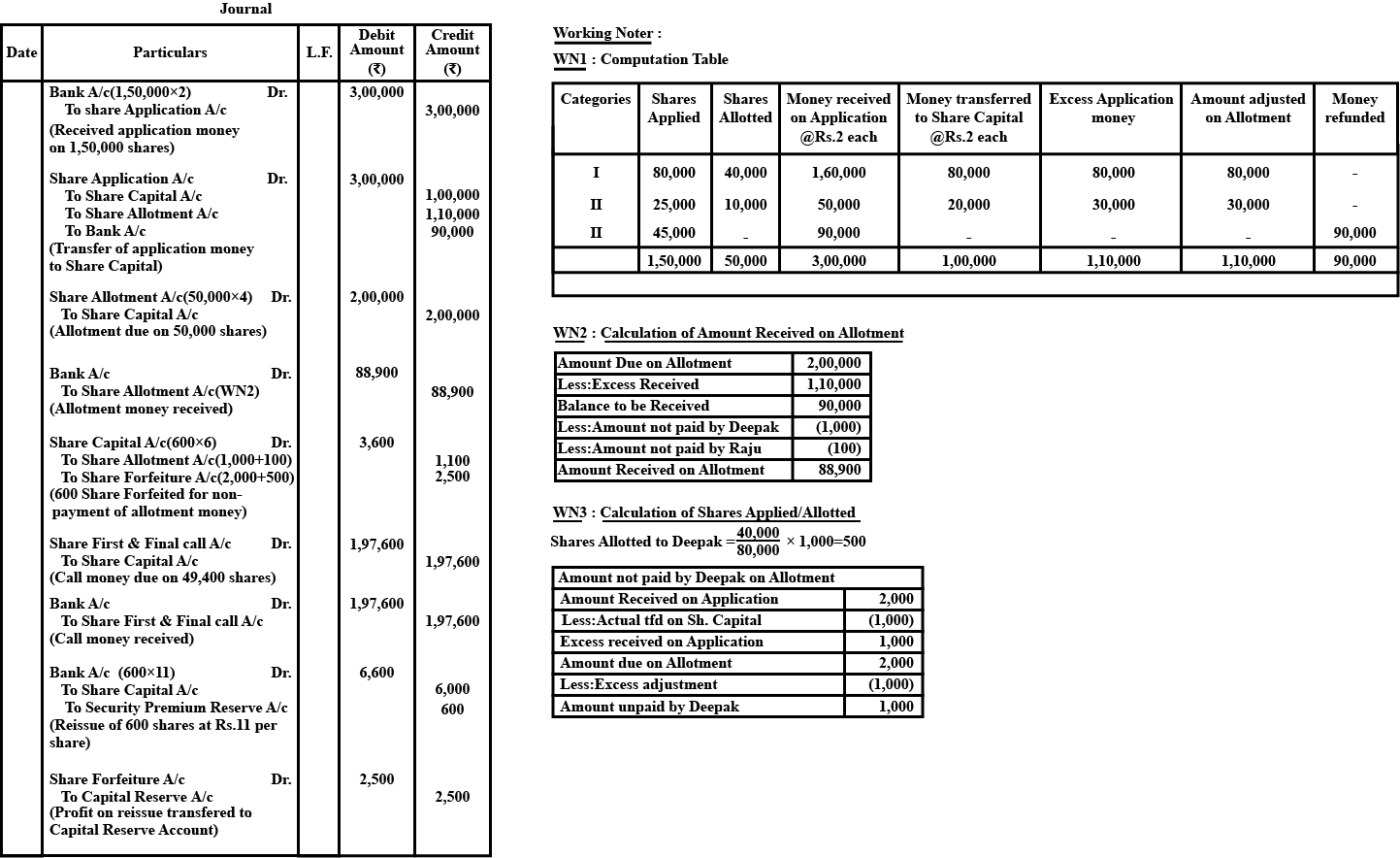

JJK Ltd. invited applications for issuing $$50,000$$ equity shares of $$Rs. 10$$ each at par. The amount was payable as follows: On Application : $$Rs. 2$$ per share. On Allotment : $$Rs. 4$$ per share. On First and Final Call : Balance Amount The issue was over-subscribed three times. Applications for $$30\%$$ shares were rejected and money refunded. Allotment was made to the remaining applicants as follows:

Category No. of Shares Applied No. of Shares Allotted

I 80,000 40,000

II 25,000 10,000

Excess money paid by the applicants who were allotted shares was adjusted towards the sums due on allotment.

