Financial Management - Class 12 Commerce Business Studies - Extra Questions

What do you mean by capital structure?

State the steps involved in financial planning?

What is the link between operating cycle and working capital?

Name the factor due to which a petro chemical company requires much higher investment in fixed capital than an information technology company. However both may generate same amount of revenue. Explain any two factors affecting fixed capital requirement?

How does 'Trading on Equity' affect the Capital structure of a company? Explain with the help of a suitable example.

Pankaj is engaged in Warehousing-Business. Identify the working capital requirements of Pankaj stating the reason in support of your answer. Pankaj is also planning to start his Transport business.

Explain any two factors that will affect his fixed capital requirements.

Enumerate three important decisions taken in financial management?

Chandra Ltd, is a manufacturer of Laptops. It made a profit of 1000 crores. The director have proposed a dividend of 38%. As a finance manager of the company, what factors would you consider while formulating a dividend policy of the company?

"During annual general meeting of Prakash Ltd CEO, Mr. Rajnesh put the expansion plan for the coming year before shareholders and asked for suitable source of finance to finance manager. Finance manager Mr. Kant proposed issue of debentures than equity with a plan that they can be paid back whenever requirement of funds is over."

In the above paragraph, which component affecting financing decision has been highlighted? Explain the component?

Define financial management.

There are three major decisions which an organisation has to take in respect of financial management. Enumerate and explain these decisions in brief.

State the objectives of financial management.

Explain factors affecting the dividend decision.

Describe the two objectives of financial planning.

Explain the role of financial planning in corporate financial management.

Discuss about working capital? How is it calculated? Discuss five important determinants of working capital requirements.

A sound financial plan is the key to Success of sound financial management of the company.Discuss?

Financial management is based on three broad financial decision. What are these?

What is meant by working capital? How is it calculated? Discuss five important determinants of working capital requirements.

What is meant by 'Capital Structure' of a company?State any two factors which affect the capital structure of a company.

Define working capital.

You are the finance manager of a newly established company. The directors of the company have asked you to plan the capital structure of the company. State any five factors that you would consider while planning the capital structure.

Name the major determinant of dividend decision.

Explain how the (i) Cost of debt and (ii) Cost of Equity affect the choice of capital structure.

Explain factors affecting financing decision.

Explain the meaning of Financial Planning. Why is it important? Give any two reasons.

What is meant by 'financial management'?

Name the financial decision which will help a businessman in opening a new branch of its business.

State whether the working capital requirement of business manufacturing the following items are big or small. Justify your answer:-

(i) Bread (ii) Coolers

(iii) Sugar (iv) Furniture

(v) Motor Car (v) Locomotives

Explain the following factors which affect the choice structure of a company:-

(a) cash flow position (b) Tax rate.

State any two objective of financial planning.

Explain the term 'Financial Management'. Briefly explain any three of its objectives.

Harish is engaged in warehousing business and his warehouses are generally used by businessmen to store fruits. Identify the working capital requirements of Harish giving reason in support of your answer. Further Harsh wants to expand and diversify his warehousing business. Explain any two factors that will affect his capital requirements.

What is meant by 'Financial Management'? Explain any three decisions involved in financial management.

What is meant by an investment decision? Give two examples?

'Determining the overall cost of capital and financial risk of the enterprise is affected by many factors.' Explain any five such factors.

Explain how 'cost of debt' affects the choice of capital structure of a company?

Explain any four factors which affect the fixed capital requirements of company.

'Determining the relative proportion of various types of funds depends upon various factors.' Explain any five such factors.

Manish is engaged in the business of garments manufacturing. Generally, he used to sell his garments in Delhi. Identify the working of your answer. Further Manish wants to expand and diversify has garments business. Explain any two factors that will affect his fixed capital requirements.

What is meant by 'Financial Planning'? Explain any five points which highlights its importance.

Explain briefly any four factors which affect the working capital requirement of a company.

The size of assets, the profitability and competitiveness are affected by one of the financial decisions. Name and state the decision.

Rahim was working in an enterprise on daily wages basis. It was difficult for him to fulfill the basic needs of his family. His daughter fell ill. He had no money for his daughter's treatment. To meet the expenses of her treatment, he participated in a cycle race and won the prize money. The cycle company offered him a permanent pensionable job which he happily accepted.

