Financial Market - Class 12 Commerce Business Studies - Extra Questions

Name the Apex statutory body of capital market to whom customer can complain to redress their grievances.

Mohan wants to sell $$50$$ shares of Tata Motors. Explain the trading procedure of shares.

Identify the market highlighted in following statement.

This market directly contributes to capital market.

Bandhu Limited is a real estate company, which was formed in $$1960$$. In about $$55$$ years of its existence, the company has managed to carve out a niche for itself in this sector. In order to establish itself in India, the company decided to list its securities on BSE, in order to raise money through India market.

State the functions performed by SEBI that make investors comfortable and secured in dealing with Bandhu Ltd.

Bhuvan got a chance to buy shares in the ratio of $$1:1$$ from ABC company. What is this type of issue called? Explain any other two ways of issue share under primary market.

"Stock market quotations contribute to better allocation of capital and promoting the habits of savings and investments". Explain.

What functions does financial market perform?

What is Badla?

Who is the borrower of call money?

Who provides protection and guidelines to the investors?

Explain the term "Water the equity".

What are the regulations of SEBI that company must comply with?

What do you mean by penny stock?

"Money market instruments are more safe than capital market instruments". Comment.

What do you mean by treasury bills?

Shares are given in the ratio of 1:1 What is this type of issue?

Describe SEBI.

Explain any two instruments used in money market.

In today's commercial world stock exchange performs vital role. Do you agree? Give reason to support your answer.

Outline the major instruments of money market.

Give the meaning of 'Secondary Market'.

Given the meaning of allocated function of financial market. State the consequences of the function.

What is meant by SEBI? Briefly explain its objectives.

State any three 'protective functions' of securities and exchange Board of India.

Nature of 'capital market' can be well explained with the help of its features. State any three such features of capital market.

Nature of money market can be well explained with the help of its features. State any three such features of money market.

State any five methods of floating new issues in the Primary Market?

Why was Securities and Exchange Board of India(SEBI) set up?Explain any four objectives of SEBI.

'To promote orderly and healthy growth of securities market and protection of investors, Securities and Exchange Board of India was set up.' With reference to this statement explain the objectives of Securities and Exchange Board of India.

State any five regulatory functions of Securities and Exchange Board of India?

What is meant by 'Money Market'?Explain any two instruments used in Money Market.

State any five functions of 'Stock Exchange'?

What is meant by 'Stock Exchange'?Explain briefly any three of its functions.

What is meant by 'Primary Market'?Explain any two methods of floating new issues in the Primary Market.

List the functions of a Stock Exchange and explain any two.

'In today's commercial world, the Stock Exchange performs many vital functions which lead the investors towards positive environment'.Explain how by giving any four reasons.

What is meant by 'Primary Market'? Differentiate between 'Primary Market' and 'Secondary Market' on any four points.

Explain Commercial Paper?

Explain the following as factors affecting the choice of capital structure:

(i)Cash flow position

(ii)Cost of equity

(iii)Floatation costs

(iv)Stock-market conditions

Explain the following money market instrument "Call money".

Identify the method of flotation adopted by the company.

'Stock Exchange not only contributes to the economic growth, but performs many other functions'. Explain any three such functions.

How stock market reaction effect dividend decision?

How access to capital market effect dividend decision?

Name the financial market used for raising working capital.Explain instruments of that market?

Identify the type of financial market through which the company is planning to raise fund.

Define money market.

State any four functions of 'Stock Exchange.'

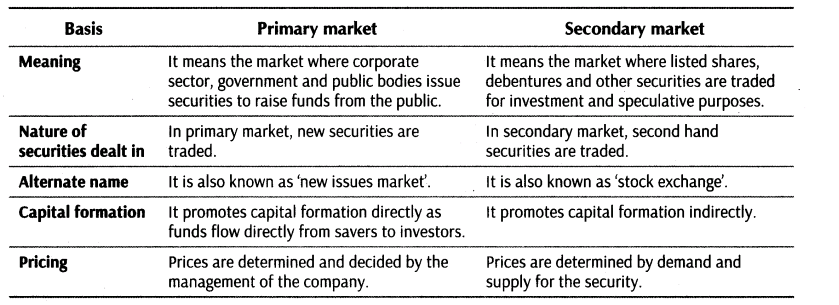

Distinguish between the following

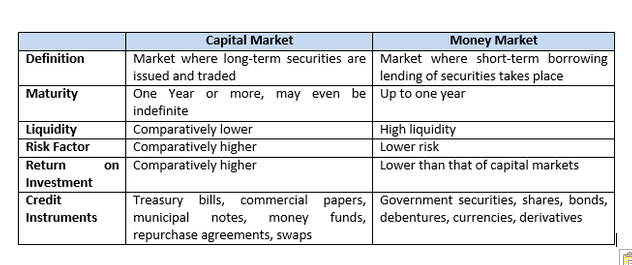

Money market and Capital market.

