Reconstitution Of A Partnership Firm - Admission Of A Partner - Class 12 Commerce Accountancy - Extra Questions

Give any two features of Goodwill.

Give three items that may appear on the debit side of the Partner's Current Account

What is meant by Capitalisation of Average Profit?

Enumerate two steps involved in valuing Goodwill according to Super Profit Method.

Give the formula for calculation Goodwill by 'Capitalisation of Super Profit Method'.

Goodwill is to be valued at three year's of average profit. Profit for past four years ending on $$31^{st}$$March of the firm were:

$$2015-Rs 12,000; 2016 -Rs 18,000; 2017 - Rs 16,000; 2018 - Rs 14,000$$

Calculate amount of Goodwill.

What is meant by Average Profit?

Give the formula for calculation Goodwill by 'Capitalisation of Average Profit'.

How is new partner admitted to the firm?

Does the change in profit-sharing ratio result into dissolution of partnership firm? Give reason in support of your answer.

Gupta and Bose had a firm in which they had invested Rs. $$50,000$$. On a average, the profits were Rs. $$16,000$$. The normal rate in the industry is $$15%$$. Goodwill is to be valued at four years purchase of profits in excess of profits @$$15%$$ on the money invested. Find the value of the goodwill.

$$A$$ and $$B$$ are partners sharing profits profits in the ratio of $$3:2$$. They decided to admit $$C$$ as a partner from $$1^{st}$$ April, 2018 on the following terms:

(i) $$C$$ will be given $$2/5^{th}$$ share of the profit.

(ii) Goodwill of the firm will be valued at two years purchase of three years normal average profit of the firm.

Profit of the previous three years ended $$31^{st}$$ March, were:

2018---Profit Rs.$$30,000$$(after debiting loss of stock by fire Rs. $$40,000$$)

2017---Loss Rs. $$80,000$$ (includes voluntary retirement compensation paid Rs. $$1,10,000$$).

2016---Profit Rs.$$1,10,000$$ (including a gain (profit) of Rs. $$30,000$$ on the sale of fixed assets).

you are required to value the goodwill.

State two main rights that a newly admitted partner acquires in the firm.

$$X, Y$$ and $$Z$$ are partners sharing profits and losses in the ratio of $$5:3:2$$. They admit $$A$$ into partnership and give him $$1/5^{th}$$ share profits. Find the new profit ratio.

Durga and Naresh were partners in a firm. They wanted to admit five more members in the firm. List any two categories of individuals other than minors who cannot be admitted by them.

Kavi, Ravi, Kumar and Guru were partners in a firm sharing profits in the ratio of $$3 : 2: 2: 1$$. On. 1/2/2017, Guru retired and the new profit sharing ratio decided between Kavi, Ravi and Kumar was $$3: 1: 1$$. On Guru's retirement the goodwill of the firm was valued at $$Rs.3,60,000$$. Showing your working notes clearly, pass necessary journal entry in the books of the firm for the treatment of goodwill on Guru's retirement.

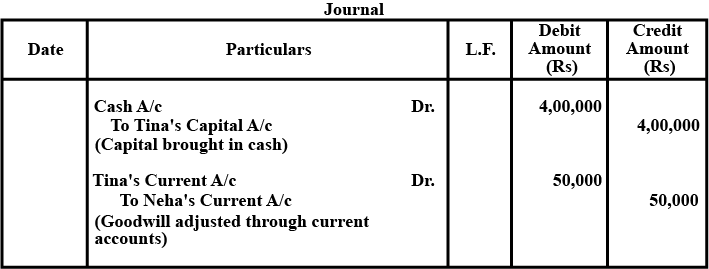

Madhu and Neha were partners in a firm sharing profits and losses in the ratio of $$3 : 5$$. Their fixed capitals were $$Rs. 4,00,000$$ and $$Rs. 6,00,000$$ respectively. On 1/1/2016, Tina was admitted as a new partner for $$\dfrac{1}{4}^{th}$$ share in the profits. Tina acquired her share of profit from Neha. Tina brought $$Rs. 4,00,000$$ as her capital which was to be kept fixed like the capitals of Madhu and Neha. Calculate the goodwill of the firm on Tina's admission and the new profit sharing ratio of Madhu, Neha and Tina. Also, pass necessary journal entry for the treatment of goodwill on Tina's admisson considering that Tina did not bring her share of goodwill premium in cash

Neetu, Meentu and Teetu were partners in a firm. On 1st January, 2018, Meetu retired. On Meetu's retirement the goodwill of the firm was valued at Rs. $$4,20,000$$.

Pass necessary journal entry for the treatment of goodwill on Meetu's retirement.

X, a resident in India and Y a resident In Pakistan are partners., The firm is carrying on the business of importing and exporting Commodity I and Commodity II. State whether the firm is. dissolved in each of the following, alternative cases:

Case (a): If a war breaks out between India and Pakistan.

Case (b): If a law is passed by which imports and exports of Commodity I are prohibited;

Case (C): If a law is passed by which import and export of Commodities I and II are prohibited.

X paid Y and Z a premium of Rs. 20,000 on entering into partnership for 10 year and the firm is dissolved at the end of 8 years. State Whether X is entitled to repayment of proportionate premium in each of the following alternative cases:

Case (a) If the dissolution is due to the death of Y

Case (b): If the dissolution is due to X s own misconduct

Case (C): If the dissolution is in pursuance of an agreement which contains no provision for return of the premium

Case (d): If the dissolution is due to Y's misconduct.

Case (e): If the dissolution is due to the insolvency of Y.

(When one of the Remaining Partners also sacrifices in addition to the Retiring Partner). X,Y and Z were partners sharing profits in the ratio of 3:2:Z retired and the new profit-sharing ratio between X and Y was 1:On Z's retirement, goodwill of the firm was valued at RS.30,Pass necessary Journal entries for the treatment of goodwill on Z's retirement without opening the Goodwill Account.

$$A, B$$ and $$C$$ are partners in a firm. They do not have a Partnership Deed. At the end of the first year of the commencement of the firm, they have faced the following problems:

$$C$$ wants that the loan given by him to the firm should bear interest $$@ 10\% p.a$$. but $$A$$ and $$B$$ do not agree.

State how you will settle these disputes if the partners approach you for the purpose.

Does a partner has right not to allow admission of a new partner, if the Partnership Deed does not exist?

$$X$$ and $$Y$$ are partners. $$Y$$ wants to admit his son $$K$$ into business. Can $$K$$ become the partner of the firm? Give reason.

Suraj and Dilip are partners in firm dealing in stationary items. The firm is well managed and enjoys the advantage of being cost effective. It buys stationery items at resonable cost from Dilip's relative who is a manufacturer of stationary items. The firm's sale outlet is situated near a school. As a result, the firm has a steady demand of stationary items and is earning good profits. the firm is donating $$10\%$$ of its profit to the nearby school for the education of the students of below poverty line. State any two factors affecting the value of goodwill of the firm.

Name any two factors which affect the Goodwill of a partnership firm.

What are 'Super Profits'?

What is meant by Super Profit?

The profit for the years ending on $$31^{st}$$March are as follows:

Year $$2014-Rs. 4,00,000; 2015 - Rs. 3,98,000; 2016 - Rs. 4,50,000; 2017 - Rs. 4,45,000$$ and $$2017 - Rs. 5,00,000$$

Calculate goodwill of the firm on the basis of $$4$$ years purchase of $$5$$ years average profit.