(i) By quoting the lines from the above para identify the needs of Rahim that are satisfied by the offer of cycle company.

(ii) Also, explain two other needs of Rahim followed by above that are still to be satisfied.

Huma is working in a company on a permanent basis. As per the job agreement she had to work for 8 hours a day and was free to work overtime. Huma worked overtime, due to which she fell ill and had to take leave from her work. No one showed concern and enquired about her health. She realised that she was fulfilling only some of her needs while some other needs still remained to be fulfilled.

(i) By quoting the lines from the above pars, identify the needs of Huma which she is able to fulfil.

(ii) Also explain two other needs of Huma folloWed by the above needs, which still remained to be satisfied.

What is a Balance Sheet?

What is a Financial Instrument?

What is meant by 'Financial Risk'?

Give the meaning of 'Investment ' and 'Financing' decision of financial management.

What do you mean by Blue Chip Companies?

State the objective of 'Financial Management'.

What is meant by Diversification?

What do you mean by Break-even Point?

What is a Hedge?

What is Return on Investment (ROI)?

Define Price-Earnings Ratio.

Who is a Financial Intermediary?

Which are the two types of finance required by the business concerns? Give examples.

Match the following.

List I: (Financial institutions)

List II: (Nature of Activity)

Match the items in Column - 1 with the items in Column - II

The Debt-Equity Ratio of a company is 2:In this relation, match the following

Sika Ltd., a reputed industrial machines manufacturer, needs Rupees twenty crores as additional capital to expand the business. Mr. Amit Joshi, the Chief Executive Officer (CEO) of the company wants to raise funds through equity. The Fiance Manager, Mr. Narinder Singh, suggested that the shares may be sold to investing public through intermediaries, as the same will be less expansive.

Name the method through which the company decide to raise additional capital.

Explain briefly any four factors that affect the Working capital requirements of a company.

In the paint industry, various raw materials are mixed in different proportions with petroleum from manufacturing different kinds of paints. One specific raw material is not readily and regularly available to the paint manufacturing companies. Bonler Paints Company is also facing this problem and because of this there is a time lag between placing the order and the actual receipt of the material. But, once it receives the raw materials, it takes less time in converting it into finished goods.

Identify the factor affecting the working capital requirements of this industry.

Ramnath Ltd. is dealing in import of organic food items in bulk. The company sells the items in smaller quantities in attractive packages. Performance of the company has been up to the expectations in the past. Keeping up with the latest packaging technology, the company decided to upgrade its machinery. For this, the Finance Manager of the company. Mr. Vikrant Dhull, estimated the amount of funds required and the timings. This will help the company in linking the investment and the financing decisions on a continuous basis.

Therefore, Mr. Vikrant Dhull began with the preparation of a sales forecast for the next four years. He also collected the relevant data about the profit estimates in the coming years. By doing this, he wanted to be sure about the availability of funds from the internal sources. For the remaining funds he is trying to find out alternative sources.

Identify the financial concept discussed in the above paragraph. Also, state any two points of importance of the financial concept, so identified.

Attempt the following

What are the factors affecting requirement of fixed capital?

Explain briefly any four factors affecting the fixed capital requirements of an organisation.

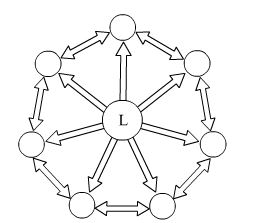

Avdhesh is the Managing Director of Delta Ltd. The company had established a good name for itself and had been doing well. It was known for timely completion of orders. The Production Manager, Ms. Priyanka was efficiently handling the processing of orders and had a team of ten motivated employees working under her. Everything was going on well. Unfortunately, Priyanka met with an accident. Avdhesh knew that in the absence of Priyanka, the company may not be able to meet the deadlines. He also knew that not meeting the deadlines may lead to customer dissatisfaction with the risk of loss of business and goodwill. So, he had a meeting with his employees in which accurate and speedy processing of orders was planned. Everybody agreed to work as team because the behaviour of Avdhesh was positive towards the employees of the organisation. Everyone put in extra time and efforts and the targets were met on time. Not only this, Avdhesh visited Priyanka and advised her to take adequate rest.