Distinguish between the following:

Primary market and secondary Market

What are the major alternatives for funds allocation?

Distinguish between

Money market and Capital market

Define financial markets.

Name the committees worked under SEBI.

What is a Limit Order?

What are the types of Capital Market?

Define depository participant (DP).

What is Internet Trading?

What is Market Capitalisation?

Define capital market.

What are medium-term public deposits and what are their advantages to public deposits?

What do you mean by Money market and how is it different from capital market?

Explain in brief the part played by stock exchange in Financial matters of business.

What are money markets? How are they different from capital markets?

Fill in the blanks with appropriate words.

The sole objective of business should be earning _________ profit.

Answer the following questions:

What are the important functions of stock exchanges?

Match the items of Column - I with the items in Column II and suggest the correct code

What is meant by 'Capital Structure'?

These days, the development of a country is also judged by its system of transferring finance from the sector where it is in surplus to the sector where it is needed the most. To give strength to the economy, SEBI is undertaking measures to develop the capital market. In addition to this, there is another market in which unsecured and short-term debt instruments are actively traded everyday. These markets together help the savers and investors in directing the available funds into their most productive investment opportunity.

(a) Name the function being performed by the market in the above case.

(b) Name the market segment other than the capital market segment in which unsecured and short-term debt instruments are traded. Also, give any three points of difference between the two.

An investor wanted to invest Rs. $$20,000$$ in Treasury Bills for a period of $$91$$ days. When he approached the Reserve Bank of India for this purpose he came to know that it was not possible.

Identify the reason why the investor could not invest in the Treasury Bill.

Write only a word or a phrase or a term which can substitute the following statement.

Name the form of electronic currency that exits only in cyberspace.

Discuss any five features of developing economy.

What is the OTCEI?

Match list 1 with list 2.

Answer briefly:

Define Management as a process.

Name the market where companies issue new securities.

In secondary market sale of securities takes place between investors only, then how does this market contribute for capital formation?

'Money market instruments are more liquid than capital market instruments'. Comment.

Name the two segments of capital market.

What is meant by capital market?

How many regional stock exchanges are there in India? Name the oldest one.

Enumerate the objectives of SEBI.

Which money market security is also known as zero coupon bond?

Explain any four functions of financial market.

'SEBI is the watch dog of security market.' Comment.

Identify the step of trading procedure in a stock exchange which has not been followed by 'Unicon securities Pvt. Ltd.'.

ABC Ltd. issued prospectus for the subscription of its shares for Rs. $$500$$ crores in $$2008$$. The issue was oversubscribed by $$20$$ times. The company issued shares to all the applicants on pro-rata basis. Later SEBI inspected the prospectus and found some misleading statement about the management of the company in it. SEBI imposed a penalty of Rs. $$5$$ crores and banned its three executive directors for dealing in securities market for three years. Identify the function and its type performed by SEBI in the given case.

Sudha Ltd. has sold $$1$$ lakh equity shares of Rs. $$10$$ each at Rs. $$12$$ per share to an investment banker, who offered them to the public at Rs. $$20$$ each. Identify the method of flotation.

Identify and state the process.

Write two values not followed by Unicon Securities Pvt. Ltd.

Name the financial instrument which may be used in the following situation.It is used by one bank having surplus funds to meet the funds requirements of another bank facing shortage of funds.

Name the authority which regulates such behaviour. Write any three other functions of this authority.

Name the financial instrument which may be used in the following situation.

A company needs funds to meet flotation cost in order to issue equity shares in the market.

Identify type of malpractice used by Charu.

Besides the shares issue method, mention two other methods.

Name the financial instrument which may be used in the following situation.

The instrument that is issued during the period of tight liquidity when the deposit growth of bank is slow but demand for credit is high.

Name the financial instrument which may be used in the following situation.

These are also known as zero coupon bonds and are issued by RBI on the behalf of central government.

How does SEBI prohibit such practices?

Dinesh has $$100$$ equity shares of a company. He wants to sell $$500$$ of these shares. Which market should he approach? Write any three advantages of selling through such a market.