Kamal and Kapil are partners having fixed capitals of $$Rs. 5,00,000$$ each as on 31st March,Kamal introduced further captial of $$Rs. 1,00,000$$ on 1st October, 2017 whereas Kapil withdrew $$Rs.1,00,000$$; on 1st October, 2017 out of capital.

Interest on capital is to be allowed @ 10% p.a.

The firm earned net profit of $$Rs.6,00,000$$ for the year ended 31st March,

Pass the Journal entry for interest on capital and prepare Profit and Loss Appropriation Account.

Calculate the goodwill of firm on the basis of years purchase of the weighted average profit of the last four year. The appropriate weight to be used and profits are:

| Year | 2014-15 | 2015-16 | 2016-17 | 2017-18 |

| Profit(Rs) | $$1,01,000$$ | $$1,24,000$$ | $$1,00,000$$ | $$1,40,000$$ |

| Weight | $$1$$ | $$2$$ | $$3$$ | $$4$$ |

(i) On $$1^{st}$$December,2016 a major repair was made in respect of the plant incurring Rs. $$30,000$$ which was charged to revenue. The said sum is agreed to be capitalised for calculation subject to adjustment of depreciation of $$10\%$$ p.a. on reducing balance method.

(ii) The closing stock for the year 2015-16 was overvalued by Rs. $$12,000$$

(iii) To cover management cost, an annual charge of Rs. $$24,000$$ should be made for the purpose of goodwill valuation.

(iv) On $$1^{st}$$April, 2015, a machine having a book value of Rs. $$10,000$$ was sold for Rs. $$11,000$$ but the proceeds were wrongly credited to Profit & Loss. Account. No affect has been given to rectify the same. Depreciation is charged on machine @$$10\%$$ p.a. on reducing balance method.

$$X$$ and $$Y$$ are partners sharing profit and losses in the ratio $$3:2$$. They admit $$Z$$ into partnership for $$1/4^{th}$$ share in goodwill. $$Z$$ brings in his goodwill in cash. Goodwill for this purpose is to be calculated at two years purchase of the average normal profit of past three years. Profit of the last three years ended $$31^{st}$$March, were:

2016--Profit Rs.$$50,000$$(including profit on sale of asset Rs. $$5,000$$)

2017--Loss rs.$$20,000$$ (including loss by fire Rs.$$30,000$$).

2018--Profit Rs.$$70,000$$(including insurance claim received rs. $$18,000$$ and interest on investment and Dividend receive Rs. $$8,000$$).

Calculate value of goodwill. Also, calculate goodwill brought in by $$Z$$.

What do you understand by Reconstitution of a Partnership Firm?

The total capital of the firm of Sakshi, Mehak and Megha is Rs. $$1,00,000$$ and the market rate of interest is $$15%$$. The net profits for the last $$3$$ years were Rs. $$30,000, Rs. 36,000$$ and $$Rs. 42,000$$. Goodwill is to be be valued at $$2$$ years purchase of the last $$3$$ years super. Calculate the goodwill of the firm.

$$A$$ and $$B$$ partners in a firm sharing profits and losses in the ratio of $$2:1$$. They decide to take $$C$$ into partnership for $$1/4^{th}$$ share on $$1^{st}$$ April,For this purpose, goodwill is to be valued at four times the average annual profit of the previous four or five years whichever is higher. The agreed profit for goodwill purpose of the past five years are:

| Year | 2013-14 | 2014-15 | 2015-16 | 2016-17 | 2017-18 |

| Profit(Rs.) | 14,000 | 15,500 | 10,000 | 16,000 | 15,000 |

Change in profit-sharing ratios amounts to dissolution of the partnership or partnership Firm. Give reason.

State any two occasions on which a firm can be reconstituted.

Why is revaluation of assets on reconstitution of partnership necessary?

Capital of the firm of Sharma and Verma is Rs. $$2,00,000$$ and the market rate of interest is $$15%$$. Annual salary to partners is rs. $$12,000$$ each. the profits for the last three years were $$Rs.60,000, Rs. 72,000$$ and $$Rs.84,000$$. Goodwill is to be at $$2$$ years purchase of last $$3$$ years average super profit. calculate goodwill of the firm.

A business earned an average profit of Rs. $$8,00,000$$ during the last few years. The normal rate of profit in the similar type of business is $$10%$$. The total value of assets and liabilities of the business were Rs. $$22,00,000$$ and Rs. $$5,60,000$$ respectively. Calculate the value of goodwill of the firm by super profit method if it is valued at $$2^{\frac{1}{2}}$$ years purchase of super profit.

Ayub and Amit are partners in a firm and they admit Jaspal into partnership w.e.f. $$1^{st}$$April,The agreed to value goodwill at $$3$$ years purchase of Super Profit Method for which they decided to average profit of last $$4$$ years. The profits for the last $$5$$ years were:

| Year Ended | Net Profit |

| $$31^{st}$$March,2014 | $$1,50,000$$ |

| $$31^{st}$$March, 2015 | $$1,80,000$$ |

| $$31^{st}$$March, 2016 | $$1,00,00$$(Including abnormal loss of Rs. $$1,00,000$$) |

| $$31^{st}$$March, 2017 | $$2,60,000$$(Including abnormal gain (point)of Rs.$$40,000$$) |

| $$31^{st}$$March, 2018 | $$2,40,000$$ |

Calculate value of goodwill.

The average profit earned by a firm is Rs. $$1,00,000$$ which includes undervaluation of stock of Rs. $$40,000$$ on an average basis. The capital invested in the business is Rs.$$6,30,000$$ and the normal rate of return is $$5%$$. Calculate goodwill of the firm on the basis of $$5$$ times the super profit.

$$A$$ and $$B$$ are equal partners. They decide to admit $$C$$ for $$\dfrac{1}{3}^{rd}$$ share. for the purpose of admission of $$C$$, goodwill of the firm is to be valued at four years purchase of super profit. Average capital employed in the firm is Rs.$$1,50,000$$. Normal rate of return may be taken as $$15%$$ p.a. Average profit of the firm Rs.$$40,000$$. Calculate value of goodwill.

On $$1^{st}$$April,2018, an existing firm had assets of Rs.$$75,000$$ including cash of Rs.$$5,000$$. Its credit amounted to Rs.$$5,000$$ on that date. The firm had a Reserve of Rs. $$10,000$$ while Partners capital Account showed a balance of Rs.$$60,000$$. If Normal rate of Return is $$20%$$ and goodwill of the firm is valued at Rs.$$24,000$$ at four years purchase of super profit, find average profit per year of the existing firm.

A partnership firm earned net profit during the past three years as follows:

| year ended | $$31^{st}$$March,2018 | $$31^{st}$$March,2017 | $$31^{st}$$March,2016 |

| Net Profit(Rs.) | $$2,30,000$$ | $$2,00,000$$ | $$1,70,000$$ |

Calculate value of goodwill on the basis of two years purchase of average super profit earned during the above mentioned three years.

A business has earned average profit of Rs.$$1,00,000$$ during the last few years. Find out the value of goodwill by capitalization method, given that the asset of the business are Rs.$$10,00,000$$ and its external liabilities are Rs.$$1,80,000$$. The normal rate of return is 10%

From the following information, calculate the value of goodwill of the firm:

(i) At three years purchase of Average Profit.