(a) Identify the leadership style of Avdhesh and draw a diagram depicting the style.

(b) Also, identify any two values highlighted by the behaviour of Avdhesh.

Distinguish between:

Fixed capital and Working capital

Answer the following question:

Explain any four features of a budget.

Why is there a need for Ratio Analysis?

State the objective of financial management.

Give two factors affecting dividend decision

Why is dividend decision called residual decision?

A Business who wants to start a manufacturing concern, approaches you to suggest him whether the following manufacturing concern would required large or small working capital:

(a) Bread (b) Coolers (c) Sugar (d) Motor car (e) Furniture manufactured against specific orders

(f) Locomotives

Give two factors affecting financing decision.

How do growth opportunities affect Dividend Decision?

There are three important decisions which an organisation has to take in respect of financial management. Enumerate and explain in brief these three decisions.

How does control of existing shareholders affect financing decisions?

What is meant by gross working capital and net working capital?

How is return on investment computed?

Give two factors affecting investment decision.

Shalini, after acquiring a degree in Hotel Management and Business Administration took over her family food processing company of manufacturing, pickles, jams and squashes. The business was established by her great grandmother and was doing reasonably well. However the fixed operating costs of the business were high and the cash flow position was weak. She wanted to undertake modernisation of the existing business to introduce the latest manufacturing processes and diversify into the market of chocolates and candies. She was very enthusiastic and approached a finance consultant, who told her that approximately Rs. 50 lakh would be required for undertaking the modernization and expansion programme. He also informed her that the stock market was going through a bullish phase.

(a) Keeping the above considerations in mind, name the source of finance Shalini should not choose for financing the modernisation and expansion of her food processing business. Give one reason in support of your answer.

(b) Explain any two other factors, apart from those stated in the above situation which Shalini should keep in mind while taking this decision.

Avik is the finance manager of Mars Ltd. In the current year the company earned high profit. However, Avik thinks that it is better to declare smaller dividend as he is unsure about the earning potential of the company in the coming years.

Avik's choice of dividend decision is based on which of the factor that affects it?

'A business that doesn't grow dies', says Mr. Shah, owner of Shah Marble Ltd. with glorious 36 months of tis grand success having a capital base of Rs. 80 crores. Within a short span of time, the company could generate cash flow which not only covered fixed cash payment obligations but also create sufficient buffer. The company is on the growth path and a new breed of consumers is eager to buy the Italian marbe sold by Shah Marble Ltd. To meet the increasing demand. Mr. Shah decided to expand his business by acquiring a mine. This required an investment of Rs. 120 crores. To seek adivice in this matter, he called his financial advisor Mr. Seth who advised him about the judicious mix of equity (40%) and Debt(60%). Mr.Seth also suggested him to take loan from a financial institution as the cost of raising funds from financial institutions is low. Though this will increase the financial risk but will also raise the return to shareholders. He also apprised him that issue of debt will not dilute the control of equity shareholders. At the same time, the interest on loan is a tad deductible expense for computation of tax liability

After due deleberations with Mr. Seth, Mr. Shah decided to raise funds from a financial institution

(a) Identify and explain the concept of Financial Management as advised by Mr. Seth in the above situation

(b) State the four factors affecting the concept as identified in part (a) above which have been discussed between Mr. Shah and Mr. Seth.

The directors of a manufacturing company are thinking of issuing Rs. 20 lacs additional debentures for expansion of their production capacity. This will lead to an increase in debt-equity ratio from $$2:1$$ to $$3:1$$. What are the risks involved in it? What factors other than risk do you think the directors should keep in view before taking the decision?

Pinnacle Ltd deals in the sale of stationary and office furniture. They source the finished products from reputed brands who give them four to six months credit. Seeing the demand for electronic items,they are also planning to market these items by opening outlets throughout India. For this, they have decided to join hands with a Japanese electronic goods manufacturer.

Identify and state any two factors that would affect the fixed capital requirement of Pinnacle Ltd as discussed above.