Deepak. a shareholder belonging to Category I. who had applied for $$1,000$$ shares, failed to pay the allotment money. Raju, a shareholder holding $$100$$ shares, also failed to pay the allotment money. Raju belonged to Category II. Shares of both Deepak and Raju were forfeited immediately after allotment. Afterwards, first and final call was made and was duly received. The forfeited shares of Deepak and Raju were reissued at $$Rs. 11$$ per share fully paid up.

Pass necessary Journal entries for the above transactions in the books of the company.

$$Z$$ Ltd. forfeited $$1,000$$ equity shares of $$Rs. 10$$ each for the non-payment of the first call of $$Rs. 2$$ per share. The final call of $$Rs. 3$$ per share was yet to be made.

Calculate the maximum amount of discount at which these shares can be reissued.

Distinguish between the following:

Transfer of shares and Transmission of shares.

Distinguish between the following:

Interim dividend and Final dividend.

What is equity share? Explain the features of equity shares.

Write short notes on:

Bonus shares

What is the difference between Equity Shares and Preference Shares?

Answer briefly the following question:

What is the minimum price at which a company can reissue its forfeited shares which were originally issued at par?

Explain the advantages of equity shares, as a source of finance.

Distinguish between the following.

Equity share and Preference share

At which stage in the formation of a company does it interact with SEBI?

Distinguish Between Share Certificate and Share Warrant.

State the essential features of a private company.

What is minimum subscription?

DF Ltd. invited applications for issuing 50,000 shares of Rs. 10 each at a premium of Rs. 2 per share, The amount was payable as follows :

On Application : Rs. 3 per share (including premium Rs. 1)

On Allotment : Rs. 3 per share (including premium Rs. 1)

On First call : Rs. 3 per share

On Second and Final Call : Balance amount

Application for 70,000 shares were received. Allotment was made on the following basis.

Applications for 5,000 shares - Full

Applications for 50,000 shares - 90%

Balance of the applications were rejected. Rs. 1,11,000 were received on account of allotment. The amount of allotment due from the shareholders to whom shares were allotted on prorata basis was fully received. A few shareholders to whom shares were allotted in full, failed to pay the allotment money. Rs. 1,20,000 were received on first call. Directors decided to forfeit those shares on which allotment and call money was due. Half of the forfeited shares were re-issued @ Rs. 8 per share fully paid up. Final call was not made.

Pass the necessary journal entries for the above transactions in the book of DP Ltd.

What is meant by Issued capital ?

Define qualification shares.

Give necessary journal entries for the forfeiture and re-issue of shares:

X Ltd. forfeited $$200$$ shares of Rs. $$10$$ each (Rs. $$7$$ called up) on which Naresh had paid application and allotment money of Rs. $$5$$ per share. Out of these, $$150$$ shares were re-issued to Mahesh as fully paid up for Rs. $$6$$ per share.

What is Dividend Distribution Tax?

What is forfeiture of shares ?