(ii) At three years purchase of Super Profit.

(iii) On the basis of capitalisation of Super Profit.

(iv) On the basis of capitalisation of Average Profit.

Information:

(a) Average Capital Employed is Rs.$$6,00,000$$.

(b) Net profit/(Loss) of the firm for the last three years ended are:

$$31^{st}$$March,2018 - Rs.$$2,00,000$$, $$31^{st}$$March,2017 - Rs.$$1,80,000$$ and $$31^{st}$$March,2016 - Rs.$$1,60,000$$

(c) Normal rate of Return in similar business is $$10%$$ .

(d) Remuneration of Rs$$1,00,000$$ to partners is to be taken as charge against profit.

(e) Assets of the firm (excluding goodwill, fictitious assets and non-trade investments) is Rs.$$7,00,000$$ whereas Partner's capital is Rs. $$6,00,000$$ and outside Liabilities Rs.$$1,00,000$$.

Average profit of the firm is Rs.$$2,00,000$$. Total assets of the firm are Rs.$$15,00,000$$ whereas Partner's Capital is Rs.$$12,00,000$$. If normal rate of return in a similar business is $$10%$$ of the capital employed, what is the value of goodwill by Capitalisation of Super Profit?

Average profit of GS &Co. Rs.$$50,000$$ per year. Average capital employed in the business is Rs. $$3,00,000$$. If the normal rate of return on capital employed is 10%, calculate goodwill of the firm by:

(i) Super Profit Method at three years purchase and

(ii) Capitalisation of Super Profit Method.

Goodwill of the firm is valued at Rs. $$5,00,000$$ at $$2$$ years purchase of average profit. Determine the missing value.

Total Profits $$= Rs. 2,50,000 + ..... + Rs. 3,00,000 - Rs. 1,00,000 + Rs. 3,50,000 = Rs....$$

Average Profit $$= \dfrac{Total \,\,Profits}{Number \,\,Of \,\,Years} = \dfrac{Rs.}{5} =$$ Rs.

Goodwill $$= Rs. .... \times 2 = Rs. 5,00,000$$

From the following particulars, calculate value of goodwill of a firm by applying Capitalisation of Average Profit Method:

(i) Profits of last five consecutive years ending $$31^{st}$$March are 2018 --Rs.$$54,000$$, 2017 --Rs.$$42,000$$, 2016--Rs.$$39,000$$,2015--Rs.$$67,000$$ and 2014--Rs.$$59,000$$.

(ii) Capitalisation rate $$20%$$.

(iii) Net assets of the firm Rs.$$2,00,000$$.

Rajan and Rajani are partners in the firm. Their capital were Rajan Rs.$$3,00,00$$, Rajani Rs.$$2,00,00$$. During the year 2017-18, the firm earned a profit of Rs.$$1,50,000$$. Calculate the value of goodwill of the firm by capitalisation of super profit, assuming that the normal rate of return is 20%.

$$P, Q$$ and $$R$$ were partners in a firm sharing profits in the ratio of $$3:2:1$$. They admitted $$S$$ as a new partner for $$1/8^{th}$$ share in the profits, which he acquired $$1/16^{th}$$ from $$B$$ and $$1/16^{th}$$ form $$R$$. Calculated the new profit sharing ratio of $$P, Q, R$$ and $$S$$.

Geeta, Sunita and Anita were partners in a firm sharing profits in the ratio of $$5:3:2$$. On $$1^{st}$$January,2015, they admitted Yogita as a new partner $$1/10^{th}$$ share in the profits. On Yogita's admission the Profit and Loss Account of the firm was showing a debit balance of $$Rs. 20,000$$ which was credited by the accountant of the firm to the Capital Accounts of Geeta, Sunita and Anita in their profit-sharing ratio. Did the accountant give correct treatment? Give reason in support of your answer.

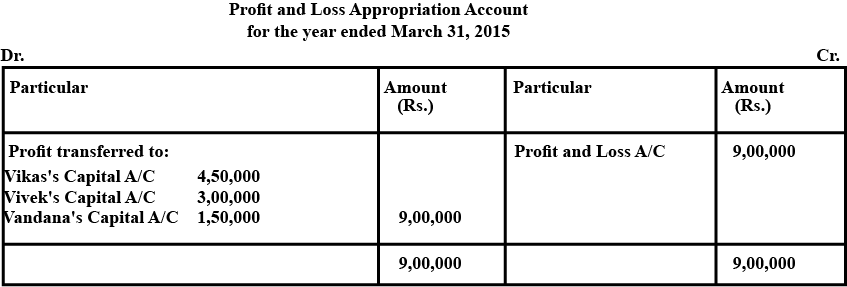

Vikas and Vivek were partners in a firm sharing profits in the ratio of 3.:On 1st April, 2017, they admitted Vandana as a new partner for 1/8th share in the profits with a guaranteed profit of Rs. 1,50,The new profit-sharing ratio between Vikas and Vivek will remain same but they decided to bear any deficiency on account of guarantee to Vandana in the ratio 3 :The profit of the firm for the year ended 31st March, 2018 was Rs. 9,00,Prepare Profit and Loss Appropriation Account of Vikas, Vivek and Vandana for the year ended 31st March, 2018.

$$A, B, C$$ and $$D$$ were partners in a firm sharing profits in the ratio of $$4:3:2:1$$. On $$1^{st}$$January,2015, they admitted $$E$$ as a new partner for $$1/10th$$ share in the profits. $$E$$ brought $$Rs. 10,000$$ for his share of goodwill premium, which was correctly recorded in the books by the accountant. The accountant showed goodwill at $$Rs. 1,00,000$$ in the books. Was the accountant correct in doing so? Give reason in support of your answer.

Short answer type question:

Why heirs of deceased partner are entitled to share of goodwill of the firm?

Anu and Bhagwan were partners in a firm sharing profit in the ratio of $$3:1$$. Goodwill appeared in the books at $$Rs. 4,40,000$$. Raja was admitted to the partnership. The new profit-sharing ratio among Anu, Bhagwan and Raja was $$2:2:1$$. Raja brought $$Rs. 1,00,000$$ for his capital and necessary cash for his goodwill premium. The goodwill of the firm was valued at $$Rs. 2,50,000$$.

Record necessary Journal entries in the books of the firm for the above transaction.

Pass entries in the firm's Journal for the following on admission of a partner:

(i) Machinery be depreciated by $$Rs. 16,000$$ and Building be appreciated by $$Rs. 40,000$$.

(ii) A provision be creaated for Doubtful Debts @ $$5 \%$$ of Debtors amounting to $$Rs. 80,000$$.

(iii) Provision for warranty claims be increased by $$Rs. 12,000$$.

Pass entries in the firm's Journal for the following on admission of a partner:

(i) Unrecorded Investment worth $$Rs. 20,000$$.

(ii) Unrecorded liability towards suppliers for $$Rs. 5,000$$.