Identify the market highlighted in following statement.

This market deals in instrument whose maturity is upto one year.

Identify the market highlighted in following statement.

It deals in medium and long term securities.

Identify the market highlighted in following statement.

It is also known as Stock Exchange and deals in sale and purchase of previously issued securities.

Identify the market highlighted in following statement.

It requires less investment as value of securities is generally low.

Why are money market Instruments are more liquid a compared to capital market instruments?

What do you mean by a stock index? How is it calculated?

Who determines the prices of new IPO?

What is the minimum amount of treasury bill?

How is the price of securities determined in the secondary market?

How does the SEBI exercise control over 'R' limited in the interest of investors?

What is REPO rate? How can it result in lowering the rate of interest on loans?

What factors effect the movement of stock indices? Elaborate on the nature of these factors.

What conclusions can you draw from the various movements of NSE stock indices?

State the functions of stock exchange used in given paragraph.

Name and explain the money-market instrument the company can use for the given purpose.

Name the concept which separate the ownership and control of stock exchange.

State the instruments to raise finance in that market.

What relationship do you see between the movement of indices in World Market and NSE indices?

Name the body set up by the government of India to contract the stock exchange.

Suggest which financial market company may approach and why?

What is the duration for which the company can get funds through this instrument?

What are the functions of financial markets?

Explain the objectives and functions of SEBI.

What are the functions of Stock Exchange?

"Money market is essentially market for short term funds". Discuss.

Explain the various money market instruments.

What are the objectives of SEBI?

Explain the capital market reforms in India.

What is REPO and reverse REPO?

Distinguish between capital market and money market.

What are the methods of flotation in Primary Market?

What is treasury bill?

Define new issue market.

"Money market instruments are more liquid than capital market instruments". Comment.

Give any three features of capital market.

Describe insider trading.

What do you mean by financial market?

What are the features of capital market instruments?

State the role of SEBI in regulating the capital market.

Describe price rigging.

Enumerate two segments of financial market.

Describe money market.

The Directors of a Company want to modernise its plants and machinery by making a public issue of shares. They wish to approach stock exchange. While the finance manager prefers to approach a consultant for the new public issue of shares. Advise the directors whether to approach stock exchange or consultant for the new public issue of shares and why? Also advise about the different methods which the company may adopt for the new public issue of shares.

Explain features of money market instruments.

Distinguish between primary and secondary market.

What is meant by 'Capital market'?

Why is SEBI called the watchdog of stock exchange?

State any one 'Development function' of Securities and Exchange Board of India.

What are the protective functions of SEBI?

What do you mean by listing of securities? How are listed securities traded in the stock exchange market?

What is meant by Primary market? Briefly explain the concept of initial public offer.

What are the regulatory functions of SEBI?

Give the meaning of 'Financial Market'.

Give the meaning of 'Money Market'.

Name the two major alternative mechanisms through which allocation of funds can be done.

What is meant by 'Financial Market'?

What is meant by a 'Commercial Paper'?

Explain the following money market instrument "Treasury Bill".

State any one 'Protective Function' of Securities and Exchange Board of India.

State the essential function of 'primary market'.

State any one consequence of a well performed 'allocated function' of a Financial market.

Give the meaning of 'Capital Market'.

Distinguish between 'Capital Market' and 'Money Market' on the following bases:

(i) Duration of securities traded

(ii) Participates

(iii) Instruments traded

(iv) Safety

(v) Expected return.

'Financial market plays an important role in the allocation of scarce resources is an economy by performing many important functions.' Explain any three such functions.

Explain the following money market instrument "Commercial Bill".

Explain any three developmental functions of SEBI.

Explain any three functions of 'Stock Exchange'?

Give the meaning of both the segments of Financial market.

Explain 'Treasury Bill' and 'Call Money' as money market instruments.

Give the meaning of both parts of Capital Market.

What is meant by 'Capital Market'? Name the two segments of Capital Market.

Explain any four methods of flotation of new issue in the 'Primary Market'.

Distinguish between 'Capital Market' and 'Money Market' on the basis of:

(i) Liquidity

(ii) Investment outlays

(iii) Participants

(iv) Safety

(v) Instruments.

Explain any four functions of stock exchange?

Explain the following money market instrument " Certificate of deposit".

How does nature of Business affect the requirement of fixed and working capital?

Explain the following money market instrument "Commercial paper".

What is meant by 'Capital Market'? Differentiate between 'Capital Market' and 'Money Market' on any four bases.