Sudha is an enterprising business woman who has been running a poultry farm for the past ten years. She has saved Rs. Four Lakhs for her business. She shared with her family her desire to utilize this money to expand her business. Her family members gave her different suggestions like buying new machinery to replace the existing one, acquiring altogether new equipments with latest technology, opening a new branch of the poultry farm in another city and so on. Since these decisions are crucial for her business, involve a huge amount of money and are irreversible except at a huge cost Sudha wants to analyze all aspects of the decisions, before taking any final decision

(i) Identify and explain the financial decision to be taken by Sudha

(ii) Also,explain briefly the factors that will affect this decision.

You are the finance manager of a company. The board of directors has asked you to determine the working capital requirement for the company. State the factors that you would take in consideration while determining the requirement of working capital for the company?

Saqib Ltd, is a large creditworthy company operating in the Kashmir Valley. It is an export-oriented unit, dealing in exclusive embroidered shawls. The floods in the Valley have created many problems for the company. Many craftsmen and workers have been displaced and raw materials have been destroyed. The firm is therefore, unable to get an uninterrupted supply of raw material, and the duration of the production cycle has also increased. To add to the problems of organization, the suppliers of raw material who were earlier selling on credit are asking the company, for advance payment or cash payment on delivery. The company is facing a liquidity crisis. The CEO of the company feels that taking a bank loan is the only option with the company to meet its short term shortage of cash.

As a finance manager of the company, name and explain the alternative to bank borrowing that the company can use to resolve the crisis.

How do rising prices affect the requirement of working capital of an organization?

Terry International Ltd. earned a net profit of Rs. 50 crores. Ankit, the finance manager of Terry International Ltd, wants to decide how to appropriate these profits. Identify the decision that Ankit will have to take and also discuss any five factors which help him in taking this decision.

Bharati Ltd. is a leading mobile company. It is planning to acquire Queen Ltd' (its close competitor) business worth Rs. 1000 crore. Which financial decision is involved in it? Explain it.

"Ranbaxy Ltd. has been earning handsome profits since last 15 years. Company enjoy fair goodwill in the market, so company can easily arrange debt as well as equity from the market, whenever needed. Therefore company decided to declare dividend with a hike of 15 % from last year.

Which two components affecting dividend decision have been highlighted in the above paragraph.

Dabur India has decided to increase credit limit and duration of credit to its customers to boost its sales. Name the type of decision involved.

When is financial leverage favourable?

Jai Bharat Company Ltd is an auto part supplier company in Guru Gram, Haryana. Its business is spread over several cities. The CEO of company wants to open a factory in Gujarat near Tata Motors Ltd. but due to recession for the last two years, its business is facing slow down. Company needs capital. Rakesh Gupta is CA and financial advisor of the company. He opines that during recession profit falls and investors prefer to invest in debentures to earn fixed income. Therefore, the company should issue debentures.

In this paragraph, which factor affecting financing decision has been highlighted?Explain state of capital market?

HCL Company's finance manager has decided to retain its entire profit to meet financial requirement for its growth. Name the type of decision involved.

Canara Bank wants to open a new branch of his bank. What is this decision called?

Tata sons has debt equity ratio of $$4:1$$ and Bajaj has $$1:1$$ debt equity ratio. Name the advantage, Tata sons may have over Bajaj.

'REI Agro Food Ltd. is a famous multinational company. Mr. S.K Nagi is its finance manager. He is making efforts to increase the market value of capital invested by the equity shareholders. He already kew it could be possible only when price of the share increases and price of shares increase only if financing, investment and dividend decisions are taken optimally. He did the same and achieved success.

Which objective of financial management has been referred here? Explain?

"Tax benefits is available only in case of payment of interest and not on the payment of preference dividend." Why?

In case of high fixed operating cost, company should prefer debt or equity?

Amit is running an 'Advertising Agency' and earning a lot by providing this service to bidding industries. State whether the working capital requirement of the firm will be 'less' or 'more'. Give reason in support of your answer.

'Sarah Ltd' is a company manufacturing cotton yarn. It has been consistently earning good profits for many years. This year too, it has been able to generate enough profits. There is availability of enough cash in the com[any and good prospects for growth in future. It is a well managed organisation and believes in quality, equal employment opportunities and good remuneration practices. It has many shareholders who prefer to receive a regular income from their investments

It has taken a loan of Rs. 40 lakhs from IDBI and is bound by certain restrictions on the payment of dividend according to the terms of loan agreement.