(iii) An item of $$Rs. 1,600$$ included in Sundry Creditors is not likely to be claimed and hence should be written back.

$$X$$ and $$Y$$ are partners in a firm sharing profits in the ratio of $$3:2$$. They admitted $$Z$$ as a new partner for $$1/4^{th}$$ share of profits. At the time of admission of $$Z$$ Debtors and Provision for Doubtful Debts appeared at $$Rs. 76,000$$ and $$Rs. 8,000$$ respectively. $$Rs. 6,000$$ of the debtors proved bad. A provision of $$5\%$$ is to be created on Sundry Debtors for doubtful debts. Pass the necessary Journal entries.

Give the Journal entry to distribute "Workmen Compensation Reserve" of $$Rs. 72,000$$ at the time of admission of $$Z$$, when these is no claim against it. The firm has two partners $$X$$ and $$Y$$.

$$A$$ and $$B$$ are partners in a business and their capitals at the end of the year were $$Rs. 7,00,000$$ and $$6,00,000$$ respectively. Calculate their opening capitals considering the following information:

(a) Drawings of $$A$$ and $$B$$ for the year were $$Rs. 75,000$$ and $$Rs. 50,000$$ respectively.

(b) $$B$$ introduced capital of $$Rs.1,00,000$$ during the year.

(c) Interest on capital credited to the Capital Accounts of $$A$$ and $$B$$ were $$Rs.15,000$$ and $$Rs. 10,000$$ respectively.

(d) Interest on drawings debited to the Capital Accounts of $$A$$ and $$B$$ were $$Rs. 7,500$$ and $$Rs. 5,000$$ respectively.

(e) Share of loss debited to Capital Accounts was $$Rs. 20,000$$ each.

$$X$$ and $$Y$$ share profits in the ratio of $$5:3$$. Their Balance Sheet as at $$31^{st}$$March,2018 was:

| Liabilities | (Rs.) | Assets | (Rs.) |

| Creditors Employees Provident Fund Workmen Compensation Reserve Capital A/cs: X 70,000 Y 31,000 | 15,000 10,000 5,800 1,01,000 | Cash at Bank Sundry Debtors 20,000 Less: Provision for Doubtful Debts 600 Stock Fixed Assets Profit and Loss A/c | 5,000 19,400 25,000 80,000 2,400 |

| 1,31,800 | 1,31,800 |

(a) Employees Provident Fund liability is to be increased by $$Rs. 5,000$$.

(b) All Debtors are good. Therefore, no provision is required on Debtors.

(c) Stock includes $$Rs. 3,000$$ for obsolete items.

(d) Creditors are to be paid $$Rs. 1,000$$ more.

(e) Fixed Assets are to be revalued at $$Rs. 70,000$$.

Prepare Journal entries, necessary account and new Balance Sheet. Also calculate new profit-sharing ratio.

Balance Sheet of Ram and Shyam who share profits in proportions to their capitals as at $$31^{st}$$March,2018 is:

| Liabilities | (Rs.) | Assets | (Rs.) |

| Capital A/cs: Ram 30,000 Shyam 25,000 Current A/cs: Ram 2,000 Shyam 1,800 Creditors Bills Payable | 55,000 3,800 19,000 16,000 | Freehold Premises Plant and Machinery Fixture and Fittings Vehicle Stock Bills Receivable Debtors Bank Cash | 20,000 13,500 1,750 1,350 14,100 13,060 27,500 1,590 950 |

| 93,800 | 93,800 |

(a) Arjun to bring in $$Rs. 20,000$$ as capital and $$Rs. 6,600$$ for goodwill, which is to be in the business and he is to receive $$1/4^{th}$$ share of the profits.

(b) Provision for Doubtful Debts is to be $$2 \%$$ on Debtors.

(c) Value of Stock to be written down by $$5\%$$.

(d) Freehold Premises are to be taken at valuation of $$Rs. 22,400$$; Plant and Machinery $$Rs. 11,800$$; Fixtures and Fittings $$Rs. 1,540$$ and Vehicles $$Rs. 800$$.

You are required to make necessary adjustment entries in the firm, give Balance Sheet of the new firm as at 1st April,2018 and also give the proportions in which the partners will share profits, there being no change in the proportions of Ram and Shyam.

(Provisions of the Indian Partnership Act, 1932). $$A, B$$ and $$C$$ are partners in a firm. They do not have a Partnership Deed.

(i) $$A$$, who has contributed more capital than other partners, demands interest on capital at $$10\% p.a$$. But $$B$$ and $$C$$ do not agree with this.

(ii) $$B$$ has devoted full time to run the business and demands a salary of $$Rs. 5,000 p.m$$. But $$A$$ and $$C$$ do not agree with him.

(iii) $$C$$ demands interest on the loan of $$Rs. 50,000$$ advanced by him at the market rate of interest which is $$12\% p.a$$.

(iv) $$A$$ has drawn $$Rs. 10,000$$ from the firm for personal use. $$B$$ and $$C$$ demand that interest should be charged @ $$10\%$$ per annum.

(v) Net Profit before taking into account any of the above claims amounted to $$Rs. 50,000$$ at the end of the first year of the business. $$A$$ demands share of profit in the capital ratio.

How will the disputes be settled?

$$P,Q$$ and $$R$$ were partners in a firm.On $$31^{st}March ,2018$$ $$R$$ is retired.The amount payable to $$R \,RS.2,17,000$$ was transferred to his loan account. $$R$$ is agreed to receive interest on this amount as per the provision of Partnership Act, $$1932$$. State the rate at which interest will be paid to $$R$$.

$$X, Y$$ and $$Z$$ are partners in a firm. Their profit sharing ratio is $$5 : 3 : 2$$. $$Z$$ is guaranteed a minimum profit of $$Rs. 10,000$$ every year. Any deficiency arising is to be met by $$Y$$. The profits for the two years ended 31st March, 2017 and 2018 were $$Rs. 40,000$$ and $$Rs. 60,000$$ respectively. Prepare Profit and Loss Appropriation Account for the two years.

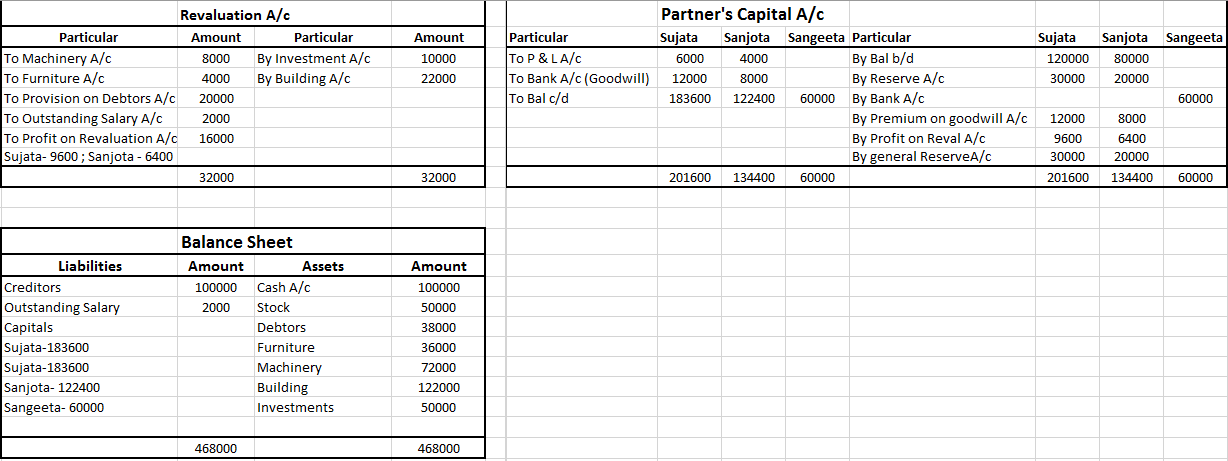

Sujata and Sanjota are partners sharing profits and losses in the ratio of $$3:2$$. Their Balance Sheet as on $$31.03.2016$$ was as follows.