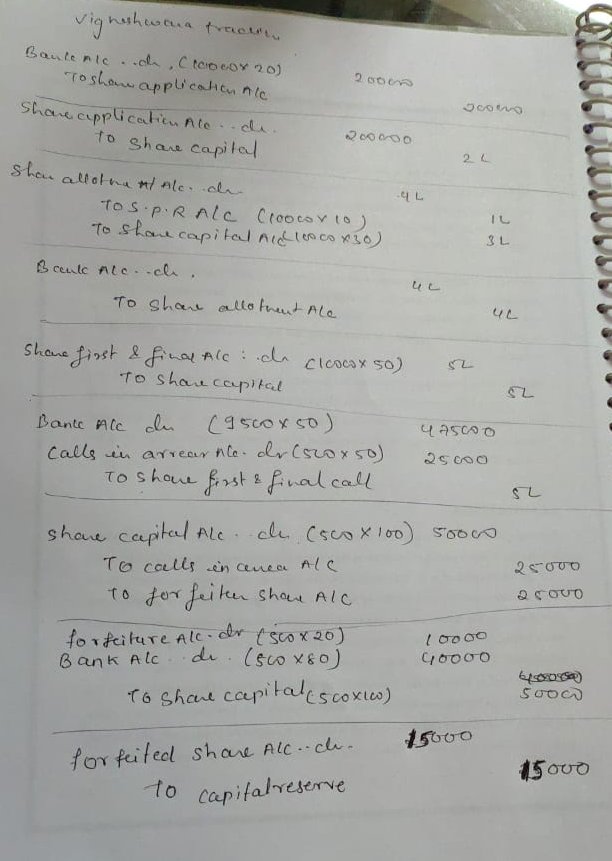

Vigneshwara Trading Co., Ltd., issued $$10,000$$ ordinary shares of $$Rs.100$$ each, at a premium of $$Rs.10$$ per share. The amount payable is as follows:

On Application $$Rs.20$$

On Allotment $$Rs.40$$ (including premium)

On first and final call $$Rs.50$$

All the shares were subscribed and the money duly received except the first and final call on $$500$$ shares. The directors forfeited there shares and re-issued them as fully paid at $$Rs.80$$ per share.

Pass the necessary journal entries in the books of the company.

Give necessary journal entries for the forfeiture and re-issue of shares:

X Ltd. forfeited $$300$$ shares of Rs.$$10$$ each fully called up, held by Ramesh for non-payment of allotment money of Rs. $$3$$ per share and final call of Rs. $$4$$ per share. He paid the application money of Rs. $$3$$ per share. These shares were re-issued to Suresh for Rs. $$8$$ per share.

Write a word/term/phare which can substitute the following statements:

A type of shares which have preferential rights over equity shares in respect of dividend and repayment of capital.

What is authorised capital?

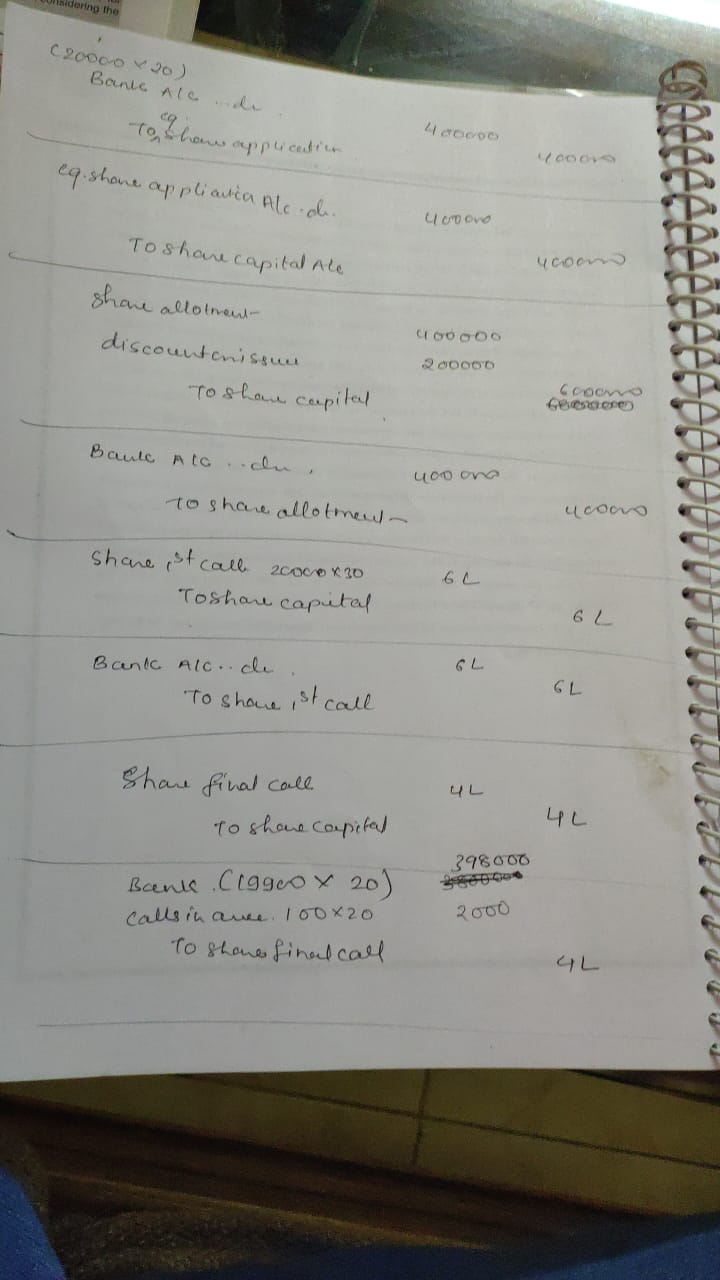

Sagar company Ltd. issued 20000 shares of Rs. 100 each, at a discount Rs. 10 per share. The amount payable as follows:

On applications Rs. 20

On allotments Rs. 20

On 1st call Rs. 30

On Final call Rs. 20

All the shares were subscribed and the money duly received except the final call on 100 shares. The directors forfeited these shares and re-issued them as fully paid at Rs. 80 per share. Pass the Journal entries related to issued shares, forfeited and re-issued.

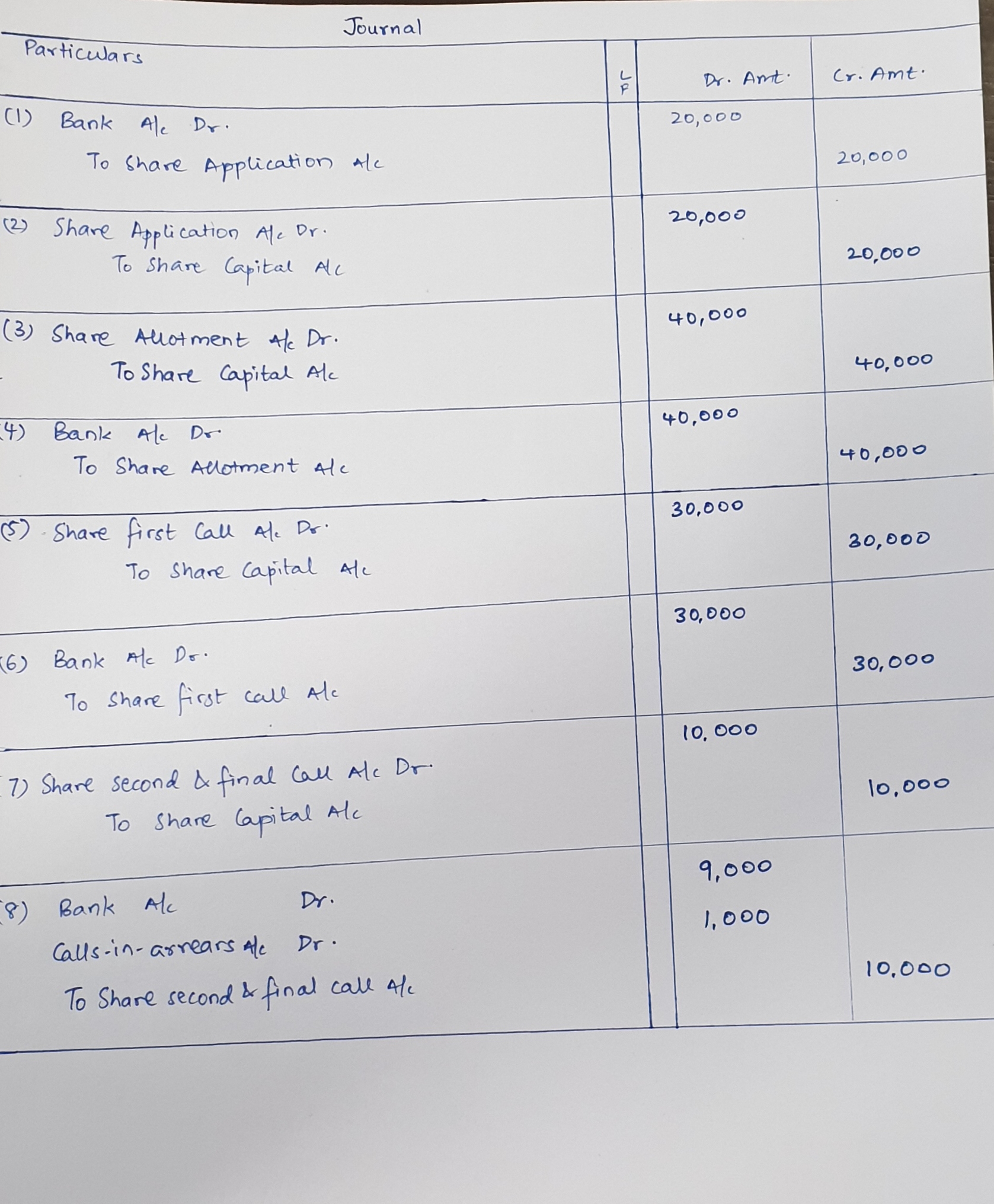

Akshat Co. Ltd. made an issue of $$10,000$$ equity shares of $$ 10$$ each, payable as follows:

On application $$ 2$$ per share

On allotment $$ 4$$ per share

On first call $$ 3$$ per share

On second and final call $$ 1$$ per share

The company received applications for $$15,000$$ equity shares of which applications for $$5,000$$ equity shares were rejected and money refunded. All the shareholders paid upto the second call except Kavita, the allottee of $$1,000$$ equity shares who failed to pay upto the final call.

Pass Journal Entries in the books of Akshat Co. Ltd.

What are the limitations of equity shares?

Briefly explain the term 'Return of allotment'?

What do you mean by preference shares?

What are the advantages of issuing equity shares?

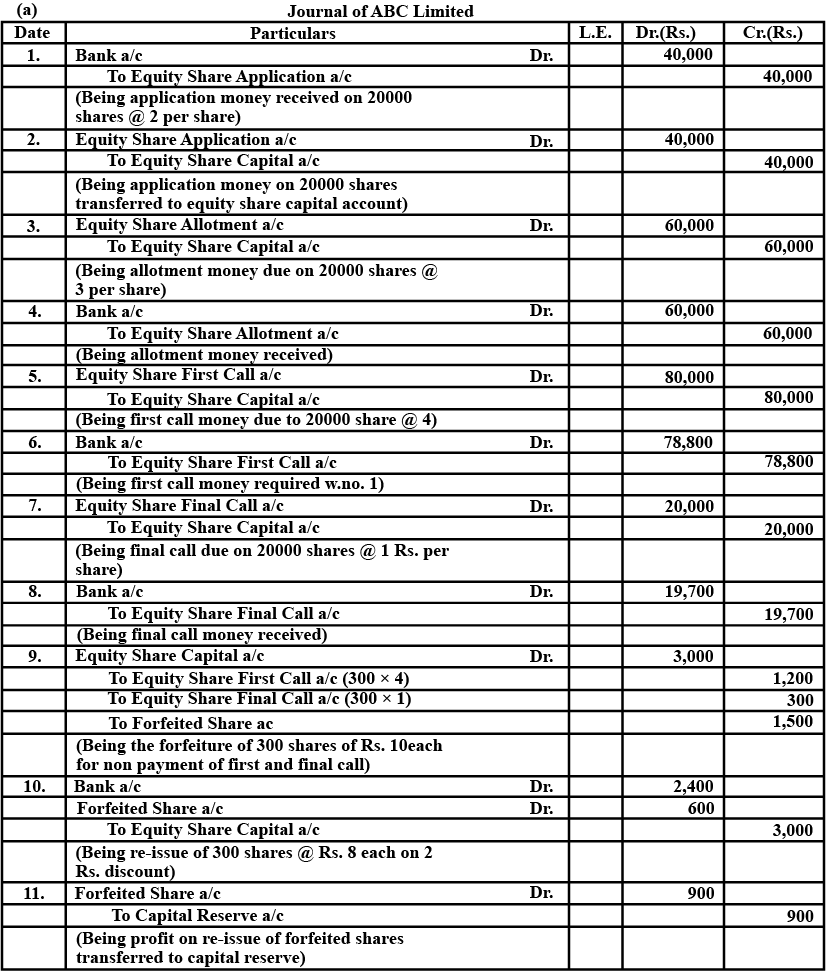

ABC Limited issued $$20,000$$ equity shares of $$Rs. 10$$ each payable as :

- $$Rs. 2 $$ per share on application

- $$Rs. 3 $$ per share on allotment

- $$Rs. 4 $$ per share on first call

- $$Rs. 1$$ per share on final call.

All the shares were subscribed. Money due on all shares was fully received except for Mr. Bird, holding $$300$$ shares, who failed to pay first call and final call money. All those $$300$$ shares were forfeited. The forfeited shares of Mr. Bird were subsequently re-issued to Mr. John as fully paid up at a discount of $$Rs. 2 $$ per share.

Pass the necessary Journal Entries to record the above transactions in the books of ABC Limited.

Is 'Reserve Capital' a part of 'Unsubscribed Capital' or 'Uncalled Capital'?