The above discussion about the company leads to various factors which decide how much of the profits should be retained and how much has to be distributed by the company.

Quoting the lines from the above discussion identify and explain any four such factor.

A company's earnings before interest and tax is Rs. 7 lakh. It pays 10% interest on its debt. Total investment of company is Rs. 50 lakh.

(a) Advise company whenever it should include debt or equity to raise its capital.

(b) Name the concept related to this.

(c) Will the company's decision to raise funds from debt or equity will change if company's EBIT becomes 3 lakh.

A decision is taken to raise money for long term capital needs of business from certain sources. What is their decision called? Explain the three factors affecting such decision.

What is another name for long term investment decision?

'S' Limited is manufacturing steel at its plant in India. It's enjoying a buoyant demand for its product as economic growth is about 7 to 8% and the demand for steel is growing. It is planning to set up a new steel plant to cash on the increased demand it is facing. It is estimated that it will require about Rs.5,000 crores to setup and about Rs. 500 crores working capital to start the new plant.

(a) What is the role and objectives of financial management for this company?

(b) What is the importance of having a financial plan for this company? Give an imaginary plan to support your answer.

(c) What are the factors which will affect the capital structure of this company?

(d) Keeping in mind that it is highly capital intensive sector. What factors will affect the fixed and working capital.

(c) What are the factors which will affect the capital structure of this company?

(d) Keeping in mind that it is highly capital intensive sector. What factors will affect the fixed and working capital.

What is favourable financial leverage?

A decision is taken to distribute certain part of profit to shareholders after paying tax. What is this decision called? Explain any three factors affecting such decisions.

Capital structure decision is essentially optimisation of risk-return relationship. Comment.

What is meant by capital structure?

What are the main objectives of financial management?Briefly explain.

Discuss the two objectives of financial planning.

Explain the term 'trading or equity'. Why, when and how can it be used by a business organisation?

What do you mean by dividend decision?

What do you mean by management of fixed capital?

Explain the link between operating cycle and working capital.

What do you mean by negative working capital?

Explain the concept of wealth maximisation as an objective of financial management.

What are the various aspects of financial planning?

Why is the dividend decision treated as residual decision?

What is meant by financial planning?

Explain the important steps of financial planning.

Explain briefly any five factors to be considered at the time of determining working capital requirement.

State why the working capital needs for a 'Service industry' are different from that of a Manufacturing industry.

A company wants to establish a new unit in which a machinery of worth Rs.10 lakh is involved. Identify the type of decision involved in financial management.

Explain the term trading on equity. Why, when and how can it be used by business organisations?

Name the concept which increases the return on equity shares with a change in the capital structure of a company.

Explain briefly factors kept in mind while planning the capital structure of a company.

Explain the meaning and nature of financial planning.

You are the finance manager of a company. The board of directors have asked you to decide the dividend policy. What factors would you keep in mind to perform this function?

Delta Cables Ltd. earned a net profit of 50 crores. Atul, the finance manager of Delta Cables Ltd. wants to decide how to appropriate these profits. Which financial decision will help him in deciding it?

How does working capital affect the liquidity of a company?

Explain the factors affecting the dividend policy of a company.

What is meant by 'Financial Planning'? State its objectives

How does 'level of competition' affect the working capital requirement of an organisation?

How does "Trading on Equity" affect the choice of capital structure of a company? Explain with the help of a suitable example.

What is the primary objective of 'Financial Management'?

State how 'Growth Prospects' affect the working capital requirements of a company?

Which type of companies can declare higher dividend?

'Financial Planning is a financial blueprint of an organisation's future operations'. Explain the twin objectives of Financial Planning in the light of this statement.

What is meant by 'Short Term Investment Decisions'?

Explain why the requirements of fixed capital for a trading concern are different from that of a manufacturing organisation.

Which component of capital structure determines the overall financial risk in an organisation?

Explain the impact of Stock Market Conditions and Regulatory frameworks on the capital structure of a company?

Explain the following factors which affect the choice of capital structure of a company?

'Financial Planning tries to link the present with the future'. Explain the importance of Financial Planning in the light of this statement?

What is meant 'Financial Planning'? State any two points of its importance.