Balance sheet as on $$31.03.2016$$

| Liabilities | Rs | Assets | Rs |

| Creditors Bills Payable Reserve fund Capitals: Sujata 1,20,000 Sanjota 80,000 | 1,00,000 50,000 50,000 2,00,000 | Cash Stock Debtors Furniture Machinery Building Investments P and L Account | 40,000 50,000 40,000 40,000 80,000 1,00,000 40,000 10,000 |

| 4,00,000 | 4,00,000 |

On $$01.04.2016$$ Sangeeta admitted into partnership on the following terms.

a) She brings in $$Rs.60,000$$ as capital and $$Rs.20,000$$ towards Goodwill for $$1/4th$$ share in future profits.

Goodwill amount is withdrawn by old partners.

b) Depreciate Machinery and Furniture by $$10\%$$

c) Provision for doubtful debts is maintained at $$5\%$$ on debtors.

d) Appreciate Buildings by $$Rs.22,000$$.

e) Provide $$Rs.2,000$$ fot outstanding salaries.

f) Investment are to be revalued at $$Rs.50,000$$

Prepare:

i) Revaluation A/c

ii) Partner's Capital A/c

iii) New Balance sheet as on $$01.04.2016$$

If the amount brought by a new partner is more than his share in capital, the excess is known as _____.

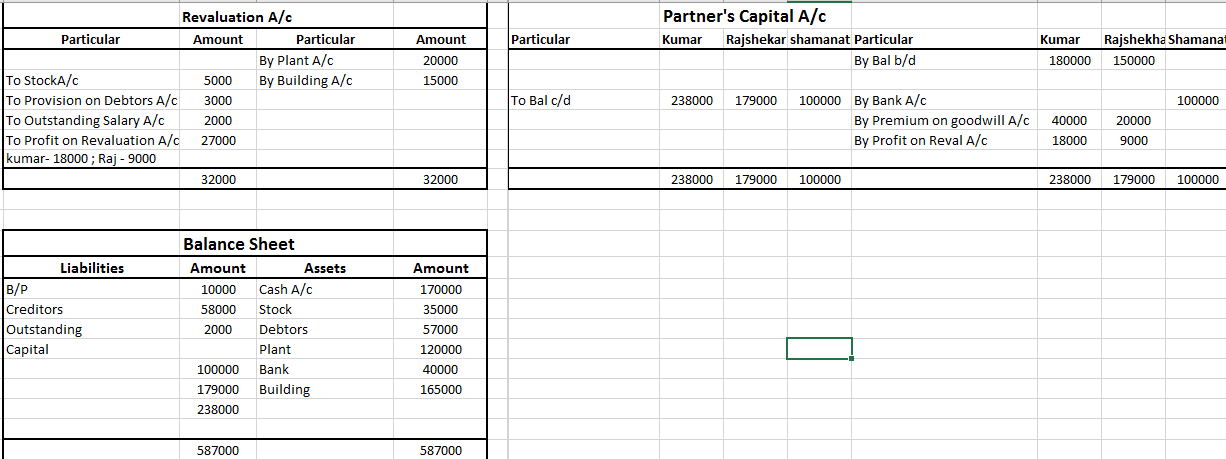

Given below is the Balance sheet of Kumar and Rajashekar, who are carrying on partnership business as on 31 March,Kumar and Rajashekar share profits and losses in the ratio of $$2:1$$.

Balance sheet of Kumar and Rajashekar as on $$31.3.2018$$

| Liabilities | Rs. | Assets | Rs. | |

| Bills payable Sundry creditors Outstanding expenses Capitals: Kumar Rajashekar | $$1,80,000$$ $$1,50,000$$ | $$10,000$$ $$58,000$$ $$2,000$$ $$3,30,000$$ | Cash in hand Cash at Bank Sundry debtors Stock Plant and Machinery Building | $$10,000$$ $$40,000$$ $$60,000$$ $$40,000$$ $$1,00,000$$ $$1,50,000$$ |

| $$4,00,000$$ | $$4,00,000$$ |

a) Shamanth bring in $$Rs.1,00,000$$ as his capital and $$Rs.60,000$$ as his share of goodwill for $$1/4^{th}$$ share in profits.

b) Plant is to be appreciated to $$Rs.1,20,000$$ and the value of Building is to be appreciated by $$10\%$$

c) Stock is found over valued by $$Rs.5,000$$

d) A provision for Doubtful debts is to be created at $$5\%$$ on Debtors. Prepare Revaluation account, partners capital accounts and Balance sheet of the constituted firm after admission of the new partner.

Sonu and Rajat Started a partnership firm on April $$1,2017$$.They contributed $$Rs.8,00,000$$ and $$Rs.6,00,000$$ respectively as their capitals and decided to share profits an losses in the ratio of $$3:2$$.

The partnership deed provided that Sonu was to be paid salary of $$Rs.20,000$$ per month and Rajat a commissions of $$5\%$$ on turnover.It also provided that interest on capital be allowed $$@8\%$$ p.a. Sonu withdraw $$Rs.20,000$$ on $$1^{st}December ,2017$$ and Rajat withdrew $$Rs.5,000$$ at the end of each month.Interest on drawing was charged $$@6\%$$ p.a.The net profit as per profit and loss Account for the year ended $$31^{st}March,2018$$ was $$Rs.4,89,950$$. The turnover of the firm for the year ended $$31^{st}March ,2018$$ amounted to $$Rs.20,00,000$$. Pass necessary journal entries for the above transactions in the books of Sonu and Rajat.

Jay, Vijay and Karan were partners of an architect firm sharing profits in the ratio of 2 : 2 :Their partnership deed provided the following :

(i) A monthly salary of Rs. 15,000 each to Jay and Vijay.

(ii) Karan was guaranteed a profit of Rs. 5,00,000 and Jay guaranteed that he will earn an annual fee of Rs. 2,00,0(X). Any deficiency arising because of guarantee to Karan will be borne by Jay and Vijay in the ratio of 3 :During the year ended 31" March, 2018 Jay earned fee of Rs. 1,75,000 and the profits of the firm amounted to Rs. 15,00,

Showing your workings clearly prepare Profit and Loss Appropriation Account and the Capital Account of Jay, Vijay and Karan for the year ended 31st March, 2018.

Average profits of a firm during the last few years are $$Rs. 80,000$$ and the normal rate of return in a similar business is $$10\%$$. If the goodwill of the firm is $$Rs. 1,00,000$$ at $$4$$ years purchase of super profit, find the capital employed by the firm.