How conditions in financial market influence capital structure decision? Explain any other two factors.

State the segment of financial market for fixed capital.

Explain Certificate of Deposit as Money Market Instruments?

Name the financial market used for raising fixed capital.

Identify the value being emphasized by the Company's Act in placing certain restrictions.

'Mission Coach Ltd.' is a large and creditworthy company manufacturing coaches for Indian Railways. It now wants to export these coaches to other countries and decides to invest in new hi-tech machines. Since the investment is large, it requires long-term finance. It decides to raise funds by issuing equity shares. The issue of equity shares involves a huge flotation cost. To meet the expenses of the flotation cost, the company decides to tap the money market.

(a) Name and explain the money-market instrument the company can use for the above purpose.

(b) What is the duration for which the company can get funds through this instrument?

(c) State any other purpose for which this instrument can be used.

State the value emphasize in given para.

What is meant by Primary Industry?

State the segment of financial market for working capital.

State the three important decisions mentioned in given para also quote the lines for each decision.

Answer the following question in $$15$$ to $$20$$ sentences.

State any five features of stock exchange.

Answer the following question in $$10$$ to $$12$$ sentences.

State any four differences between capital market and money market.

Answer the following question in $$20$$ to $$30$$ sentences.

State the functions of SEBI.

Write a word/term/phare which can substitute the following statements:

An institution which controls and regulates activities of the stock exchange.

Answer the following question in $$15$$ to $$20$$ sentences.

Distinguish between money market and capital market.

Answer the following question in $$20$$ to $$25$$ sentences.

What is stock exchange? Explain the functions of stock exchange.

Answer the following question in a sentence or a word.

Expand "SEBI".

Answer the following question in a sentence or a word.

Expand NSEI.

What is the purpose and role of SEBI?

This market helps to save time, effort and money that both buyers and sellers of a financial asset would have to otherwise spend to try and find each other.

Name the market and identify the function being referred to.

List the market segments of NSE.

One of the functions of Securities and Exchange Board of India is

Promotion of fair practices and code of conduct in securities market. State the category to which this function belongs and state any two other functions of this category.

'Foods India Ltd. is a company engaged in the production of packaged juice since $$2010$$. Over this period, a large number of competitors have entered the market and are putting a tough challenge to Foods India Ltd.. To face this challenge and to increase its market share, the company has decided to replace the old machinery with an estimated cost of $$Rs.100$$ crores. To raise the finance, the company decided to issue $$9\%$$ debentures. The Finance department of the company has estimated that the cost of issuing the $$9\%$$ debentures will be $$Rs. 10,00,000$$. The company wants to meet its floatation cost.

(a) Explain the instrument that the company may issue for this purpose.

(b) In which type of financial market, is the instrument explained in (a) above traded ? Also explain how safe the instruments are in this market.

Write a short note on the following topic- Sensex.

Answer the following question:

Explain any five examples of credit instruments of money market.

State the functions performed by financial market.

Mr. Vikas Mehra was the Chairman of 'IBM Bank'. The Bank was earning good profits. Shareholders were happy as the bank was paying regular dividends. The market price of their shares was also steadily rising. The bank was about to announce the taking over of 'UK Bank'. Mr. Vikas Mehra knew that the sharp price of 'IBM Bank' would rise on this announcement. Being a part of the Bank, he was not allowed to buy shares of the bank. He called one of his rich friends Mukand and asked him to invest Rs. 4 crores in shares of his bank promising him the capital gains.

As expected after the announcement, the share prices went up by 50% and the market price of Mukand's shares was now Rs. 6 crores. Mukand earned a profit of Rs. 2 crores. He gave Rs.1 crore to Vikas Mehra and kept Rs. 1 crore with him. On regular inspection and by conducting enquiries of the brokers involved, Securities and Exchange Board of India (SEBI) was able to detect this irregularity. SEBI imposed a heavy penalty on Vikas Mehra.

Quoting the lines from the above para identify and state any two functions performed by SEBI in the above case.

Class 12 Commerce Business Studies Extra Questions

- Business Environment Extra Questions

- Consumer Protection Extra Questions

- Controlling Extra Questions

- Directing Extra Questions

- Financial Management Extra Questions

- Financial Market Extra Questions

- Marketing Extra Questions

- Nature And Significance Of Management Extra Questions

- Organising Extra Questions

- Planning Extra Questions

- Principles Of Management Extra Questions

- Staffing Extra Questions