Explain the meaning and the objective of Financial Management.

'Indian Logistics' has its own warehousing arrangements at key locations across the country. Its warehousing services help business firms to reduce their overheads, increase efficiency and cut down distribution time.

State with reason, whether the working capital requirements of 'Indian Logistics' will be high or low?

Investment decision can be long-term. Explain long term investment decision and state any two factors affecting this decision.

Name the process which helps in determining the objectives, policies, procedures, programmes and budgets to deal with the financial activities of an enterprise. Explain its three points of importance.

Explain how (i) Risk consideration and (ii) Tax Rate affect the choice of capital structure.

To avoid the problem of shortage and surplus of funds, what is required in financial management? Name the concept and explain why three points of its importance.

Name the decision a financial manager takes, keeping in view the overall objective of maximizing shareholders' wealth. Explain any two factors affecting this decision.

How do 'Choice of Technique' and 'Nature of Business' affects the 'Fixed Captial' requirements of a company? Explain.

What is meant by 'Investment Decision'? State and three factors which affect the Investment Decision.

Explain the following as factors affecting financing decision:-

(i) Cost

(ii) Cash flow position of business

(iii) Level of fixed operating cost and

(iv) Control considerations

Pranav is engaged in 'Transportation-Business'. Identify the working capital requirements of Pranav stating the reason in support of your answer. Pranav also wants to expand and diversify his Trasport-Business. Explain any two factors that will affect these fixed capital requirements.

Explain any four factors which affect the 'Working Capital' requirements of a company.

Give the other name of Long-term Investment Decision and state any three factors which affect this decision?

What is meant by Financial Planning? State any three points of its importance.

What is meant by 'Long-term Investment Decision'?State any three factors which affect the long term investment decisions.

Explain any four factors which affect the 'Dividend Decision' of a company.

What is meant by Dividend decision? State any four factors affecting the Dividend decision.

"Sound Financial Planning' is essential for the success of any business enterprise." Explain this statement by giving any six reasons.

Neelabh is engaged in 'Transport Business' and transports fruits and vegetables to different states. Staring the reason in support of your answer, identify the working capital requirements of Neelabh. Neelabh also wants to expand and diversify his transport business. Explain any two factors that will affect his fixed capital requirements.

Identify the financial decision which determines the amount of profit earned to be distributed and to be retained in the business. Explain any four factors affecting this decision.

What is mean by 'Capital Structure'? State any four factors affecting the choice of capital structure.

What is working capital?Explain any four factors affecting the working capital requirements.

Identify the decision taken in financial management which affects the liquidity as well as the profitability of business.

What is meant by 'Financing decision'? State any four factors affecting the financing decision.

Explain any four factors which affect the fixed capital requirements of a business?

You are the Financial Manager of a newly established company. The Directors have asked you to determine the amount of working capital requirement for the company. Explain any four factors that you will consider while determining the working capital requirement for the company.

How does 'cost of equity' affect the choice of capital structure of a company? Explain.

'Bharat Express' specialises in courier services. Its 'wide range of express package and parcel services' help business firms to make sure that the good are made available to the customer at the right time.

State with reason, whether the working capital requirements of 'Bharat Express' will be high or low

Explain the following factors affecting working capital requirements:-

(i) Level of competition

(ii) Seasonal factors

(iii) Production cycles.

Explain briefly any four factors which affect the choice of capital structure of a company.

Abhishek Ltd'. is manufacturing cotton clothes. It has been consistently earning good profits for many years. This year too, it has been able to generate enough profits. There is availability of enough cash in the company and good prospects for growth in future. It is a well managed oranisation and believes in quality, equal employment opportunities and good remuneration practices. It has many shareholders who prefer to receive a regular income from their investments.

It has taken a loan of Rs 50 lakhs from I.C.I.C.I. Bank and is bound by certain restrictions on the payment of dividend according to the terms of the loan agreement.

The above discussion about the company leads to various factors which decide how much of the profits should retained and how much has to be distributed by the company.

Quoting the lines from the above discussion, identify and explain any four such factors.

You are the Financial Manager of a newly established company. The Directors have asked you to determine the amount of Fixed capital requirement for the company. Explain any four factors that you will consider while determining the Fixed capital requirement for the company?