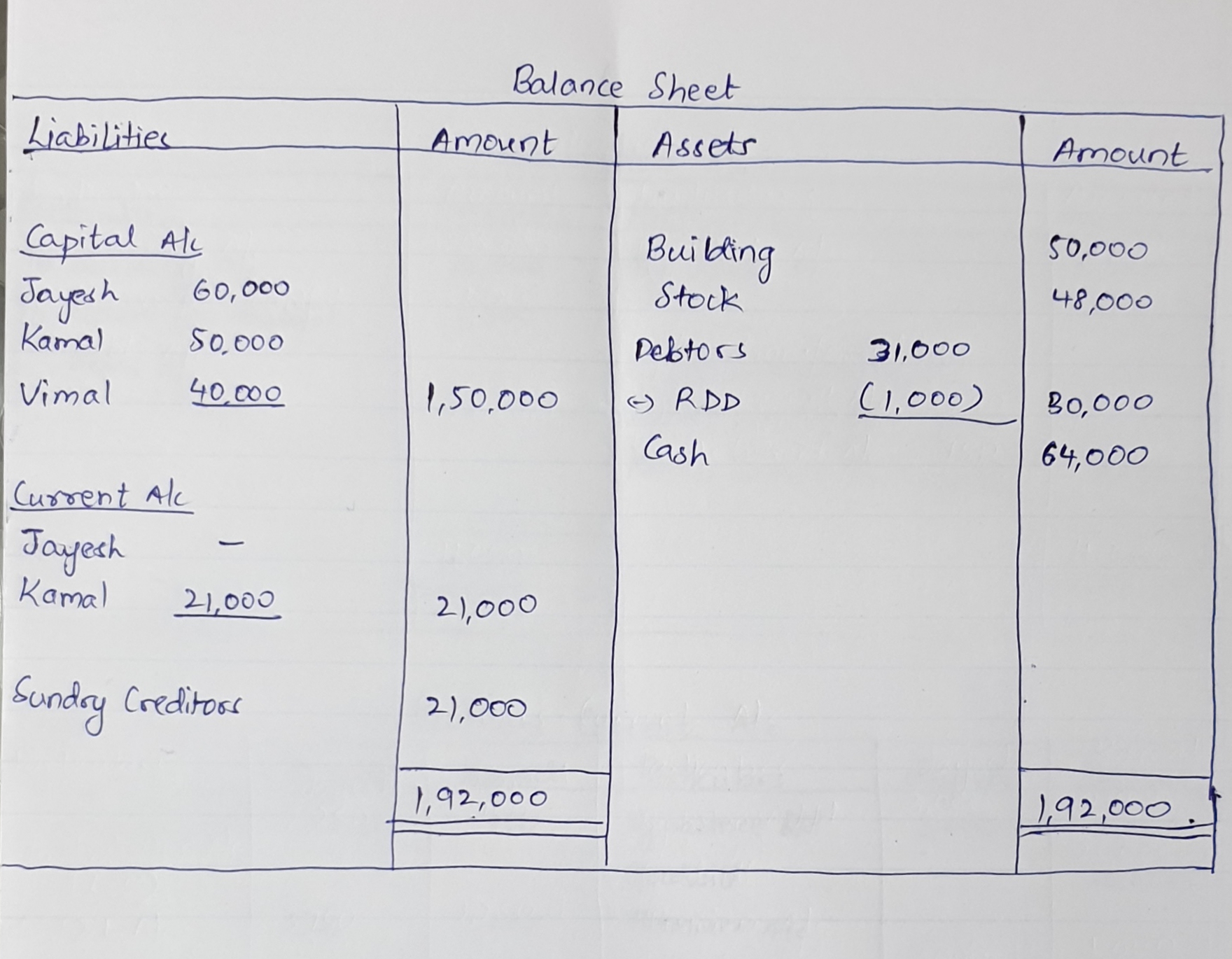

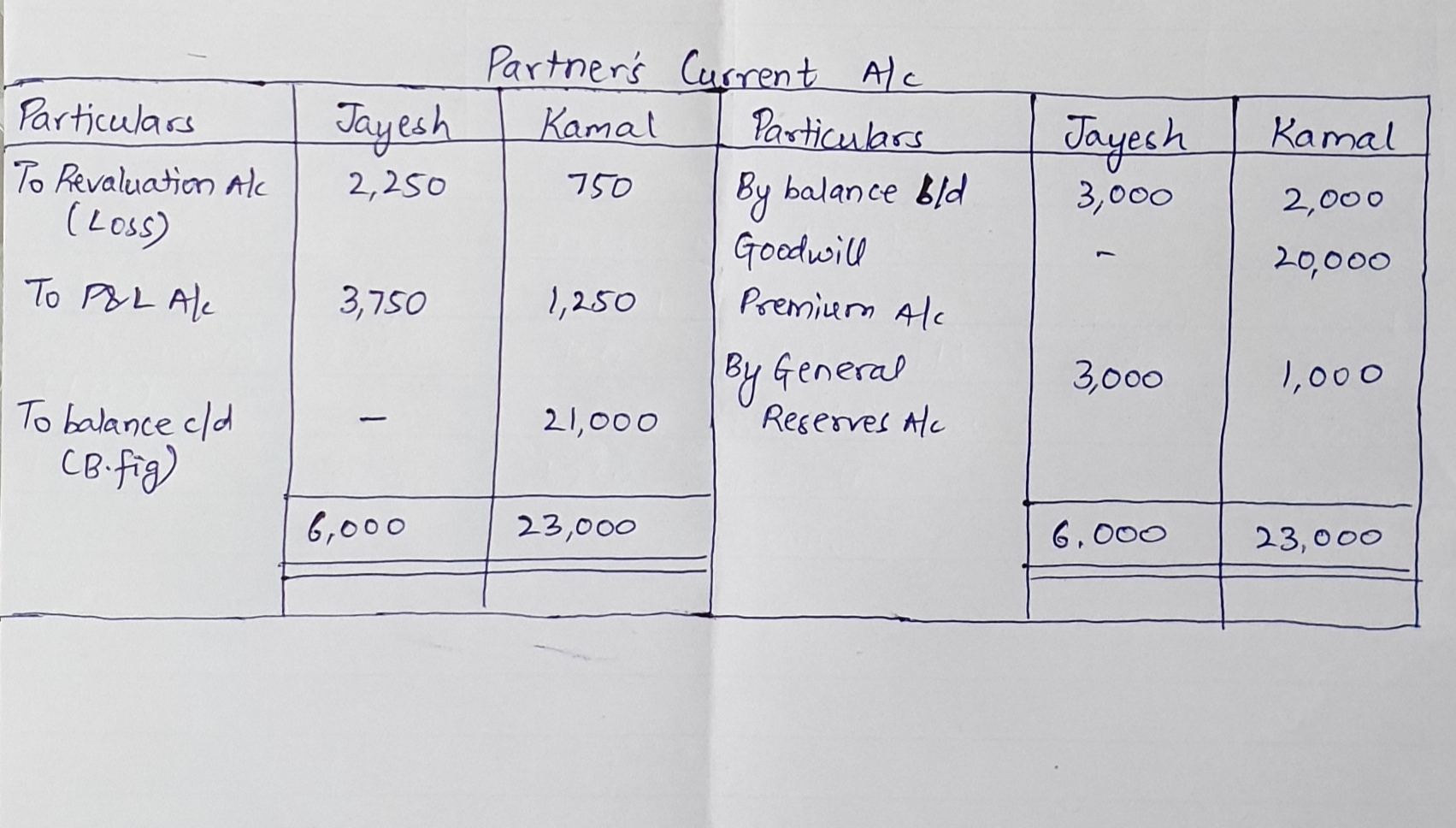

Jayesh and Kamal are partners in a firm sharing profits and losses in the ratio $$3 : 1$$. The following is their Balance Sheet as on 31st March, 2016 :

Balance Sheet as on $$31^{st} \, March, \, 2016$$

| Liabilities | Amount ₹ | Assets | Amount ₹ |

| Capital accounts Jayesh Kamal Current accounts Jayesh Kamal Sundry creditors General reserve | 60,000 50,000 3,000 2,000 21,000 4,000 | Building Stock Sundry debtors Cash Profit and loss account | 60,000 40,000 31,000 4,000 5,000 |

| 1,40,000 | 1,40,000 |

They admitted Vimal as a partner on 1st April, 2016 in the firm on the following terms:

(1) She should bring $$Rs. 40,000$$ as her capital for $$\dfrac{1}{4}^{th}$$ share in future profits and $$Rs.20,000$$ as her share of goodwill.