Distinguish between:

Shareholder and Debentureholder.

Satrun Ltd. was registered with an authorized capital of $$Rs. 12,00,000$$, divided into $$1,20,000$$ equity shares of $$Rs.10$$ each. It issued $$40,000$$ equity shares to the public at premium of$$ Rs.5$$ per share, payable as follows:

On application $$Rs. 6$$

On allotment $$Rs. 9$$ (including premium of $$Rs. 5$$)

All the shares were applied for and allotted. One shareholder holding $$500$$ shared did not pay the allotment money and his shares were forfeited. Out of the forfeited shares, the company reissued $$400$$ shares at $$Rs.7$$ per share fully called up.

You are required to :

(a) Pass journal entries on the book of the company.

(b) Prepare

(i) Securities Premium Reserve Account.

(ii) Share Capital Account

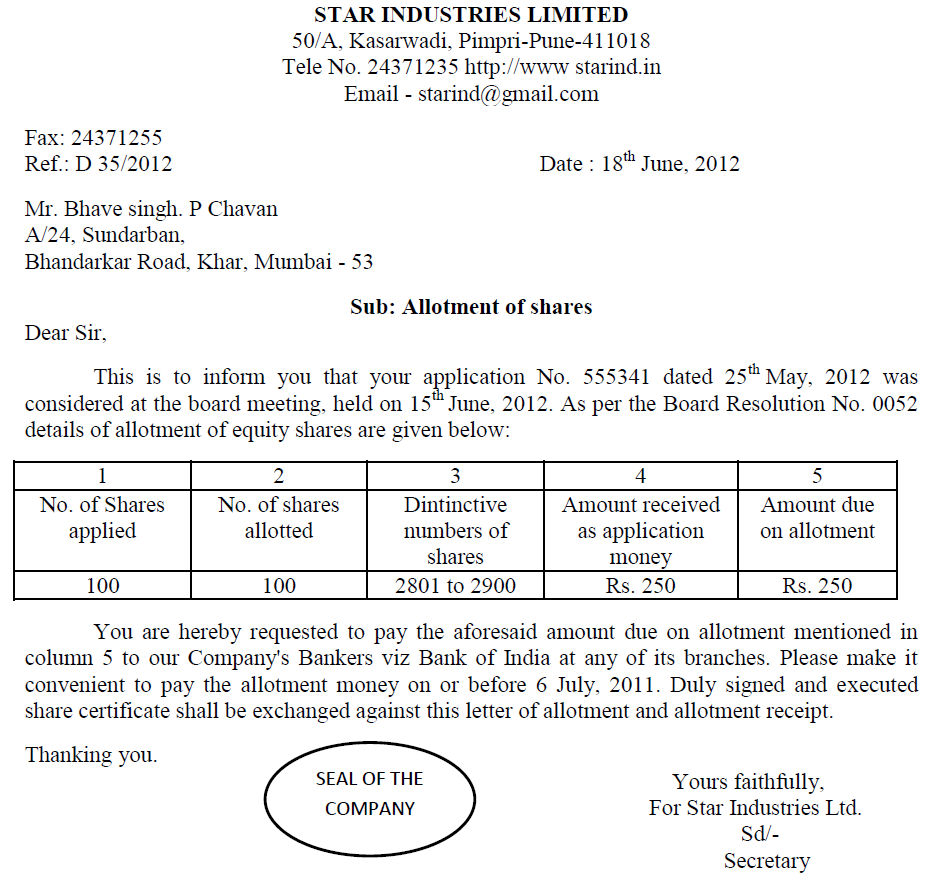

Draft a letter of the allotment of shares.

Class 12 Commerce Accountancy Extra Questions

- Accounting For Not-For-Profit Organisations Extra Questions

- Accounting For Partnership: Basic Concepts Extra Questions

- Accounting For Share Capital Extra Questions

- Accounting Ratios Extra Questions

- Analysis Of Financial Statements Extra Questions

- Cash Flow Statement Extra Questions

- Dissolution Of Partnership Firm Extra Questions

- Financial Statements Of A Company Extra Questions

- Issue And Redemption Of Debentures Extra Questions

- Reconstitution Of A Partnership Firm - Admission Of A Partner Extra Questions

- Reconstitution Of A Partnership Firm - Retirement / Death Of A Partner Extra Questions