What is meant by 'Dividend Decision'? Explain any four factors which affect the dividend decision of the company.

Explain the following factors affecting working capital requirements:-

(i) Business cycles

(ii) Operating efficiency

(iii) Inflation.

Explain briefly any four factors which affect the fixed capital requirement of a company?

Answer the following question in $$2$$ or $$3$$ sentences.

Write the meaning of dividend decisions.

Answer the following question in a word or a sentence.

What is business finance?

Answer the following question in $$15$$ to $$20$$ sentences.

Explain any five factors, which may influence the amount of fixed capital requirements in business.

Answer the following question in $$15$$ to $$20$$ sentences.

Explain any five objectives of financial management.

Distinguish between of the Fixed and Working Capital.

Write notes on Capital structure and its components.

Answer the following question in $$2$$ or $$3$$ sentences.

Give the meaning of financing decisions.

Answer the following question in $$20$$ to $$30$$ sentences.

Describe objectives of financial management.

Answer the following question in $$2$$ or $$3$$ sentences.

State any two types of financial decisions.

List few aspects of business affected by financial management decisions.

Answer the following question in $$10$$ to $$12$$ sentences.

Explain any four factors affecting financial decision.

Answer the following question.

As a financial consultant, give the list of any $$10$$ factors which affect the choice of capital structure.

What is the aim of Financial Management?

Match the correct pairs of words from group 'A' and group 'B':

What is the meaning of Business Finance?

What is the importance of Financial Management in Business?

'G. Motors is the manufacturer of sophisticated cranes. The Production manager of the company, reported to the Chief Executive Officer, Ashish Jain that one of the machines used in manufacturing sophisticated cranes had to be replaced to compete in the market, as other competitors were using automatic machines for manufacturing cranes. After a detailed analysis, it was decided to purchase a new automatic machine having the latest technology. It was also decided to finance this machine through long term sources of finance. Ashish Jain compared various machines and decided to invest in the machine which would yield the maximum returns to its investors.

(a) Identify the financial decision taken by Ashish Jain.

(b) Explain any three factors affecting the decision identified in (a) above.

What is meaning and role of Financial Management?

What is dividend?

How do you calculate Capital Structure?

What do you mean by Investment Decision?

Write difference between Debt and Equity.

What do you mean by financing decisions?

What are the major issues in financial management?

Why Investment decision is important?

Define capital structure.

What kinds of financial decisions are taken in financial management?

What are the factors affecting financing decisions?

Define Financial Leverage.

Define trading on equity.

Define yield.

Define Fixed Capital.

Name the concept of financial management which increases the return to equity shareholders due to the presence of fixed financial charges.

What do you mean by fixed capital requirement?

What do you mean by working capital requirement?

What does the term business finance mean?

Write notes on the following :

Legal provision regarding unclaimed/ unpaid dividend.

Rizul Bhattacharya after leaving his job wanted to start a Private Limited Company with his son. His son was keen that the company may start manufacturing of Mobile phones with some unique features. Rizul Bhattacharya felt that the mobile phones are prone to quick obsolescence and a heavy fixed capital investment would be required regularly in this business. Therefore he convinced his son to start a furniture business.

Identify the factor affecting fixed capital requirements which made Rizul Bhattacharya to choose furniture business over mobile phones.

Name and state the aspect of financial management that enables to foresee the fund requirements both in terms of 'the quantum' and 'the timings'.

The Return on Investment (ROI) of a company ranges between $$10-12\%$$ for the past three years. To finance its future fixed capital needs, it has the following options for borrowing debt:

Option 'A': Rate of interest $$9\%$$

Option 'B': Rate of interest $$13\%$$

Which source of debt, 'Option A' or 'Option B', is better? Give reason in support of your answer. Also state the concept being used in taking the decision.

Class 12 Commerce Business Studies Extra Questions

- Business Environment Extra Questions

- Consumer Protection Extra Questions

- Controlling Extra Questions

- Directing Extra Questions

- Financial Management Extra Questions

- Financial Market Extra Questions

- Marketing Extra Questions

- Nature And Significance Of Management Extra Questions

- Organising Extra Questions

- Planning Extra Questions

- Principles Of Management Extra Questions

- Staffing Extra Questions