(2) Building is found overvalued by 20% and stock is found undervalued by 20% in the books. These assets are to be adjusted at their proper values.

(3) $$Rs. 1000$$ are to be maintained as reserve for doubtful debts.

Prepare Balance Sheet of the firm after Vimal's admission.

Jayesh and Kamal are partners in a firm sharing profits and losses in the ratio $$3 : 1$$. The following is their Balance Sheet as on 31st March, 2016 :

Balance Sheet as on $$31^{st} \, March, \, 2016$$

| Liabilities | Amount ₹ | Assets | Amount ₹ |

| Capital accounts Jayesh Kamal Current accounts Jayesh Kamal Sundry creditors General reserve | 60,000 50,000 3,000 2,000 21,000 4,000 | Building Stock Sundry debtors Cash Profit and loss account | 60,000 40,000 31,000 4,000 5,000 |

| 1,40,000 | 1,40,000 |

They admitted Vimal as a partner on 1st April, 2016 in the firm on the following terms:

(1) She should bring $$Rs. 40,000$$ as her capital for $$\dfrac{1}{4}^{th}$$ share in future profits and $$Rs.20,000$$ as her share of goodwill.

(2) Building is found overvalued by 20% and stock is found undervalued by 20% in the books. These assets are to be adjusted at their proper values.

(3) $$Rs. 1000$$ are to be maintained as reserve for doubtful debts.

Prepare old partners current accounts.

Kiya and Leela are partners sharing profits in the ratio of $$3: 2$$ . Kiran was admitted as a new partner with $$\dfrac{1}{5}th$$ share in the profits and brought in $$Rs. 24,000$$ as her share of goodwill premium that was credited to the capital accounts of Kiya and Leela respectively with $$Rs. 18,000$$ and $$Rs. 6000$$.

Calculate the new profit sharing ratio of Kiya, Leela and Kiran.

Amit and Been are partners in a firm sharing profits and losses in the ration of $$3:1$$. Chaman was admitted as a new partner for $$\cfrac{1}{6}$$ th share in the profits. Chaman acquired $$\cfrac{2}{5}$$th of his share from Amit. How much share did Chaman acquired from Beena?

P, Q and R are in a partnership and as at 1st April 2017 their respective capitals were; Rs. 40,000, Rs. 30,000 and Rs. 30,Q is entitled to a salary of Rs. 6,000 and Rs. 4,000 p.a. payable before division of profits. Interest is allowed on capital @ 5% p.a. and is not charged on drawings. Of the divisible profits, P is entitled to 50% the first Rs. 10,000, Q to 30% and R to 20%, rest of the profits are shared equally. Profits for the year ended the 31st March 2018, after debiting partners' salaries but before charging interest on capital was Rs. 21,000 and the partners had drawn Rs. 10,000 each on account of salaries, interest and profit.

Prepare Profit and Loss Appropriation Account for the year ended 31st March 2018 showing the distribution of profit and the Capital Accounts of the Partners.

Balance Sheet as on 31.03.2012

Liabilities Amount

Rs. Assets Amount

Rs. Capital:

Ram

Madan

General reserve

Sundry creditors

1,00,00

1,00,00

40,000

55,300Plant and machinery

Furniture

Sundry debtors 92,600

Less: R.D.D 1,000

Stock

Cash in hand

Cash at bank 90,000

15,000

91,000

68,000

4,200

27,100 2,95,300 2,95,300

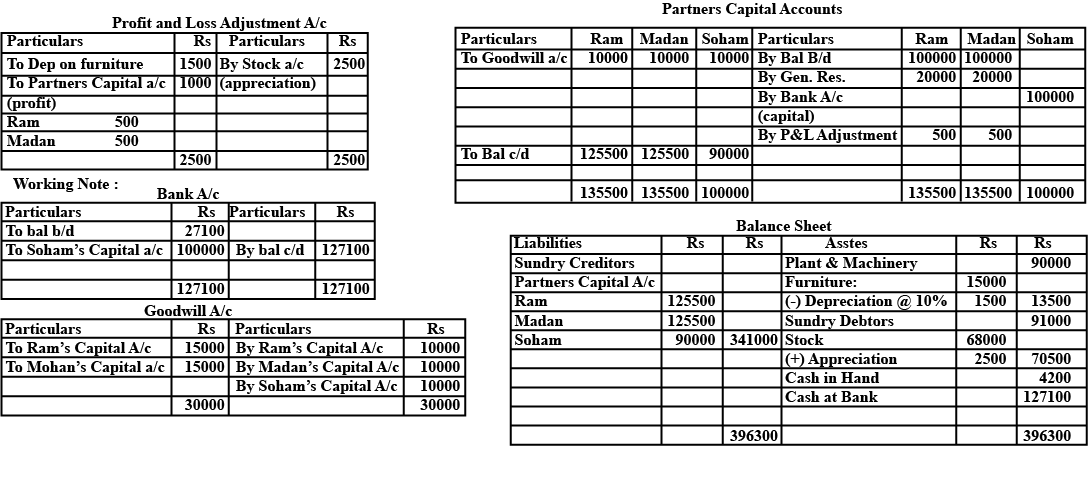

Ram and Madan were partners in a firm sharing profits and losses equally. Following was their balance Sheet as on 31.03.2012:

On $$1^{st}$$April, 2012, Soham was admitted as a partner in the firm on the following terms:

(1) Soham is to bring in Rs. 1,00,000 as his capital. He is to be given $$\dfrac{1}{3}^{rd}$$ share in future profits.

(2) Goodwill of the firm to be raised at Rs. 30,It was decided that 'goodwill' should not appear in the books of the new firm.

(3) Furniture to be depreciated by 10%. Stock was valued at Rs. 70, 500.

Prepare:

(1) Profit and Loss Adjustment Account.

(2) Partner's Capital Accounts.

(3) Balance Sheet of the new firm.

| Liabilities | Amount Rs. | Assets | Amount Rs. |

| Capital: Ram Madan General reserve Sundry creditors | 1,00,00 1,00,00 40,000 55,300 | Plant and machinery Furniture Sundry debtors 92,600 Less: R.D.D 1,000 Stock Cash in hand Cash at bank | 90,000 15,000 91,000 68,000 4,200 27,100 |

| 2,95,300 | 2,95,300 |

On 31st March, 2014, the balances in the Capital Accounts of Saroj, Mahinder and Umar after making adjustments for profits and drawings, etc., were Rs. 80;000,Rs. 60,000 and Rs. 40,000 respectively. Subsequently it was discovered that the Interest on capital and drawings has been omitted. (a) The profit for the year ended 31st March, 2014 was Rs. 80,000; (b) During the year Saroj and Mahinder each withdraw a sum of Rs. 24,000 in equal instalments in the end of each month and Umar withdrew Rs. 36,000.

(c) The interest on drawings was to be charged @ 5% pa. and interest on capital was to be allowed @ 10% p.a. (d) The profit-sharing ratio among partners was 4 : 3 :1. Showing your workings clearly, pass the necessary rectifying entry.

(c) The interest on drawings was to be charged @ 5% pa. and interest on capital was to be allowed @ 10% p.a.

Azad and Benny are equal partners, Their capitals are Rs. 4,00,000 and Rs.7,80,000 respectively. After the accounts for the year have been prepared, it is discovered that interest @ 5% p.a. as provided in the partnership agreement has not been credited to the Capital Accounts before distribution of profit. It is decided to make an adjustment entry in the beginning of the next year. Record the necessary Journal entry.

Ritu and Gurpreet are partners in a firm. On 1st April, 2017, their capitals were Rs. 2,00,000 and Rs. 3,00,000 respectively. They decided to adopt a school, in the locality and develop play ground, instail drinking water facility and develop toilets. They decided to earmark 10% of the net profit every year for the above purpose. The Partnership Deed provides for the following: (a) Ritu and Gurpreet each will get salary of Rs. 7,500 per month.(b) Interest on capital is to be allowed. @ 5% p.a. (c) Charge interest on drawings @ 10% p.a. Interest on Drawings was computed as Rs. 7,500 and Rs. 10,000 respectively for Ritu and Gurpreet. Profit of the firm for the year ended 31st March, 2018 was Rs. 10,00,Identify any four values that were kept in mind by Ritu and Gurpreet. Also, prepare Profit and Loss Appropriation Account of the firm for the year ended 31st March, 2018.

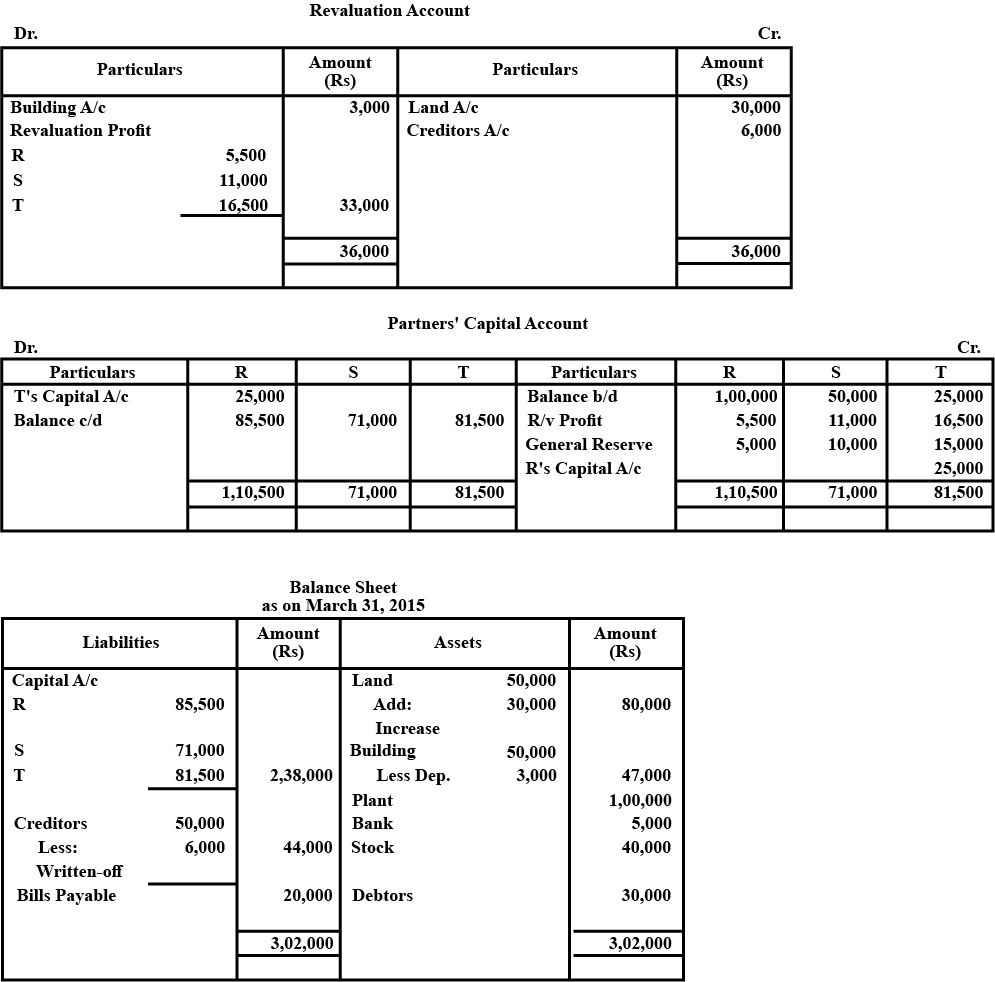

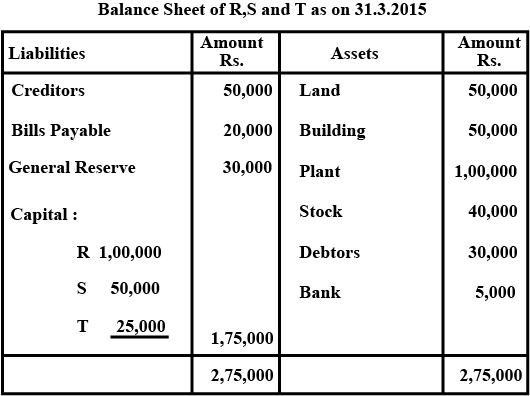

$$R,S$$ and $$T$$ were partners in a firm sharing profits in the ratio of $$1:2:3$$. Their Balance sheet as on $$31.3.2015$$ as follows.

Refer image,

$$R, S$$ and $$T$$ decided to share the profits equally with effect from 1.4.For this it was agreed that :

(a) Goodwill of the firm be valued at $$Rs.1,50,000$$.

(b) Land be revalued at $$Rs.80,000$$ and building be depreciated by $$6\%$$.

(c) Creditors of $$Rs.6,000$$ were not likely to be claimed and hence be written off.

Prepare Revaluation Account, Partner's Capital Accounts and the Balance Sheet of the reconstituted firm.

Class 12 Commerce Accountancy Extra Questions

- Accounting For Not-For-Profit Organisations Extra Questions

- Accounting For Partnership: Basic Concepts Extra Questions

- Accounting For Share Capital Extra Questions

- Accounting Ratios Extra Questions

- Analysis Of Financial Statements Extra Questions

- Cash Flow Statement Extra Questions

- Dissolution Of Partnership Firm Extra Questions

- Financial Statements Of A Company Extra Questions

- Issue And Redemption Of Debentures Extra Questions

- Reconstitution Of A Partnership Firm - Admission Of A Partner Extra Questions

- Reconstitution Of A Partnership Firm - Retirement / Death Of A Partner Extra Questions